The Weakest Week of the Weakest Month Already in Pullback Mode

And so begins the weakest week of the weakest month of the year. In fact, for all of September’s ominous tones, you can attribute more than 100% of the negativity to this week. (hat tip to my friend Rob Hanna of Quantifiable Edges) Now, before you start thinking about crashes and collapses, let’s remember that we are talking about an average, not a certainty. And last Friday was down decently against the backdrop of the auto strike and one of the big four options expirations of the year.

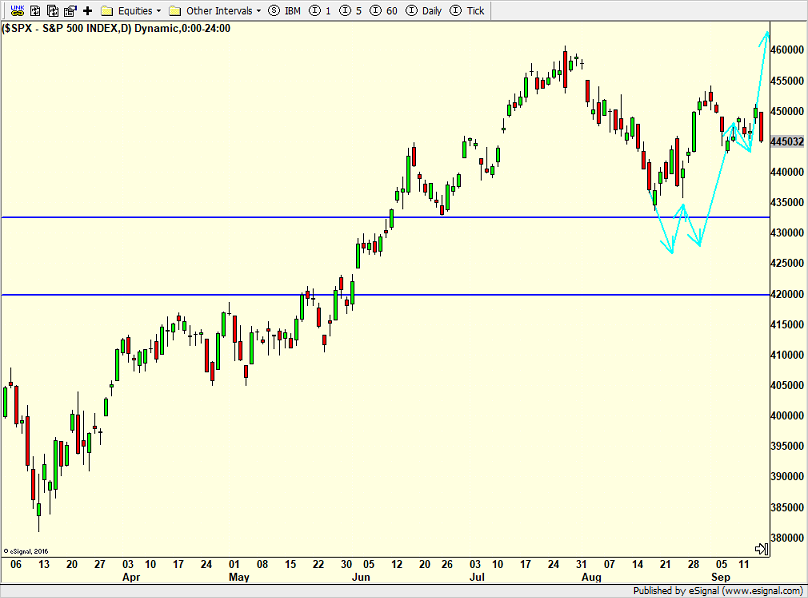

Nonetheless, stocks remain in pullback mode as they have since mid-July and early September. As I have written about several times, I do not like the set up of late. You can see below that the S&P 500 has been bracketed by the September peak and trough which are not that far apart. I thought and still think that when the index closes above or below one of these levels we should get a bigger move. For now, we just wait, but Friday’s decline turns the very short-term tide back to the bears.

A decline below the September lows should put 4250-4350 in sight on the downside with 4280-4300 as a more granular target. And if that happens, we should see a solid low forming from which a big Q4 rally should emerge. Lots of “ifs” right now, but that’s what I continue to look at.

As usual, I have no idea what the catalyst will be. Government shutdown, bond yields spiking, oil prices, China. I don’t think it will be the Fed which meets this Wednesday. Regarding bonds which have treated me poorly this year, the market looks like higher yields are coming on the 10 and 30-Year.

On Friday we sold EMB, PCY, some NFLX, some EPOL, some mid cap value and some levered NDX.