***SPECIAL Fed Update – Cost of Living Index at All-Time High – Dow to 50,000***

Today is FOMC statement day. The model for the S&P 500 is plus or minus 0.50% until 2pm and then volatility with a rally. There are two problems with the model today. First, stocks have rallied smartly into the meeting which pulled forward the anticipated strength. Second, this morning’s CPI release came a tad cooler than expected although the cost of living index scored yet another all-time high. Pre-market futures looks higher by more than 1%.

The model says to be short from the open and then aggressively use stops after 2pm.

Our 2024 Fearless Forecast said the Fed would cut rates 2-3 times with the risk being much less. That flew in the face of conventional Wall Street wisdom which was looking for 6-7 cuts. I remember being admonished for saying anyone who thought the Fed would cut 6-7 times had to either be clinically insane or on some serious drugs. But don’t worry folks. Those Wall Street firms and pundits changed their predictions as they often do so they can be right by the end of the year. And the media will largely ignore the revisionist history and not hold anyone accountable.

It’s been going on for decades. Rinse and repeat.

The Fed will not cut interest rates today. I think everyone agrees on that. Many folks want a cut. Some want a hike. No move is the right move. Frankly, as I have mentioned several times before, if I am around that FOMC table all year, I would try to get through all of 2024 without touching rates. Let them be until the labor market weakens. Worry about inflation which is still not close to being under wraps. Recall that 3% inflation is the new 2%.

The Fed doesn’t live on Main Street and neither does the administration. Inflation even at 2% still means prices went up, just at a less steep ascent. It’s disgusting to hear politicians and bureaucrats celebrate winning the war against inflation when the average American cannot keep pace with rising prices. Working Americans actually buy groceries, clothe their families, use energy and put roofs over their heads.

I sat around with some folks yesterday who would definitely be labeled affluent. We talked about sports and politics, markets and the economy. While our views vastly differed on most topics, it was amazing that everyone commented about how expensive it is to live right now. I heard about the insane cost of dining out, whether that was in New York City where it’s always out of control to Charleston, Bozeman and New Haven which is probably a bit more representative. And then talk turned to the cost of groceries. I chuckled when I heard people quoting prices of goods. I thought I was the only one anal enough to memorize individual product prices.

Imagine what the average family of four does, making $75,000 a year. It’s a real challenge.

The Fed is to blame. The government is to blame. They went wildly overboard during COVID and took way too long to stop.

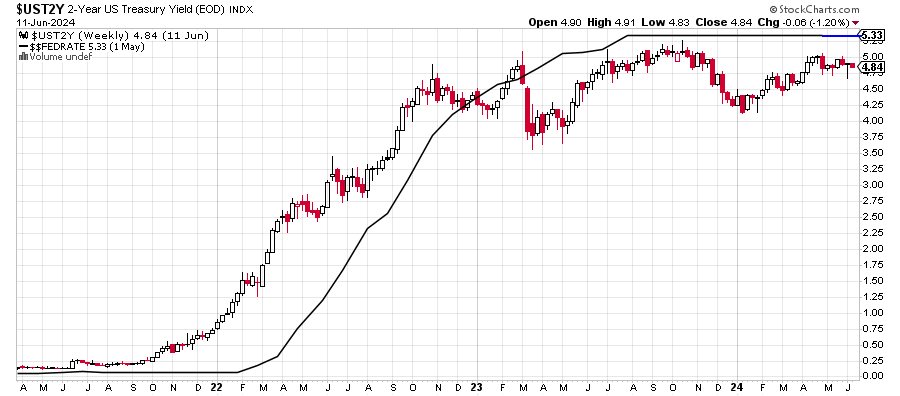

Back to the Fed meeting, the chart below is the only one that really matters when it comes to the Fed’s actions on rates. If you only watch one single metric, it should the 2-Year Treasury which is in red, white and black below. The Fed Funds rate is in solid black. Since March 2023 the 2-Year has been below the Fed Funds, meaning that the Fed is neutral at best with the next action coming to be a cut.

Right now, there is roughly .37% to .50% difference which says the Fed should reduce rates by at least .25% to .50% over the coming quarters. They shouldn’t rush with such a small spread.

Regarding the markets, as I have been saying, the path of least resistance remains higher. Wall Street came into 2024 with very modest upside targets. As usual, they have been habitually wrong and are now revising their targets higher to avoid looking bad again.

While there is a lot of air beneath the markets, they remain on solid footing. The next pullback may not be far away, but that should only serve to refresh for more all-time highs. There should be a tradeable peak in the stock market in Q3 with a low in Q4. Dow 50,000 is the next target before the bull market ends.

On Monday we bought RYBHX and more RYWAX and RYOCX. We sold FDLO, PCY, levered S&P 500 and RYDHX.