Stocks Were Looking for an Excuse to Pull Back

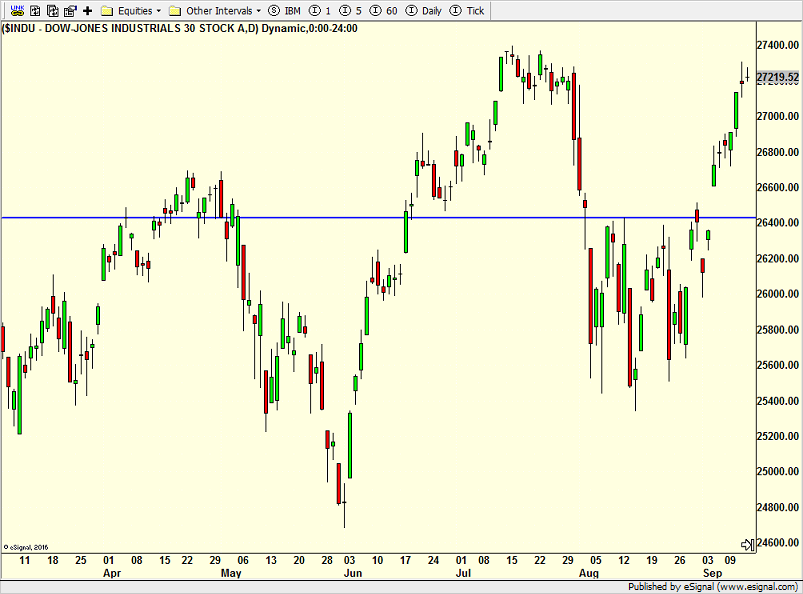

While stocks had another nice run last week, they didn’t exactly close Friday with much strength. That’s not surprising given how most of the major stock market indices were pushing up against all-time highs. So many times, we will a see security come back up and say hello to a previous important peak, only to watch it pause or mildly pullback first. The weekend news about Iran or Yemen conducting drone attacks on Saudi refining facilities was just what the market needed to pause. The key will be how stocks react over the course of the day. I suspect Monday will not become a day of celebration by the bears. The truly important price level is down at 26,400 on the Dow.

Last week, semiconductors scored a fresh, all-time high. As you know, this is a group I have been very positive on all year and especially over the past few months as it began to outperform with each passing tariff tantrum tweet. In other words, semis began to behave better and ignore what seemed to be bad news on the trade front. At the same time, consumer discretionary is right back to the July highs. Banks and transports are threatening to break out. That would make all four key sectors in gear together. What a change from the summer concerns.

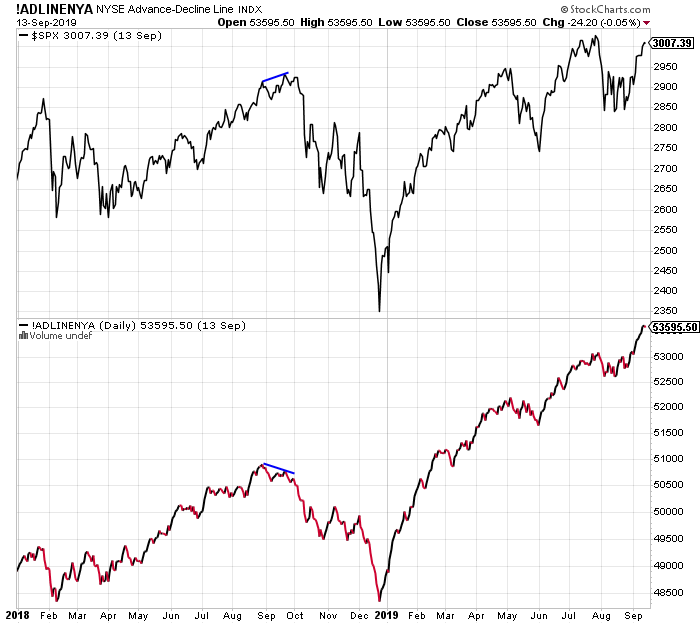

At the same time, the New York Stock Exchange Advance/Decline Line is enjoying its time looking at blue skies above. I read over the weekend that some utter clown was using the NYSE A/D Line as reason to believe a large decline was unfolding. He concluded that the A/D Line was not making new highs, but rather going down as the stock market was rallying. As you can see below, he could not be any farther from reality.