Stocks Pull Back on Schedule

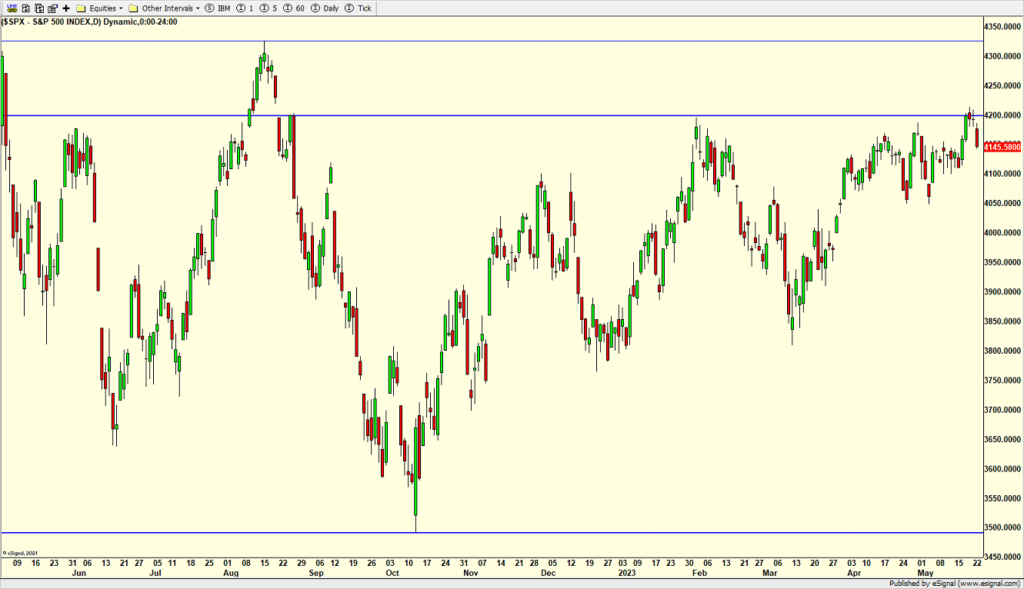

The media is all over the stock market decline that has been going on for all of two days. Two days after a super nice rally off of the March lows. And the decline began almost perfectly on schedule as the leading NASDAQ 100 exceeded the key high from last August and the S&P 500 breached its 2023 high. See the charts below.

Many or most times when prices revisit a previous peak or trough, they back off before going through those levels. That’s what’s happening now. The debt ceiling will be blamed but it would have happened regardless. And despite the growing chorus of imminent doom for the markets, I remain in the camp that a short, sharp decline is possible and would serve to push Congress to a solution. If you follow the trades I post at the end of the blog, you know I have been a net seller overall lately. This week, we haven’t had any activity, but I am looking to buy any woosh lower until proven otherwise.

Finally, the opportunity I see right here and right now is in bonds. I like the risk/reward in treasuries and high quality corporate bonds. I also see an opp setting up in gold and silver stocks over the coming days or so.