Stocks Ain’t Done – Lots of Clowns Pretending to Know – Fed to FINALLY Taper

Let me start off by sharing a fun, engaging and informative interview I did with the good folks at Investors Hub. The Federal Reserve is currently meeting and we are finally going to hear about the long-awaited, surprise to no one, way overdue plan to taper asset purchases. This should have started over a year ago when inflation was in its infancy. Of course, my readers began hearing about inflation in the summer of 2020 as the train was leaving the station.

To go a step further, another surprise to no one, I made some very bold market and economic calls during a Yahoo segment where I used the words, “the best is yet to come“. Have a watch. Two secrets regarding inflation and economic growth were shared, but the 2% GDP growth in Q3 should make a trough.

If you lost sleep about the mystery of the missing office key, you can rest easy. After 5 months and countless accusations, the key turned up, safely asleep in the pocket of my raincoat which was last worn in May.

Does anyone know why it is a badge of honor not to use heat until November? But it is okay to turn on the A/C whenever? Well, me neither. So last Friday night, I prepared the pellet stove for winter 21-22 and gave it a test run. While it really enjoys being the heating leader in the Schatz house, I had to let it know that for the second straight winter, I was going to also use the oil furnace as we still have 1500 gallons left at $1.35 to burn. I didn’t even discuss the propane insert on the other side of the house.

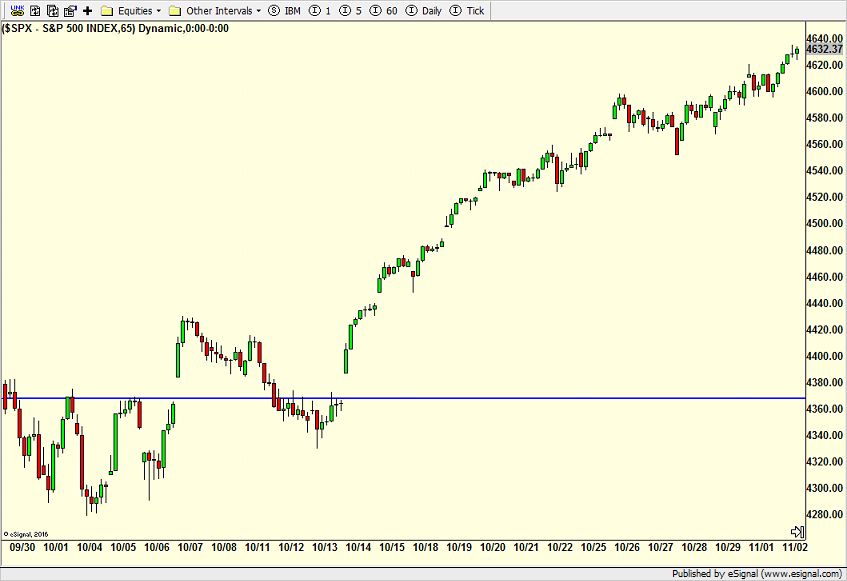

Markets that quietly grind higher can become a little boring or make you complacent, especially if you are fully invested. Some refer to them as “creeper” markets because they just, well, creep higher. While I wouldn’t yet call today’s stock market a creeper, it is getting close. I was just looking at the hourly chart of the S&P 500 over the past month, which is posted below, and you can really see how the recent strength has been unabated since mid-October. The bulls have been in total control. Mind you, on the left side of the chart is when there was a louder bear chorus calling for a 10-20% correction and the peak for the year. Um, well, no on all counts.

If you are that woeful bear who keeps hoping and praying for doom and gloom to strike, it has been a very long 20 days, let alone, 20 months. It seems like every week or so I get served an ad or someone retweets or re-posts some Armageddon call from Kiyosaki or Stansberry. Those always make me laugh. I guess if you make bold calls for the end of the world, the media laps them up like a puppy attacking a bowl of water in the summer.

The problem is that it is almost impossible to find a single perma-bear who has effectively managed money over the years. And now with inflation soaring, cash and cash equivalents lose buying power in a meaningful way. I guess that’s why those perma-bears are better suited to hocking newsletters for $19.95 a month and promising untold riches rather than managing real money in portfolios. You can always hide from, forget or disavow a bad call. In the real world with real money, you can’t avoid your own performance. And all of us doing this professionally know that bad days, weeks, months, quarters and years are unavoidable. As I always tell prospective clients, sometimes, I just really stink it up.

Finally, getting back to the stock market that just seems to grind higher, it can be super frustrating if you are on the outside with lots of cash looking in. At some point, stocks will pull back. And it’s probably sooner than later. However, for all those people looking for “the big one” or even something meaningful, I think you will be disappointed. Don’t be surprised to see my long-standing target of Dow 36,000 hit this week.