Still Sloppy, Choppy & Frustrating

Stocks staged an impressive rally on Turnaround Tuesday, however we still did not see volume in stocks going up overwhelm that in stocks going down. The price action was strong and leadership was powerful. But remember, it was one single day. And for those operating on the thesis that this is a bear market, those kinds of rallies can and occur often. I am not one of them, but it should be said. Buying strength and selling weakness is tough in this market as momentum has been ebbed.

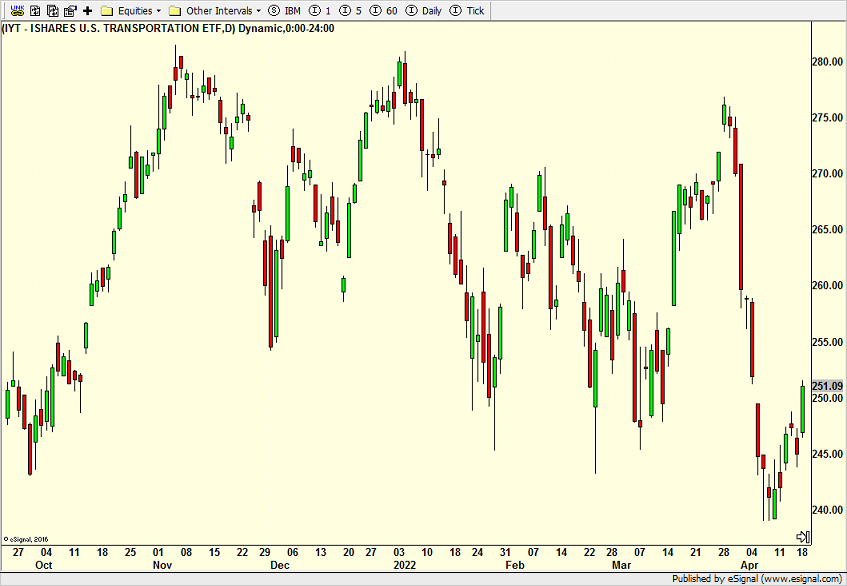

Stock market index leadership appears to be finally coming to light with the S&P 400 and Russell 2000 trying. That would be really good if it happens, but we have been down this road before. Semis and banks have been hit hard, but have bounced strongly. They need to resist falling to new lows again. Transports collapsed and then surged. For the life of me, I cannot make heads or tails of this sector right now. Maybe you can.

Finally, high yield bonds remain mired. That absolutely must change.

To keep repeating myself, 2022 is not the year for equities. It’s choppy. It’s sloppy. It’s frustrating. It requires patience and time to get near to the Fed’s end like we saw in early 1995 and 2019. Without recession in 2023, the Dow should see 40,000. For now, we wait.

On Monday we bought levered Russell 2000, KBE, FAPR and more levered NDX . On Tuesday we bought levered inverse S&P 500, FIVE, MDY, IWM and more SOXL. We sold TGNA and some FTEC and large cap value.