Still Bullish. Junk Bonds & Taxes

Stocks have definitely been quiet of late although that’s from a bull’s perspective from the inside looking out. There has been a very slight drift higher. From a bear’s perspective from the outside looking in, it must be painful first watching stocks relentlessly melt up and then continue to grind higher day after day after day. These types of markets wear on anyone holding cash waiting to invest. From my perspective, I have tried to do my best not to screw up my bullish outlook.

Looking at the major indices, it’s hard to make a seriously negative argument. Sure, I can poke some holes, but nothing significant. Of the four key sectors, the semis and discretionary continue to rock. Transports look like they want to pullback and then explode higher while the banks just frustrate investors. I think if the financials are going to shine, their time is coming this quarter.

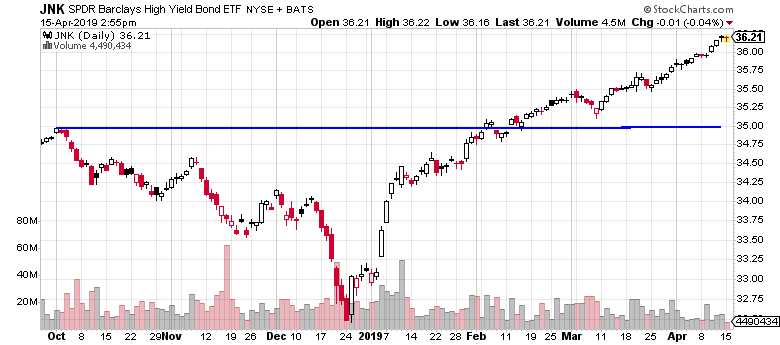

While I have written about some recession concerns, the credit markets are not showing any worries. High yield bonds just keep making new highs day after day and week after week. Long before stocks peak and well before the economy peaks, I fully expect the junk bond market to put in a major high. We’re not even seeing junk bonds peak yet, so I have to laugh at all those Chicken Littles out there who yell that the U.S. economy has been in recession for months. That’s just not the case.

If I had to point to one somewhat dumb little supporting fact at just how strong stocks are, look no further than the strength leading up to tax day. While roughly 80-85% of the country saw their taxes fall in 2018, we know that those of us living in high SALT states like CT, NY, NJ, CA, IL & MA may see higher tax bills due today. I would have thought that would have caused a mild pullback to meet those liabilities, but maybe I am either overthinking it too simplistic in my analysis.

Anyway, today is tax day and it’s typically one of the strongest days of the year. I think the logic goes that investors make their IRA contributions at the very last minute and portfolio managers tend to invest that all at once. I actually reasoned that people sold some holdings to cover tax bill and sellers got exhausted before today. Who knows. I’m glad tax day is behind us. I do like seeing all that money in my checking account. That is, until the IRS pulls it and then cashes my April estimated tax check.