Three Scenarios to Year-End

On the surface, you would think that the past nine days were nine easy days for the bulls. After all, the Dow was up more than 5%. What could be bad? Beneath the surface, there was much wrong with the post-election rally that began the day before the election. To begin with, the Dow was a leading index, followed by the Russell 2000. The S&P 500 and S&P 400 were nothing special. The NASDAQ 100 was actually down over the two post-election days and is lagging very badly. Reread that last sentence. With the Dow up 5% over two post-election days, the usually leading NASDAQ 100 lost ground over those two days. That is not a healthy market.

Internally, it looks even shakier with the average stock on the New York Stock Exchange closing lower post-election. Now the bulls will argue that it’s because the bond market has been hit so hard and there are a large number of bond-related issues trading on the NYSE. They are correct. The bears, however, will state that these very bond-related issues are the ones which have powered the NYSE Advance/Decline line to new high after new high and their fall from grace is definitely a strong warning sign. The bears are correct as well.

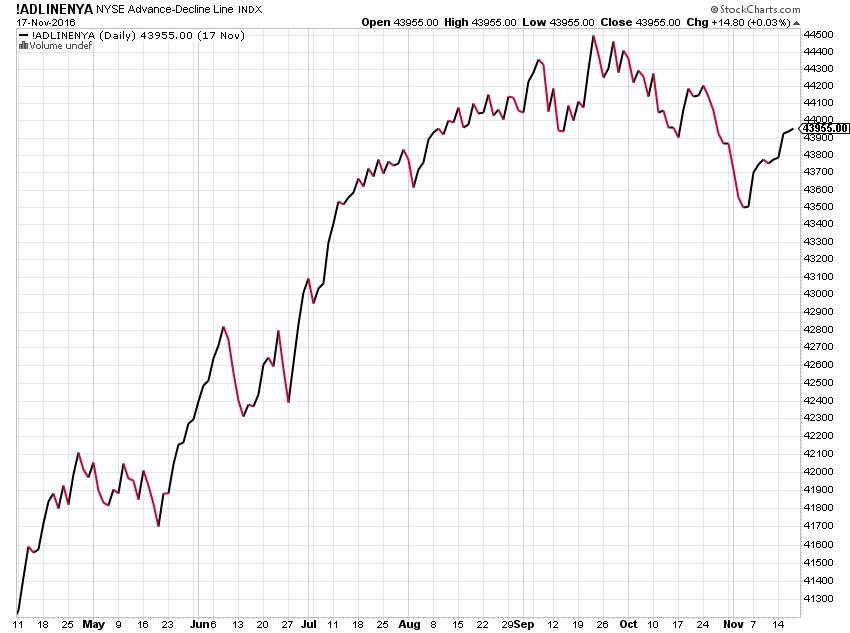

Below, I am going to depict this quandary in two different but similar ways. First, you can see the old tried and true NYSE A/D Line which is just a cumulative total of each day’s number of stocks going up and down. It peaked in late September but so far, has been unable to regain that level and confirm the market’s huge surge.

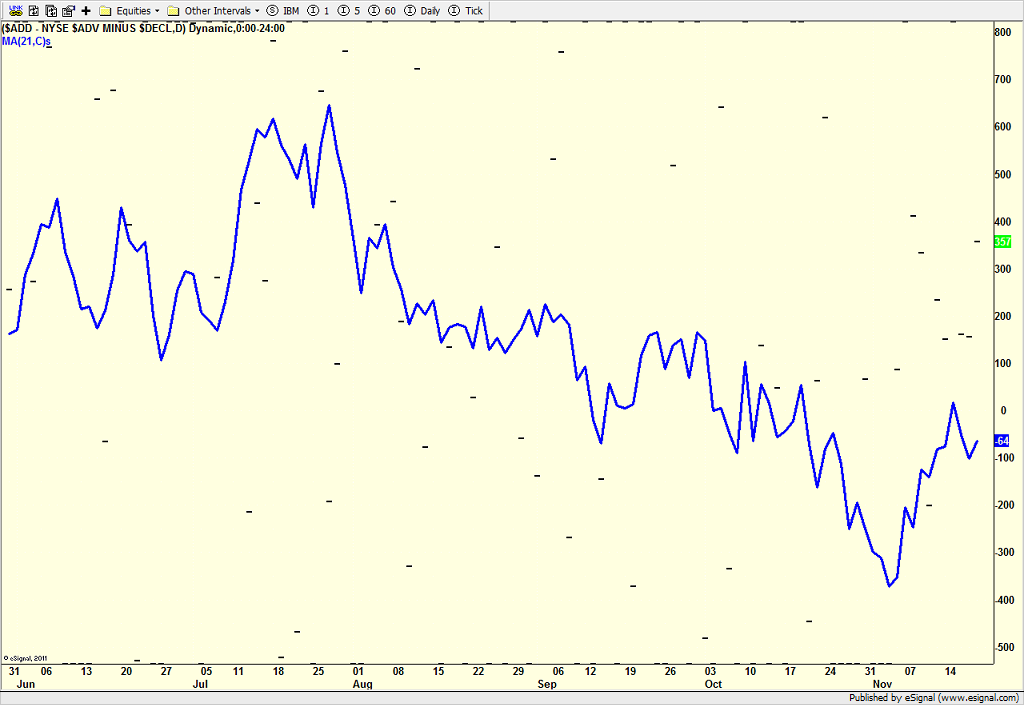

Next, you can see the S&P 500 with the 21 day moving average of the number of stocks going up and down on the NYSE. This is a shorter, but also valuable indicator of participation and health in the stock market.

This indicator peaked back in July and has been almost steadily in decline except for its recent uptick post-election. It, too, is not confirming the strength seen in stocks since the election.

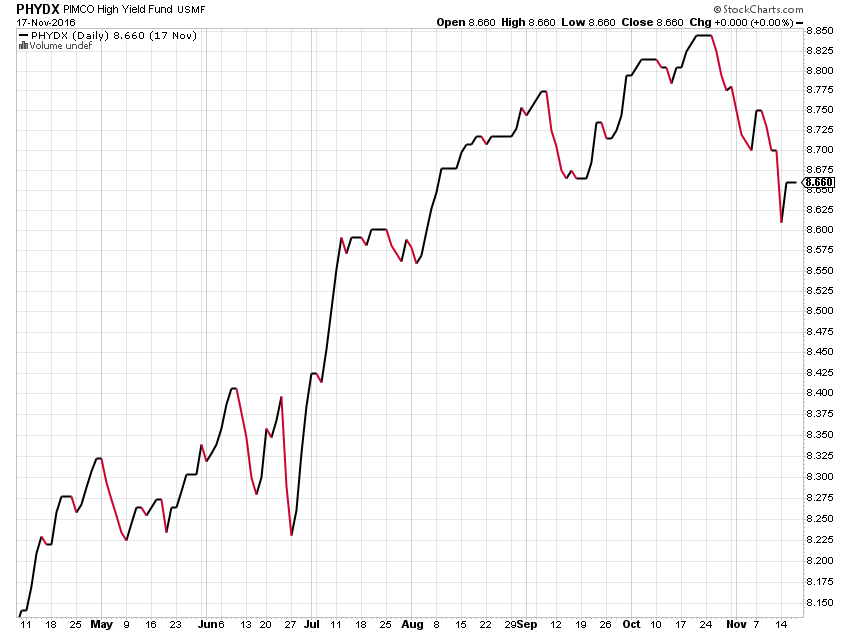

Finally, below is the PIMCO High Yield Fund which is a good proxy for the high yield (junk) bond market. As you know, high yield bonds are perhaps my favorite canary in the coal mine. This sector peaked in October and has been very weak ever since, including post-election.

Something just isn’t right…

On the sector leadership front,banks, semis and transports, all key sectors, have celebrated the Trump victory in a huge way all soaring to new highs. Discretionary has been the lone key sector hold out, but that group is trying to get its act together as a late comer to the party. This strength in leadership somewhat mitigates the dire picture painted above.

On the sector leadership front,banks, semis and transports, all key sectors, have celebrated the Trump victory in a huge way all soaring to new highs. Discretionary has been the lone key sector hold out, but that group is trying to get its act together as a late comer to the party. This strength in leadership somewhat mitigates the dire picture painted above.

When our research indicates a weak market while stocks are at new highs, I often refer to a “window of opportunity” for a decline. While that window is open, like now, a decline has a higher probability of occurring. Once that window closes, it becomes less likely. I was emailing with one of our adviser clients the other day and Mike asked what were the most likely scenarios I saw unfolding through year-end.

1 – Stocks peak now and decline 4-8% over the next month and rally strongly into year-end.

2 – All of the weakness I described above is absorbed by the market. Stocks pause for a week or so and then roar back to life right into January.

3 – Stocks meander around for another month and then rally modestly into January where they peak and see a 10% correction in Q1.

At this point, I am hesitant to score the scenarios, but the action over the next week or so should allow me to remove at least one scenario. The window of opportunity for a stock market decline has opened and it’s time to play defense. We will see what shakes out. This is not the time to be complacent.

If you would like to be notified by email when a new post is made here, please sign up HERE