Tailwinds Are Here

I am just back from CA and that was a long trip home late last night. Friends, food and fun.

I did get to binge the full second season of The Diplomat which I highly recommend. I also watched some of Industry season two which is a bit dark and not enough action for me. The Eagles played on Sunday night and I since I so dislike them, I couldn’t stand to watch the whole game.

Let’s start with the calendar. It’s Thanksgiving week which means a seasonal tailwind for the markets. Today and tomorrow are usually coin flips to a slight bullish bias. The better tailwinds come on Wednesday and Friday, but they haven’t been as strong in recent years.

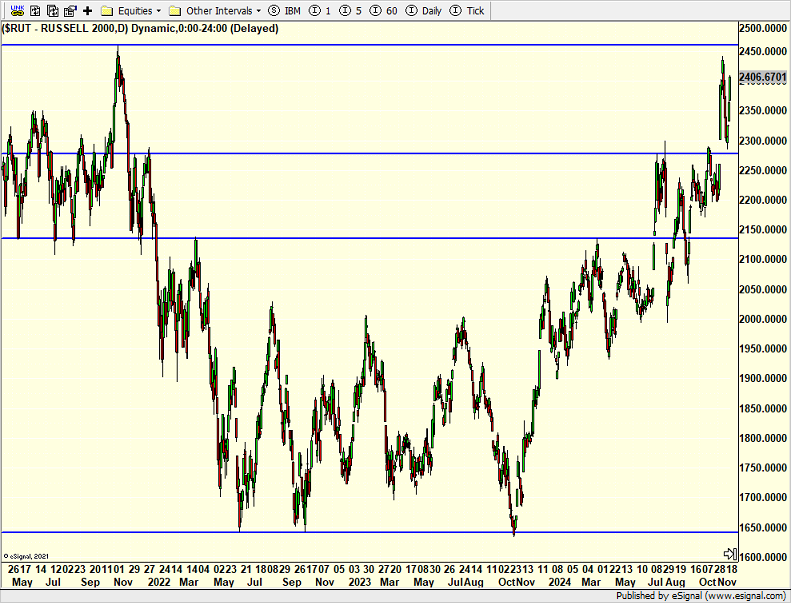

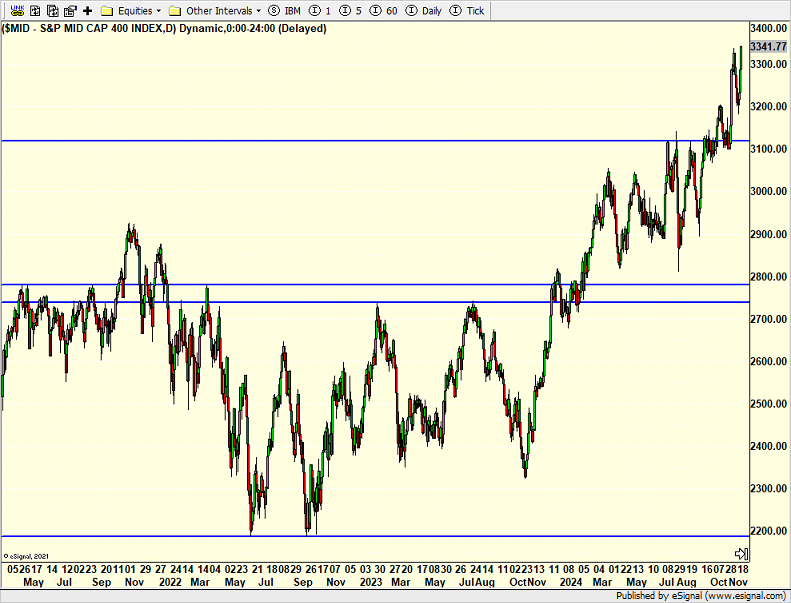

Certainly not to our surprise, the stock market remains in solid shape with all major indices at or close to new highs. Even the long left for dead Russell 2000 index of small companies is only one good day away. Recall that I offered the Russell and S&P 400 index of mid caps as good opportunities a few weeks ago. They are now leading and playing catch up in a huge way.

For weeks, I have read how the stock market is due to fall hard. Pretty much those same Chicken Little’s who have missed the last two years of great gains. Don’t get me wrong. Everything is not perfect. There are some small holes, like crypto speculation. There will be a pullback before year-end. However, as I have said all year and basically since late 2022, weakness remains a buying opportunity until proven otherwise. Healthy bull markets rotate. Unhealthy ones see dwindling participation and leadership.

On Wednesday we bought SSO, EMB, PCY, more MQQQ, QQQW and MTUM. On Thursday we bought SDS, XMMO, QMOM, IYT and more TAN. We sold SSO and RSP. On Friday we bought more MC.