Stocks Plunge – Bullish Implications

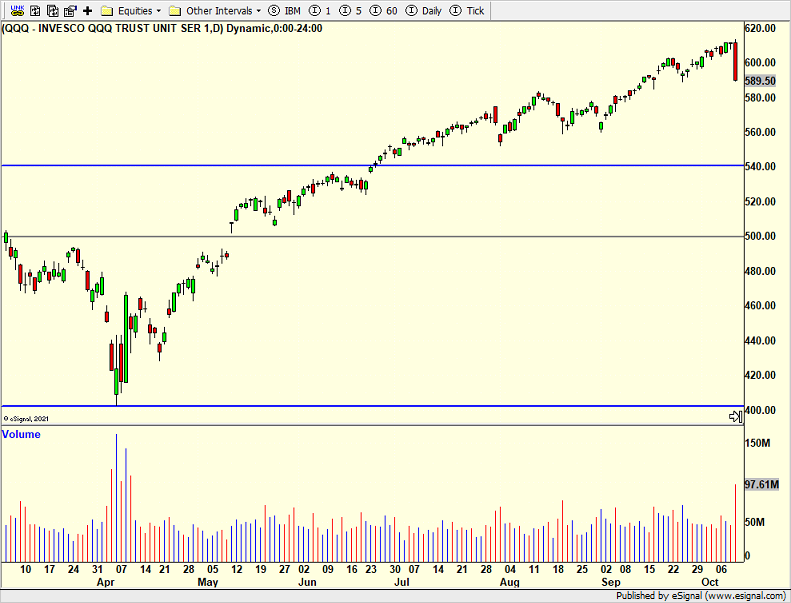

Friday was an ugly day for risk assets as most saw their largest one day plunges since the tariff tantrum period in April. A pullback has been for a while. 80%+ of the volume was in stocks that declined. What rallied the most was hit the hardest. The QQQ which tracks the NASDAQ 100 saw a volume spike to almost 100 million shares as early, all-time high celebrations reversed when Donald Trump tweeted about hitting China with “massive tariffs”. Whether I agree with that strategy or (I do not), I continue to vehemently disagree with releasing market moving information during the trading day.

Last week on FOX Business and Schwab Network I discussed my outlook for a pullback that could be two, three or even five percent, but that markets were absolutely not in a bubble. Lazy and simple people needed to do their homework. On Friday late afternoon amidst the carnage I tweeted and posted on Facebook that closing down at least 2.5% had bullish implications for stocks. That wasn’t an opinion, a spin or a narrative. It was based on data-driven research that concluded the next 5 to 10 days would be sanguine for investors. In a perfect world, I would have liked to see stocks continue lower on Monday or at least Monday morning, but we rarely operate in a perfect world.

I find those one-day plunges from an all-time high more challenging to navigate when it comes to investing new money. More often than not, investors buy up that first decline and all is well. Every now and then we see follow through to the downside over the coming days. In any case, I remain a buyer on weakness this month. As I wrote before, after the first week, October has seasonal weakness until the last week. That seems to be playing out right now. Remember, seasonal trends are tailwinds and headwinds not triggers.

On Friday we sold SSO, SPYQ and DXHYX.