***SPECIAL Fed Update – Pivot on the Way, No Recession Yet***

Let’s start with the market info of the day. It’s Fed announcement day and the market usually trades plus or minus 0.50% until 2pm and then volatility expands and we get a big move, usually to the upside. With the pre-market strong, much work looks to already be done. Because the last two days were weak that strengthened the trend today to a large degree and on Twitter you saw the additional positions taken.

Jay Powell and the rest of the FOMC are going to hike interest rates by 3/4% today which puts the top end at 2.50%. That fits squarely in the lower end of my range where I thought the Fed would pause and then pivot, 2.5% to 3%. I still laugh at those who think rate hikes are somehow good for the economy. It’s not. Not now. Not in the past. The economy is weakening. Inflation is peaking. Energy and food commodities have plunged. Long-term interest rates have come down sharply. (I still love bonds as I have since 3%) The dollar surged and is now softening. All very much like 1980 and 1994.

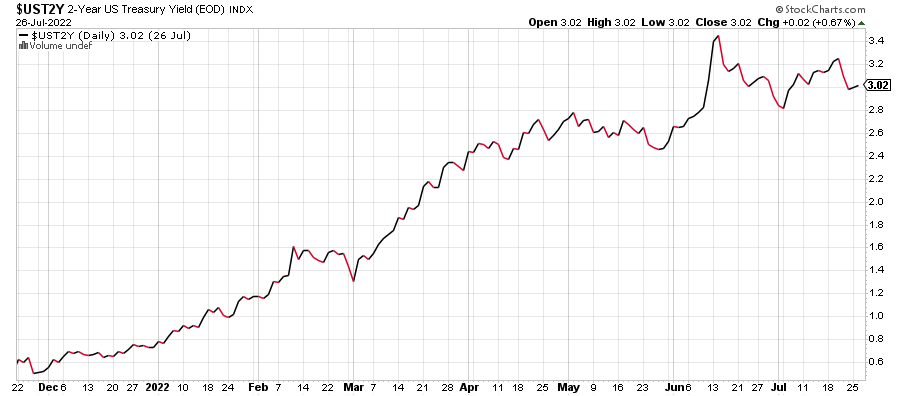

Below you can see the 2-year treasury note which is the single best leading indicator for what the Fed is going to do. Right now, that yield is 3%. Usually, when the Fed’s rate hike cycle is getting long in the tooth, the 2-year will go sideways and then a little lower and meet the Fed Funds Rate as it goes up. So somewhere between 2.5% and 3% seems reasonable. I wish I wrote down the names of all those pundits who were screaming about 5%, 6% and even 7% Fed Funds Rate. Of course, we know they will either disavow those calls or revise history with a bout of selective amnesia.

Before I spend some time on the economy, let me say that whether or not inflation is tamed, (I argue it is) Powell and the Fed will blink. I believe the unemployment rate is bottoming right here and right now. The economy created 372,000 new jobs in June and I do not think that number will be surpassed for the next 12-18 months. In all likelihood, a negative monthly print will be seen in Q4 2022 or Q1 2023.

Now tell me; will Jay Powell continue to raise rate when the economy is losing jobs? Not convinced? When Congress hauls Powell to The Hill, will there be any political will for fighting inflation when constituents are losing their jobs? Who will care about higher prices when people don’t have jobs? In a rare bipartisan moment, Congress will universally coalesce against Powell and the Fed.

First look at Q2 GDP will be released on Thursday morning. The administration is already spinning the potential for a second straight negative quarter as not confirming recession. Widely held belief is that back to back negative quarters of GDP is a recession. As I have written countless times, this is incorrect. Only the National Bureau of Economic Research (NBER) can officially declare the start and end of recession. And given the strength in the labor market, it is highly unlikely recession is here right now, contrary to a number of outspoken pundits.

If and when recession hits, the most likely scenario is a mild, uneven and targeted one like 1980 and 2001. The technology and housing sectors should be the most hard hit while areas like travel and leisure may see little weakness. I will not be surprised to see some tech companies announce hiring freezes in Q3 that will prelude layoffs in Q4.

The NASDAQ didn’t collapse 36% because things were going to be good in tech land. It is pricing in some rough quarters ahead. The S&P 500’s decline almost met the average for a mild recession. It’s not like the stock market is oblivious to what lies ahead. This is not 2008. It’s not 2002 or 1982 nor 1974. 2023 is going to be a year for the bulls. Don’t believe the nonsense. What how markets react more than what the news is.

On Monday we bought MRNA, FSTA, levered Russell 2000 and more levered NDX and high yield funds. On Tuesday we bought RSP and more levered NDX.