Stocks Still On Track For All-Time Highs

Greetings from 35,000! A quick trip to Gainesville, FL and Athens, GA. I hope everyone had a great Father’s Day weekend. Mine was full of family, golf and well, more golf. The U.S. Open was one of the best finishes ever with so many pros experiencing despair amidst a few small pockets of jubilation. For most of the tournament I never thought JJ Spaun would even finish in the top 10. And poor Sam Burns. Hard to come back from that kind of collapse on one of the toughest tracks in the country.

Back at home my in-laws joined my wife and I for a Parent/Child golf event. We happily finished even par, but that didn’t even sniff a prize. Growing up I fondly recall playing in dozens of Father/Son golf tournaments where my dad and I had an enviable track record. Only one do I remember failing miserably when we made a 10 on the opening hole. After he was no longer physically able to play, my mom, a former CT amateur champ, and I buzz sawed through our share of Parent/Child fields. My dad has been gone for 7 years and I think about him everyday.

Turning to the markets, the S&P 500 declined just over 1% on Friday and it could have been much worse with oil prices spiking. This is not the 1970s or even the 90s for that matter. Oil spikes are not the same as they used to be as the U.S. produces so much energy domestically. The Israel/Iran conflict doesn’t appear to have widened over the weekend so pre-market trading is bouncing back by a half percent. I wouldn’t be surprised if markets give up those gains at some point today, regardless of how they finish.

As I mentioned last week, the stock market was set up for a pullback. It was waiting for an excuse. 2-4% seems logical. Aside from Israel/Iran, the Fed is meeting this week. Jay Powell & Company have been wrong. They need to pivot as inflation has been dead and the economy has weakened since last year. It’s not rocket science.

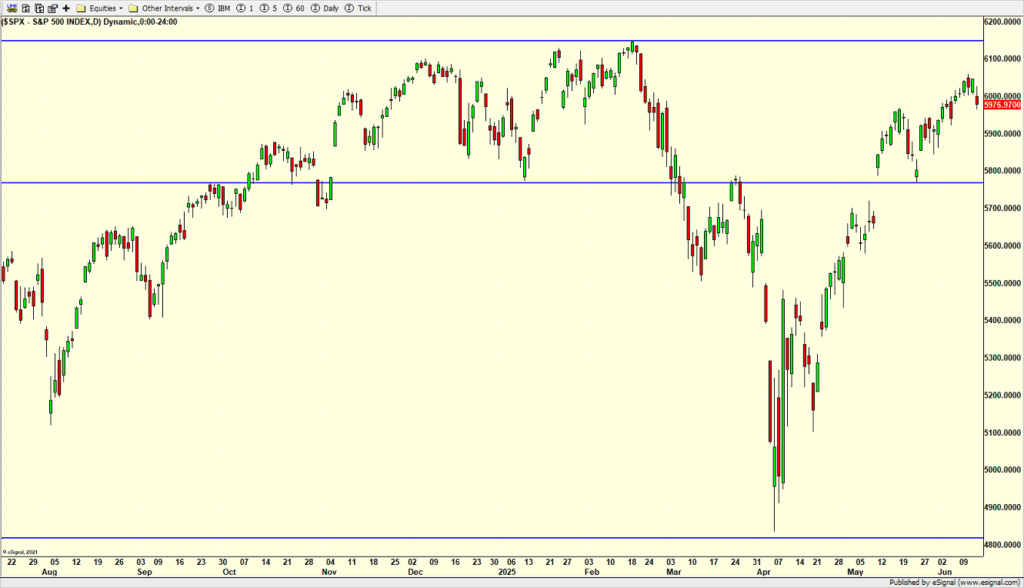

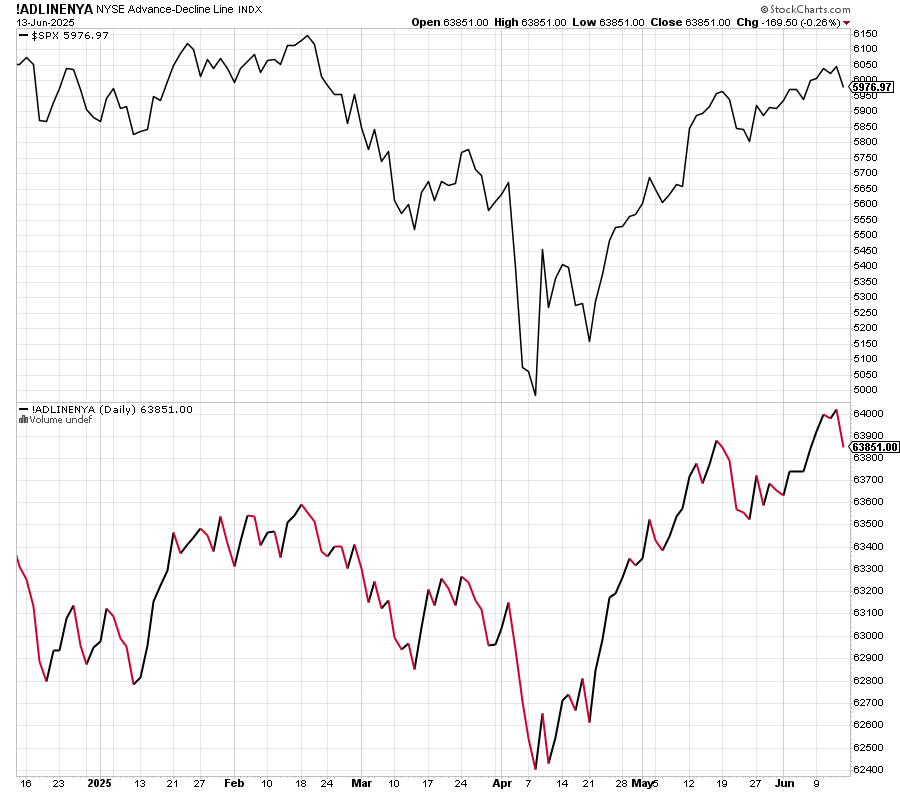

The charts below say a lot about what Q3 should look like for stocks. It’s an oldie but a goodie and one of my favorite indicators. The upper panel below is the S&P 500. The lower panel is the New York Stock Exchange Advance/Decline Line which simply measures participation in the stock market. You can see on the far right that the NYSE A/D made an all-time high last week which says there is underlying strength in the stock market. In other words, new highs should be forthcoming for the S&P 500, something I started forecasting in early April amidst the tariff tantrum plunge.

As long as volatility doesn’t get moving to the upside, the market should be fine in Q3. If I am right about this pullback, weakness should be bought.