The Fed is Woefully Wrong & Jay Powell Has Become a Cocktail Party Punchline

As the popular 80s band, Whitesnake, once wrote, “Here I go again on my own. Going down the only road I’ve ever known.”

You can substitute the “I” for “we” and you have the FOMC of the Federal Reserve. You know that group. The ones that raise and lower interest rates without fully assessing the markets and economy. The ones who are supposed to be smartest financial minds on earth and the greatest bankers.

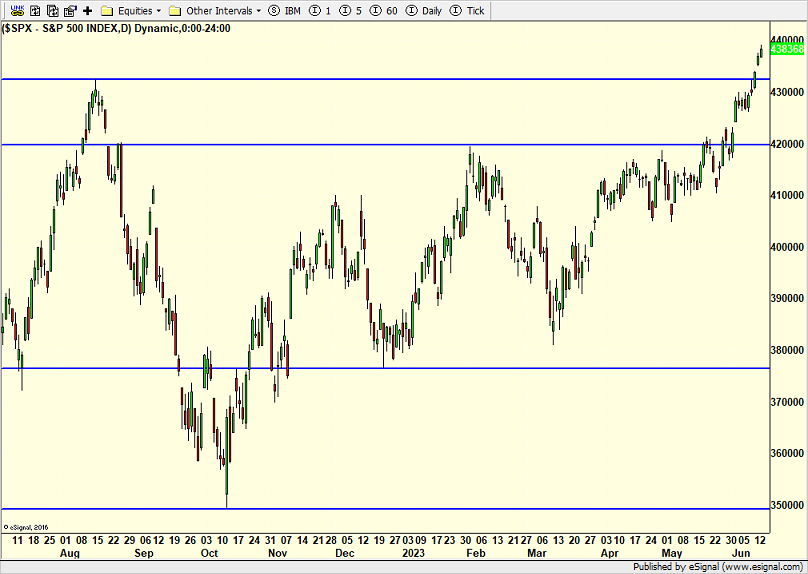

Before I continue, let me offer the lay of the land for Fed statement day. Stocks will trade in a range of plus or minus 0.50% until 2pm and then see expanding, two-way volatility. Pre-Jay Powell, there was a strong trend to see strength into the close. Now it is more of a coin flip. Additionally, because the S&P 500 has rallied so smartly this month and into the announcement, much of the strongly bullish trend has been muted. In short, there is no discernible edge to exploit.

With that said, given where stocks are, I am more apt to view any post-Fed strength as an opportunity to harvest some acorns, reduce exposure or take down risk. It has been an epic run in some areas and I am rarely hesitant to take action on a subjective basis unless a strategy does not permit.

Getting back to the Fed meeting, Jay Powell & Company will not raise interest rates today. They will talk about this “pause” but be very stern that the July meeting is “hot”, meaning the opportunity to hike rates again. Far be it for me to be blunt (sarcasm), but Jay Powell et al have become a cocktail party punchline.

Jay Powell was woefully wrong about inflation and Americans suffered mightily. Janet Yellen was woefully wrong about another financial crisis and Americans suffered mightily. Ben Bernanke was woefully wrong subprime mortgage contagion and Americans suffered mightily. Alan Greenspan was woefully wrong about so many things, I don’t have space to write.

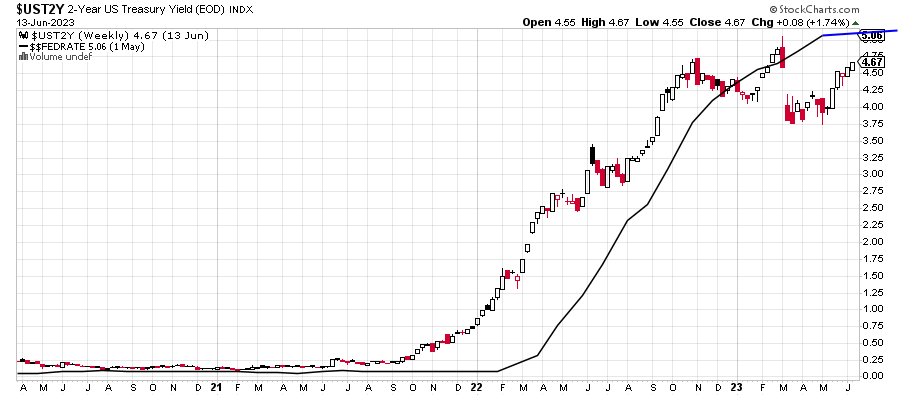

Below is a chart I often feature on Fed day. It is simply the Fed Funds Rate, the main tool of the FOMC, against the 2-Year Treasury Note. My friend, Tom McClellan first shared it with me a few decades ago.

The Fed basically follows the market. In this case it is the 2-Year. That is, until the Fed decides it knows more than the market. And that never, ever works out well for the economy or markets. Let me be crystal clear. I am not saying the Fed should follow every little wobble in the 2-Year. Put a moving average on the 2-Year and call it a day. Seriously.

At the end of 2022, the 2-Year and Fed Funds Rate crossed, signaling equilibrium. That’s the beginning of the end for rate hikes. The 2-Year is telling us that we need a period of sideways movement now in rates. The Fed should be done. If the economy, especially the jobs market weakens, we will see the 2-Year head below 4% and Fed rate cuts will be back on the table. If not and Goldilocks continues, the Fed should stand pat at 5% and the 2-Year can trade between 4.25% and 5%. End of story.

Finally, while I was the lone loud and strong bull from September into January, and I am still bullish today, I am certainly less so. I felt great being questioned all the time when I forecast a 15-20% up year for stocks with a plausible chance for 30%. The masses all thought 2023 would be really challenging for stocks during the first half. I thought it would front-loaded with semis, tech and biotech leading the way.

The easy money has been made. After all this strength we are now starting to see the media pundits open the possibility that a new bull market began, something I first started discussing last October. All those investors in the bomb shelters, defensively positioned for economic Armageddon are sitting around without a clue on what to do. I get it. Truly I do. I am not throwing new money into our aggressive strategies. But these folks now have to either chase returns because their benchmarks are so far away or hope and pray for a 20% decline. Neither is a great strategy.

On Tuesday we bought PEY, SAMBX, PHFNX and more IJS.