Stock Market & Economy Yawn as Trump Terminates Iran Deal

I have to laugh when I hear so many pundits surprised that Trump withdrew from the Iran nuclear deal. It was one of his many campaign promises. Most members of his revolving door administration were squarely against the deal’s continuation. What was so surprising?

While my interview was 5 minutes, only a few comments made the segment on WTNH (ABC in CT) last night. I don’t think the Iran news will have any economic impact at all. It’s been fairly priced in the markets.

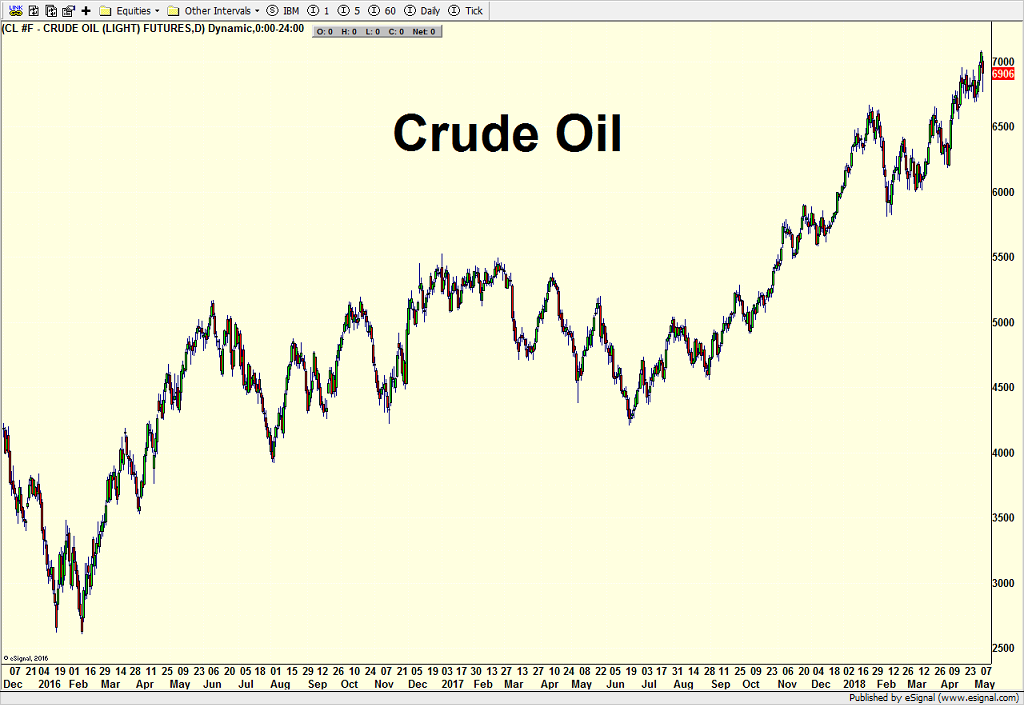

Oil had one of its most volatile days in years as you can see from the ETF that owns oil below. However, counterintuitively, oil did not rally sharply on the news that perhaps Iran won’t be able to sell all of their oil as they have been doing.

The truth is that oil has been rallying for two years from $26 to $70 as I have forecast a few times in my Fearless Forecast. $100 has been my upside target, but I do not believe it is going there during this rally. Oil is at the point where too many people finally believe in the rally. That’s usually the beginning of the end.

The major stock market indices are taking all of the geopolitical news in stride. Consolidation seems to be the operative word as stocks ready for an upside resolution. The S&P 400 and Russell 2000 have been behaving better than their cousins, but I can’t argue with any action over the past 5 days since I wrote about the green shoots.