THE Bottom or A Bottom? Banks Looking Good

After Monday’s mauling by the bears the losses mounted to roughly 5% and was pretty much in straight line fashion since the May 1 FOMC meeting. In other words, for all the fire and brimstone by the bears, all we have see, so far, has been a normal, routine and what I will call “healthy” single digit, bull market pullback. Very little internal damage has been done.

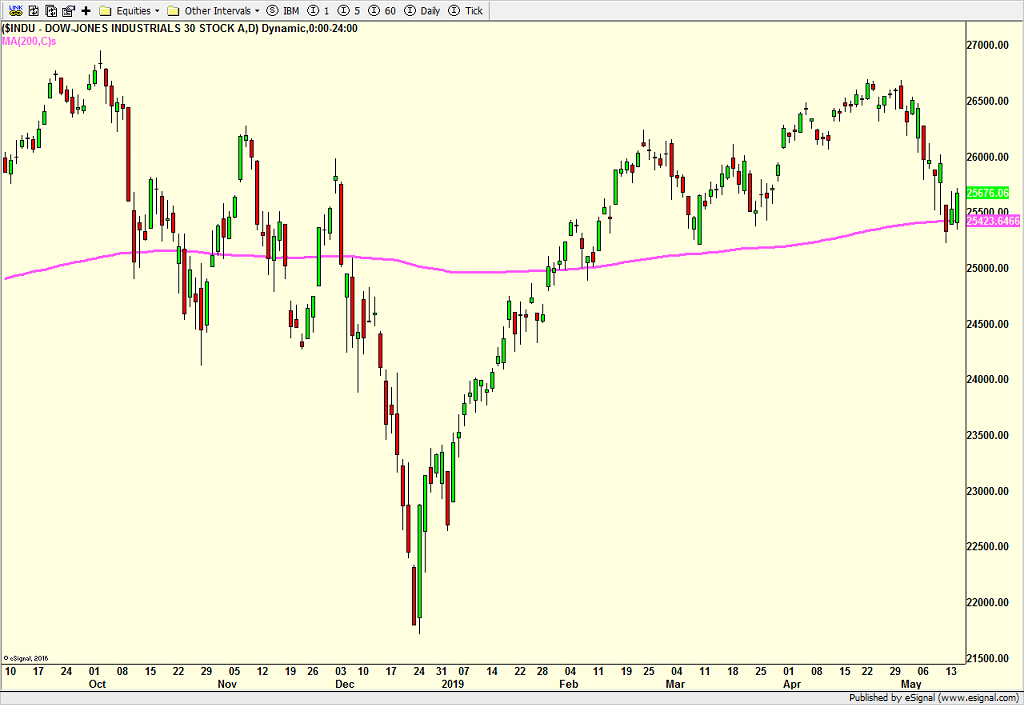

The Dow Industrials said hello to its long-term trend, the average price of the last 200 days, but no other index has made that trip. You can see that line below in the pink. I am not viewing it as all that important.

At Monday’s close a whole of our models and indicators flashed green, meaning very favorable conditions ahead to own stocks. Since we take any defensive action ahead of the decline, we really didn’t have much dry powder to use on that new green signal.

One thing that bothers me is that stocks closed near their lows on Monday and jumped higher out of the gate on Tuesday. That’s a very atypical fashion to put in a bottom. I would rather have seen some more short-term weakness. As such, I am keeping that scenario open, where we may see another decline below Monday’s lows. Regardless of which scenario stocks follow, I remain firm that this is not going to be a full-fledged 10%+ correction and that the bull market is not over. Furthermore, all-time highs should be seen in Q3.

Sector-wise, although I still really like technology, I would rather buy it at lower levels with new money. The banks interest me right here and right now. Sentiment is poor on the sector and I don’t hear anyone talking them up. That’s the kind of trade I like. Additionally, it’s hard to argue with the behavior in the defensive area, specifically staples, REITs and utilities. They are certainly signaling slower economic growth and a thirst for yields.

I think I need to do a bigger update outside of the blog. Maybe tomorrow.