Tariffs Trump Tired

Greetings from being back in CT! My flight to Florida has been delayed for mechanical reasons and the airline isn’t sure when or even if it’s going to fly.

Last Friday I wrote about the stock market being tired. It had rallied very far and very fast, similar to how it plunged in April although the downs are almost always sharper than the ups. I thought maybe some sideways action or a few percent lower. The news of the weekend and morning ran right over the tired notion as a deal with China to reduce tariffs has supposedly been made in principle. As such pre-market trading is sharply higher by 3%+. If that price action holds the S&P 500 will be above my next target of 5800.

When I started to forecast all-time highs, people thought I was crazy, as usual. I heard plenty from the bears and geopolitical experts how this was just a quick bounce in a bear market and I would get run over taking the bullish side. And I will freely admit that I did not see such a quick recovery. I thought stocks would regain what they lost during the tariff tantrum plunge and then spend some time figuring out Wal-Mart’s growth scare comments from mid-February. The rebound and associated thrusts higher in the market have been impressive.

And this market is exactly why managing portfolios by geopolitics is about the worst process imaginable.

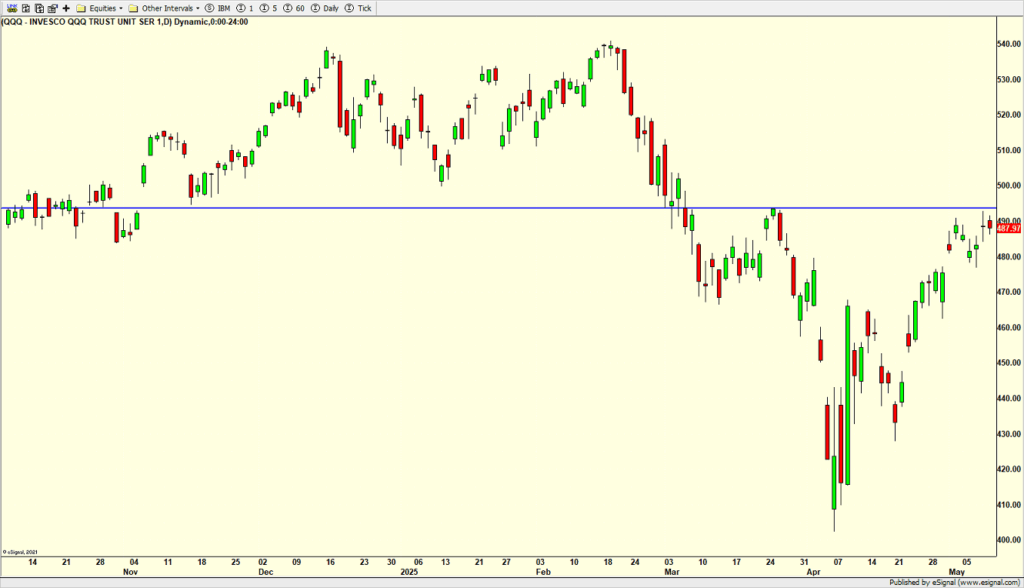

The NASDAQ 100 is below and it’s even stronger than the S&P 500. While I was thinking new highs in Q4 or Q1, the scenario is happening much faster. The markets not near new highs to be clear, but they are also much better positioned than they were a week or two ago.

Usually, when so many people are so glaringly wrong many revise history or panic buy/sell. I am sure I will get plenty of emails from folks who chirped me about my bullish stance only to now ask when they should buy and what. That is a tough position to be in.

On Friday we sold PCY, QLD and some MQQQ.