Tariff Tantrum Part ?

Here we go again? Kinda? Sorta?

Donald Trump was at it again this morning with threats of 50% tariffs on the European Union along with specifically targeting Apple. I remember telling folks after the supposed China “deal” that it wasn’t the end. It was the end of the beginning. And my opinion remains that the worst has been seen on the tariff front. Additionally, I still believe that one day this year we will wake up to bad news on the tariff front and the stock market rallies. Then, we will know that tariffs have been fully priced in and the markets have moved on to other issues. That’s certainly not today.

If we learned anything from Trump 1.0 it is that President Trump uses chaos as a management style. That’s not a knock; it’s just how it is. If the administration pulled Treasury Secretary Bessent back from the spotlight and inserted Peter Navarro, I would be more concerned about a more significant pullback.

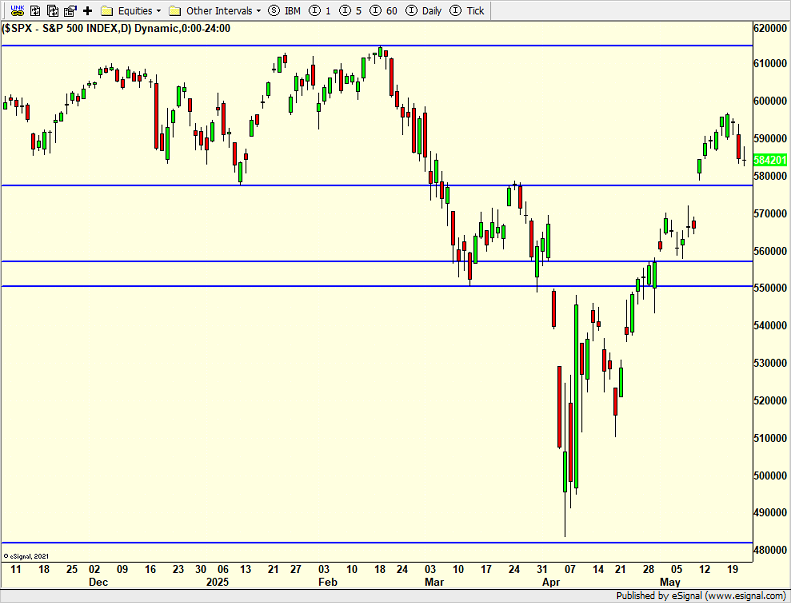

As it stands, stocks look to open about 2% lower which puts the S&P 500 below 5800 and last week’s low. In turn, that opens the door to weakness just below 5700, probably by month’s end.

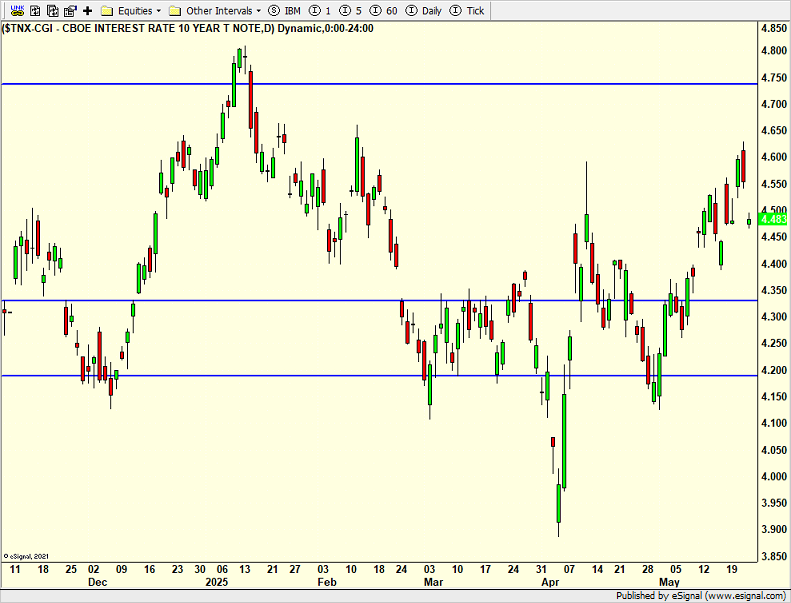

This week, long-term interest rates have been the big issue as they have risen from 4.40% to just under 4.65%. Pundits have all become geniuses on the bond market with calls of 5% or higher in the here and now. The tariff news throws a wet blanket on the rise in yields because the threats on the EU are an economic dampener, meaning slower growth and lower long-term yields on bonds.

While the news may be a surprise or even a shock to some, the stock market had soared very far and very fast. A pullback was due. It’s here. I think it will be healthy and routine and one to buy.

The unofficial start of summer is here. While many of us think of Memorial Day weekend as a time to enjoy family, friends, cookouts and fun, it’s also (and mainly) a time to honor those who have fought for our freedom. Thank you to all those who have bravely served this great country!

On Monday we bought QMMY. We sold PCY and PEP. On Tuesday we bought SSO, DH and more MQQQ. We sold QLD and SDS. On Wednesday we bought more QLD. We sold EMB and some MQQQ. On Thursday we bought RECS, more KIE and more SPLV. We sold some SSO.