THE Weakest Seasonality of the Year is Here

Stocks are looking a little tired. That’s my take today. The bulls have tried twice to score new highs, but the bears have put up a little resistance over the past two weeks. While I do not believe the market is on the verge of a bear market or even a 10% decline, risk/reward is no longer tilted strongly towards the bulls. And that’s okay. FYI, next week is the weakest week of the year on an historical basis for the stock market.

Stocks have run fairly hard since the August lows without much in the way of leadership deterioration. In fact, leadership has only gotten stronger with semis and discretionary pulling up transports and banks. Junk bonds are only slightly off all-time highs. There is lots of upside room left in this bull market.

I heard an interview with the head of a midwest state pension fund yesterday. I am not 100% sure, but I thought it was Wisconsin. Maybe not. But that’s what my 53 year old brain remembers. Anyway, I was absolutely floored with what I heard. First, this guy said he expects to earn 6% a year over the next 5 years which led me to think they had a very high allocation to anything but bonds. Then he said the fund is 45% allocated to bonds. And then he proclaims that his peers will only earn 5% a year over the next 5. His confidence lies in the fact they own a lot of private investments in private equity, private real estate and private debt and they know how to find only the best managers.

I was shocked at his arrogance and flat out ignorance. Someone should have told him that pension money is usually viewed as “dumb money” by analysts. To think he could outearn what he forecast for his peers by 20% is laughable. If that was a way to short his fund and buy someone else’s, I would love to do it.

When asked about why active investing was about to have its renaissance over passive, something I do believe will begin in the early 2020s, this joker boldly states that it’s because a few huge stocks are dominating the indices while the rest of the market is not doing well. HELLO! ANYBODY HOME?

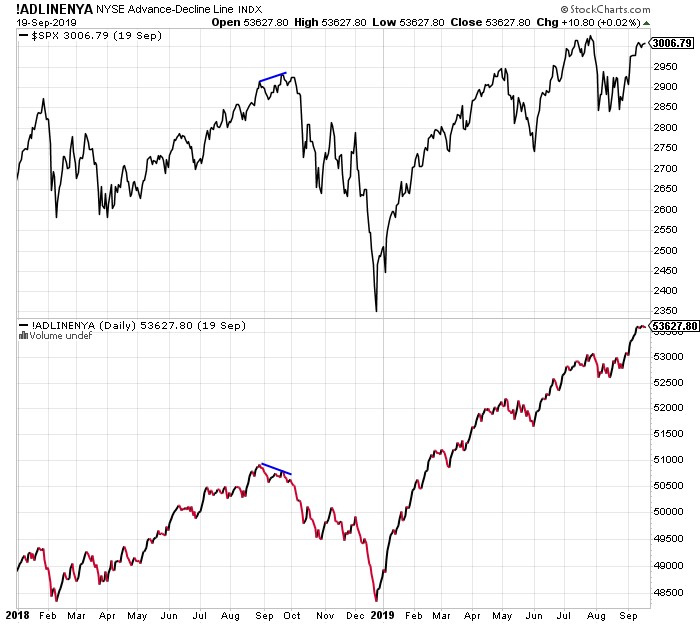

This is where a seasoned, market informed interviewer would strongly push back on a thesis not supported by facts. Look at one of my favorite canaries below, the New York Stock Exchange Advance/Decline Line which measures participation in the stock market.

Where is it and has it been sitting?

ALL-TIME HIGHS

That means that the rally is broad -based with lots of of stocks participating and going up. I can’t believe a manager charged with tens of billions in assets can seriously be this clueless. I mean, if you don’t know, why make statements that can so easily be refuted with facts? I will be shocked if this fund will outperform its peers over the next 5 years with a leader not in touch with reality.