Stocks Grind Higher As Sentiment Becomes Giddy & Greedy

The stock market has morphed into what I like to call a “grinder” or “creeper” market, meaning that stocks just grind or creep higher without any pullbacks of more than 1% or so. This behavior is usually seen during the second leg of a new bull market rally after the masses did widespread selling at or near the bottom, followed by a vicious initial leg of the rally where the majority believes it is just a bounce with more selling to follow. They’re trapped.

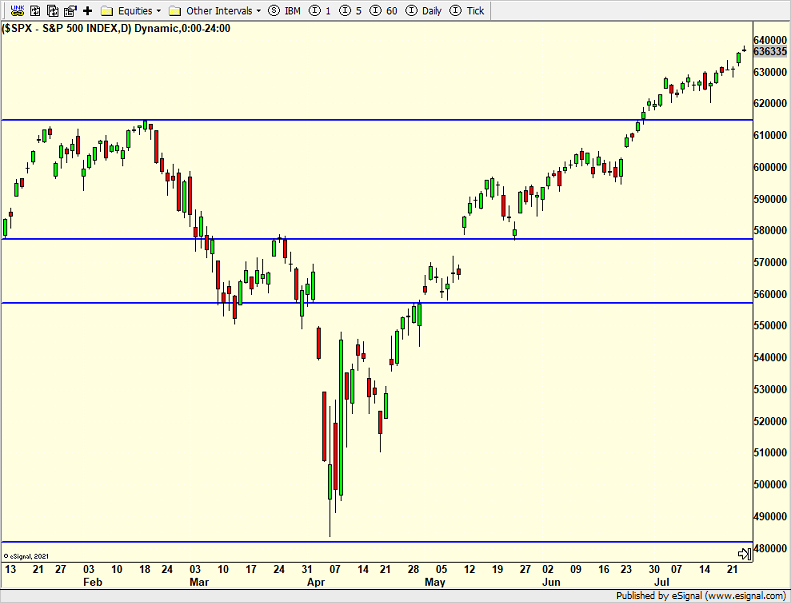

As the first pullback begins, we often hear choruses that new lows are coming. Pundits advise selling the rally. When stocks continue higher and volatility collapses, the masses know they are woefully wrong again and need to buy. The problem is that because so many people are in the same boat, stocks do not weaken. Rather, with volatility low, the stock market begins to just creep higher day after day after day. That started in mid-June, precisely when I wrote that so many people who hated and disavowed the rally were starting to embrace it. Since then, stocks have barely pulled back, forcing so many who sold when the S&P 500 was below 5400 are now forced to buy back in above 6000.

The chart below is the S&P 500 to see what I am referring to.

In April, pervasive sentiment was fearful, despondent and terrified. It is now greedy, giddy and confident. Yes, I am cherry picking the chart below. I want to show you a microcosm of the crazy sentiment in stock terms.

Looks at Opendoor Tech. A 50 cent stock soars to $5 in less than two weeks. Look at the volume in the lower panel. The stock looks like a Dotcom or AI stock from the wild west. I have seen these dozens of times in my 37-year career. 90%+ end up doing a round trip right back where they started. I won’t be surprised if this one does that too.

It has been super easy to make money in stocks lately. Investors are feeling way too confident that it will continue, which makes me feel on the uncomfortable side. While the underpinnings of the stock market remain solid, a quick 2-5% shakeout is likely coming sooner than later. Our models have been more active, but we are definitely dancing closer to the door.

On Monday we bought FDLO, XLRE, PCY and more TAN. We sold CRCL, FLUT, some XHB, some SII and some XLF. On Tuesday we bought LYFT and EMB. We sold QLD. On Wednesday we bought QLD. On Thursday we bought SDS, PANW and more XLRE and more CROX. We sold CYBR, RECS, PZZA, LULU, XYZ and some PDBC.