The Bears Just Won’t Give Up

Greeting from snowy and chilly Vermont where D and I did our thing on Sunday, drive up in yet another storm. That’s four straight drives in storms this month. While skiing was really, really good yesterday, we are hoping for an epic powder day since it’s been at or below 0 for so long. That turns the snow into Utah-like cold smoke, meaning super, super dry, light and fluffy. We’ll figure out how and when to go home after lunch.

As much as the media tries to sell gloom, doom and negativity, the markets see right through it. As much as people try to do the “BUT BUT BUT” with geopolitics, the markets see right through it. We know from the data that earnings are strong. The economy is growing very well and core inflation is at a 5-year low. I don’t understand why so many folks are so negative.

I had a question about the broadening trade I have written about since Q2 2026. While I have shared the large caps versus small caps chart many times, let me share a different one. Below is the equal-weighted S&P 500 versus the cap-weighted S&P 500. In other words, it’s the S&P 500 where each company has the same weight versus the S&P 500 where the largest companies represent 40% of the index. You can see that since November the equals have led which is broadening.

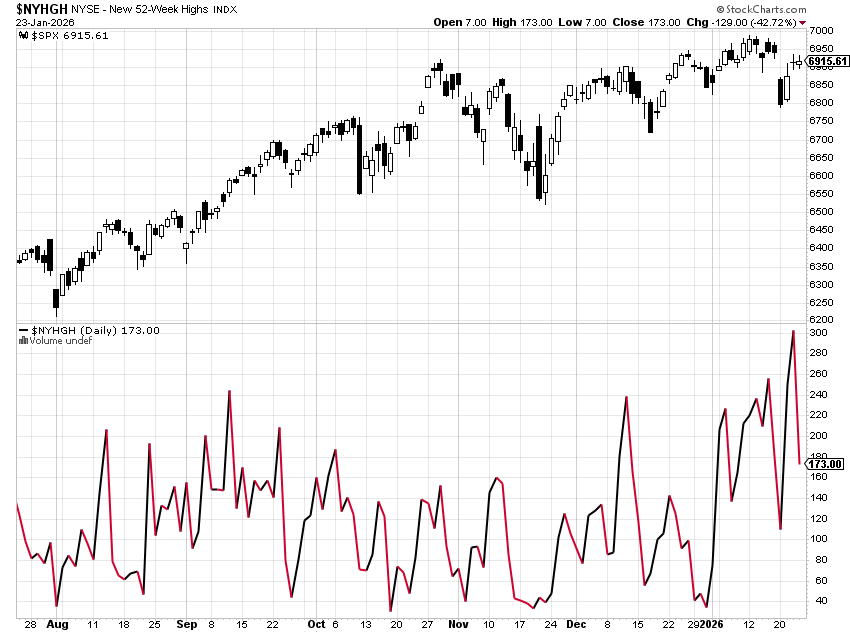

I saw something else last week that was interesting. Below is the number of stock making new 52-week highs. I have heard a number of pundit crying about the “paltry” number of new highs. Well, on Thursday the number of new highs more than doubled.

Finally, lots of chatter about the emerging markets which thrive on a weaker dollar. Below is a monthly chart. It seems like people finally noticed that the EEM ETF made an all-time high. For all intents and purposes EEM hasn’t made a nickel since 2007. 20 years is an awfully long time to sit tight in dead money.

There is nothing with stocks taking a breather or having the broadening trade rest for a few days to a few weeks. Weakness remains a buying opportunity. I continue to look for new highs across the board this quarter and Dow 50,000.

On Friday we bought more IYR. We sold some SLB.