Still Waiting For The Bottom to Line Up

Thank you to those who attended last night webinar where we discussed the events of Q3, reviewed performance of our strategies and took a sneak peak at Q4.

The stock market surely is taking its time getting to wherever it is going. Both time and price windows are open, but the indices have calmed over the past few days. That’s not typically the behavior seen if the ultimate bottom was just hammered in. So, in all likelihood, there should be at least one more move lower before the bottom is made. That could or should coincide with the Volatility Index (VIX) spiking at least into the mid-20s.

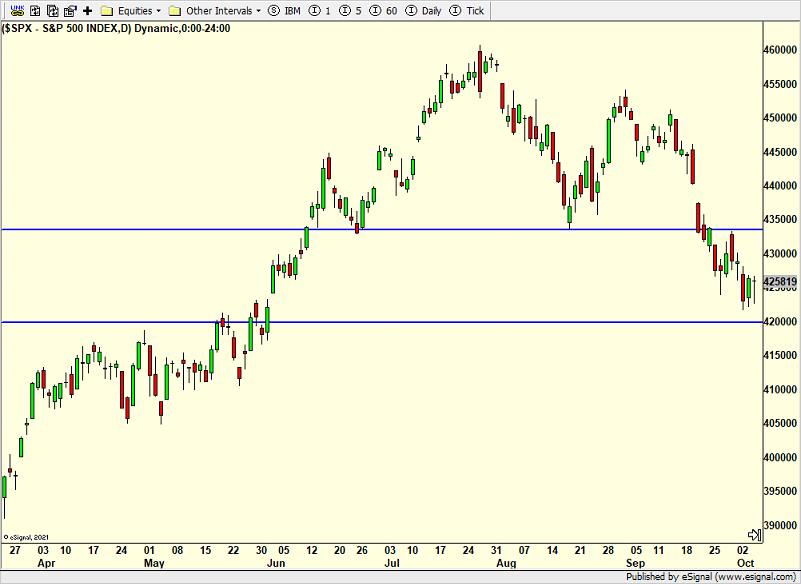

Below is the same chart I keep showing for the S&P 500. It certainly has the feel of a market that wants to break lower and test the mettle of weaker handed bulls. Maybe we see a quick flush below 4200 and vicious reversal back up? That would satisfy many things in my scenario. We have the monthly employment report this morning and that is usually a big market mover.

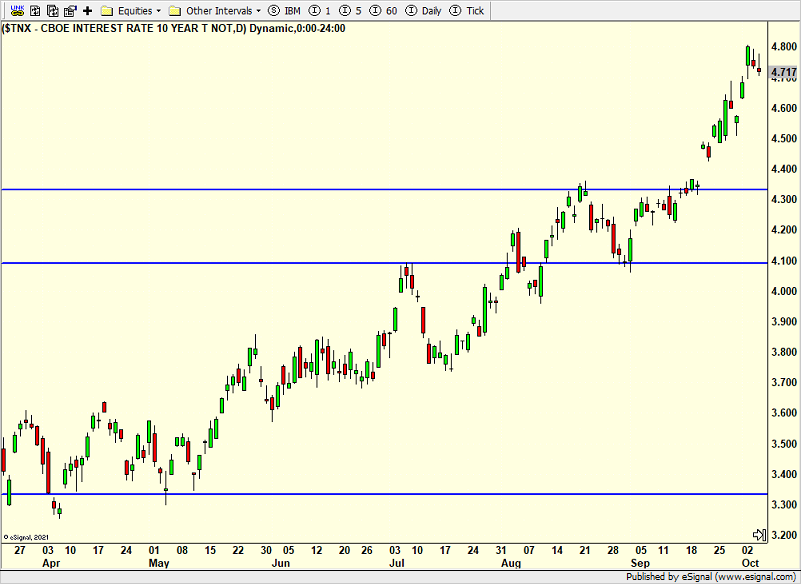

Bonds are below and you can see the 10-Year hasn’t done anything yet to suggest a peak. It just looks like a tech stock during a mania. Manias normally can farther and longer than most expect. Without a reversal, we are likely looking at 5% this month. That could be the final trigger to get stocks to bottom as well.

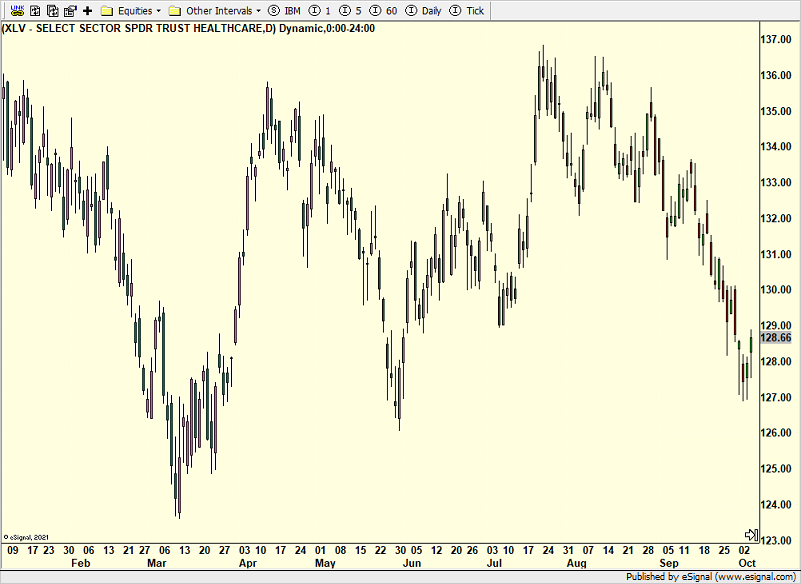

Looking at the sectors, healthcare is quietly getting some love. It is definitely not a sexy or exciting group. It usually does well in a slowing economy which we have not seen yet.

The September jobs report just came out and it’s much stronger than expected. 187,000 new jobs were expected. 336,000 were reported. However, the unemployment rate ticked up to 3.8% and wages grew at a slower pace. All this is a bit murky. The bond market immediately hates the data so yields are rising again. Pre-market equities aren’t thrilled either. The most important thing is to see how everything reacts today. Stocks, bonds, dollar, oil and gold. It should be a volatile day.

Last week, I heard that over the 16 weekends of “summer”, 12 saw rain in CT. Read that again. Truly insane! And guess what? More rain this weekend in CT. I know what’s going to happen. Right when ski season starts in 5-6 weeks, the rain will end and we won’t have snow for months. Been down this road before. It’s not fair, especially after last year’s dud of a winter. At least this week has been a gorgeous fall few days. The leaves should start turning next week. And Macouns are plentiful.

On Wednesday we bought more levered NDX. On Thursday we bought EPI, RYPMX, PMPIX, and more XLV. We sold BASA, SARK and some levered NDX.