Taking Stock Of The Major Indices As Q3 Begins

Happy July 1st!

Today is the start of the new week, month, quarter and half. Seasonally, today is a strongly positive day and that tailwind carries through until next Monday.

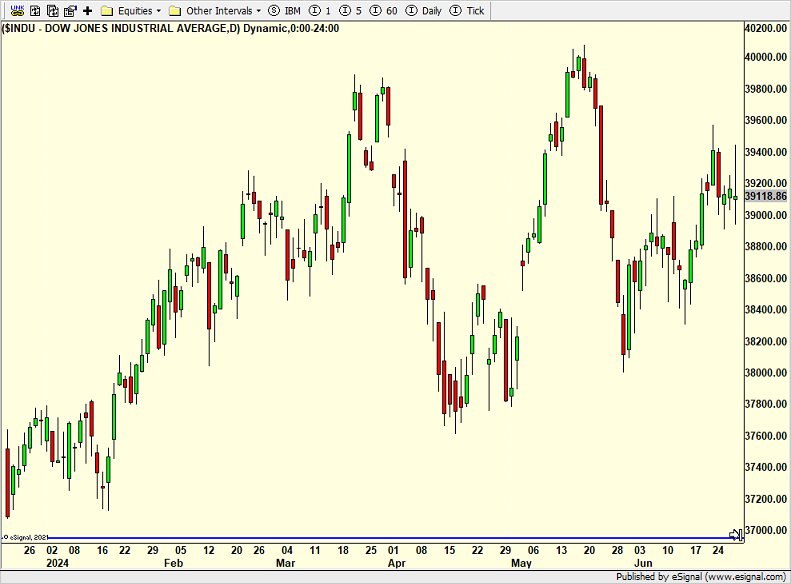

I thought we would take stock of the major stock market indices today. The Dow Industrials is first and it is really just mired in a range.

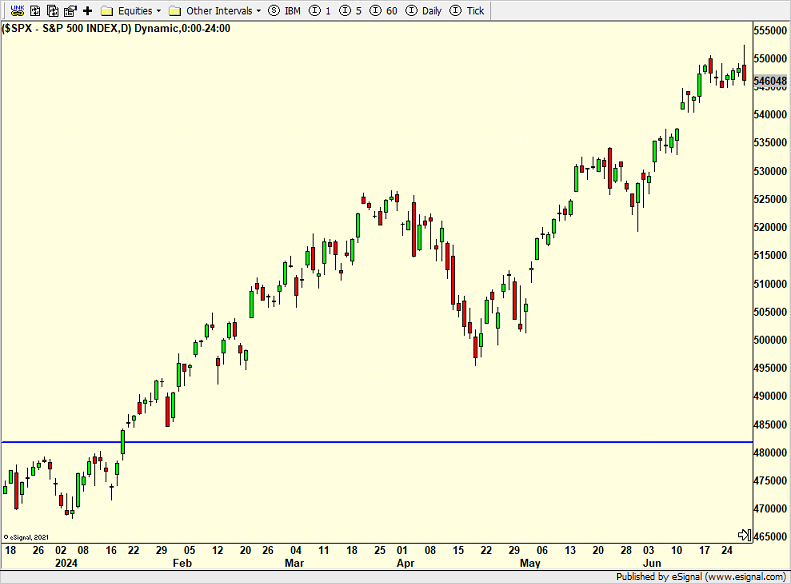

The S&P 500 is next and it looks different from the Dow. This index is dominated by the AI stocks like Nvidia, Microsoft, Google, etc. It is in a strong uptrend.

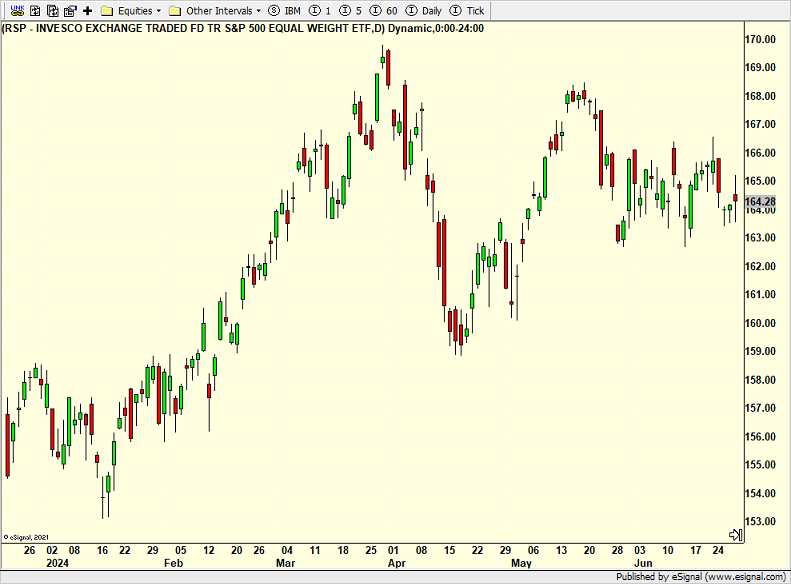

Just for comparative purposes, let’s look at the same S&P 500 but equally weighted across all 500 stocks and not just a few AI ones. It looks more like the Dow, doesn’t it? This is what the average stock looks like.

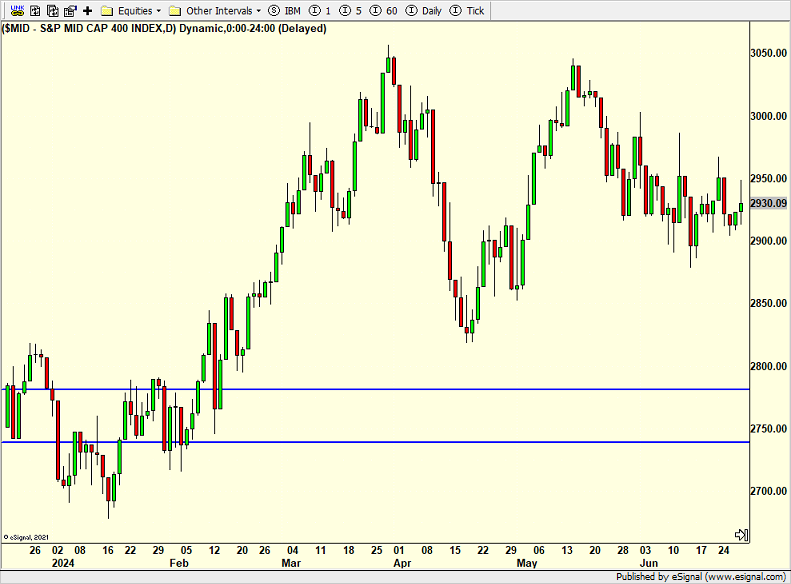

The S&P 400 Mid Cap Index is below. Guess what? It looks like the Dow and equal weighted S&P 500.

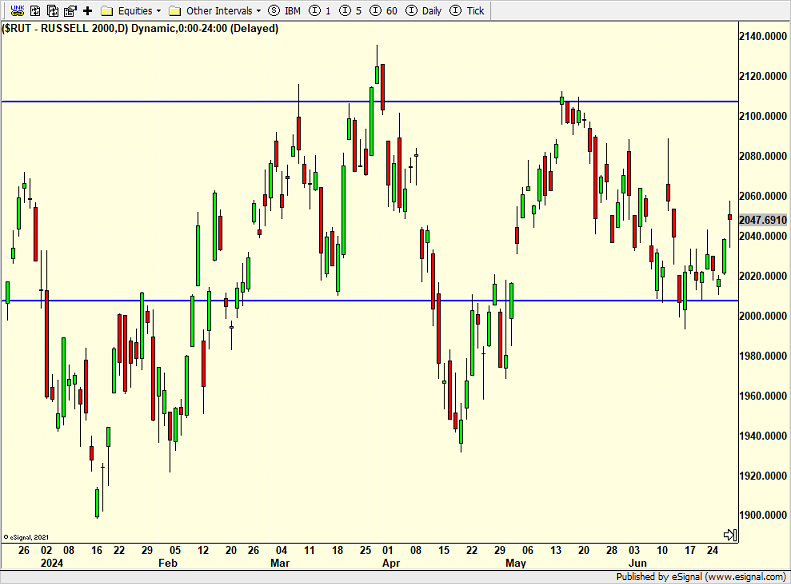

Do I even need to turn to the Russell 2000 Index which covers small cap companies? It looks like the chart above, doesn’t it? Another uninspiring index mired in a range.

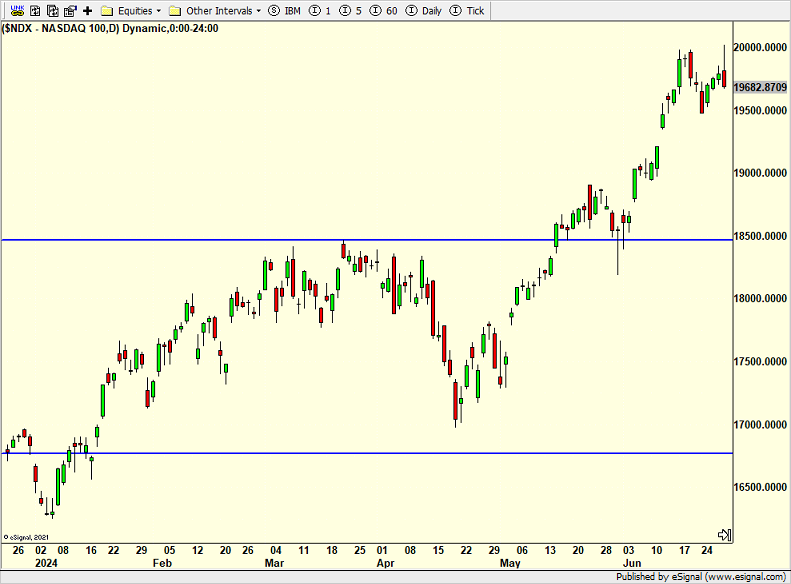

However, here is the NASDAQ 100 which like the S&P 500, is totally dominated by a handful of hot and sexy stocks. Apple, Broadcom, Nvidia, Google, Facebook and Amazon comprise more than 40% of the index. Are we surprised that the index has powered higher?

Finally, just like we did with the S&P 500, let’s look at the NASDAQ 100 where all 100 stocks are equally weighted. That index goes from a juggernaut on a mission to something a little stronger than the weak indices.

What’s the takeaway in all this you ask?

The rally certainly narrowed in Q2, especially as the quarter progressed. A handful of stocks were even more responsible for the gains seen in the S&P 500 and NASDAQ 100. During the Dotcom Bubble, this behavior essentially lasted for 18-24 months before it really matters. And then, the S&P 500 lost 50% of its value while the NASDAQ 100 was incinerated by almost 80%.

Before you ask, the answer is no. I do not believe this is another bubble like the Dotcom one. Perhaps, we will see the AI bubble inflate in the coming years with IPOs and the like, but that’s not the case today.

On Friday we bought RYRHX and more levered NDX. We sold FBND.