***SPECIAL Fed Update – The Fed Can’t Win – The Final Countdown***

The stock market model for today is plus or minus 0.50% until 2pm and then a bigger move. Given the recent decline there could be a little more juice in that trade, but it would have been better had stocks fallen into Tuesday’s close.

I joined my friend Tim Lammers and the morning team on Fox61 today to offer a primer on the Fed meeting and correct one of the biggest myths about the Fed. You can watch HERE.

Driving to the airport in CA the other night, the song The Final Countdown by Europe was on the radio. I feel like it’s been a long 6 weeks between Federal Reserve meetings and that day is finally here. Interestingly, the stock market peaked at the close of trading on May 4th although at lower levels than the all-time high. On May 4th, the FOMC raised interest rates by 1/2%. The stock market responded very favorably and then has been hammered ever since. The bond market responded by rallying (lower rates), quickly declining and then rallying for several weeks before joining the equity market in being hammered.

So here we are again. Another one of those “most anticipated Fed meetings ever”. Markets are on anything but solid footing and the decline from Thursday through Monday was one for the ages, ranking up there with one of the most intense. On Monday I wrote about my difficulty labeling a bear market simply because a price decline went from -19.90% to 20.10%. That never made sense and it still doesn’t, yet that is the generally accepted conventional definition. I prefer behavior and a more subjective view, not that I have the end all, be all answer. Bull markets are much easier to label.

Anyway, the Jay Powell Fed has done an excellent job (sarcasm lacking) of communicating moves well in advance of their official announcement. And I am being serious. They have been steadfast about hiking another 1/2% today, so that’s the absolute minimum we will see. The problem is that while there is plenty of evidence that inflation peaked, last week’s CPI report was still hot and the market quickly priced in a 3/4% raise today, even with a slightly cooler PPI report on Monday.

All this makes Powell’s job more challenging. Plenty of pundits have opined that the more the Fed does right here and now, the happier markets will be. I am not sure I share that view although I do not have a high conviction opinion. Folks should be careful what they wish for. In the last 40 years, I don’t think there has been one time where investors openly rooted for the Fed to go big on rate hikes and forecast better times for the markets. Those are opposing outcomes.

My concern is that the Fed goes bigger and the markets don’t react positively.

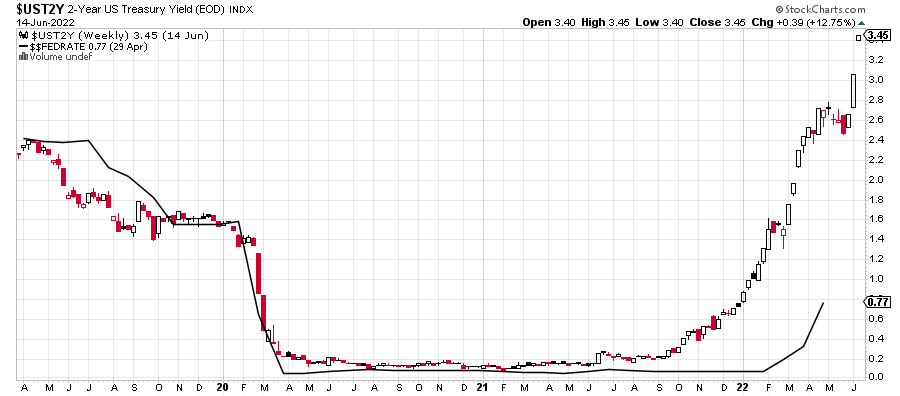

Every 6 weeks or so, I like to share this chart which makes analyzing the Fed super simple. My friend, Tom McClellan, is the originator.

The Fed follows the market. That is inarguable and how it’s been. The two-year Note could very ably replace the interest rate votes by the Fed. Right now, it is at 3.45% which says where the Fed Funds Rate should be. What usually ends up happening is that the two-year Note and the Fed Funds will meet with the former peaking and curling over and the latter catching up but below the peak of the former. I thought the market was almost there before last week. When that becomes inevitable, look for the Fed to pivot as the economy becomes sufficiently weaker.

This is going to be yet another fascinating time to watch the Fed try and recover from an epic blunder. “Inflation is transitory”. They have warned the country to expect some pain as they try to tame inflation. Pain equals recession.

The three obvious scenarios are no recession (1995), mild recession (1980) and moderate recession (1982). No recession leads to Dow 40,000 in 2023. Mild recession is largely priced in right now and leads to more sideways action and a double digit year in 2023. Moderate recession means more pain in the markets, but bonds start to perform better than stocks.