Thunderstorms Brewing

It cannot be July 31st. No way. Can we get summer to slow down a bit? I am sure those in the sweltering and parched areas of the country don’t want to see that, but I do, especially after we finally got a glorious Sunday with golden sunshine, low humidity and temps in the low 80s. It was so nice that after we grilled and ate outside last night, I built a fairly substantial bonfire that began slowly with some fits and starts before turning into an inferno that raged all night.

Today is the last day of the month in what has been another sanguine month for the bulls. This year has been super fun so far, however, I do expect some changes coming. To beat a dead horse, I have been unequivocally bullish for 9 months. I don’t know many people who have been as positive as I have been, certainly no one who stuck their neck out while in the abyss to call for an end of the bear market and a new bull market. I know. I know. What have I done for you lately?

While I am absolutely not calling for the end of the bull market or even a full-fledged correction of 10%+, I do think whatever weakness is coming by year-end is right in front of us. Summer brings thunderstorms, some quick, some longer, some powerful and destructive, some more mild. On either side of the storms, there is usually really nice weather. The weather is gorgeous now and I think it will be again as well. But Bull Airlines may encounter some turbulence in August and/or September. Please stay seated and fasten your seat belt just in case.

There are lots of things I am watching and this week has a surge in Q2 earnings coming out. If my memory is correct we have Apple and Amazon reporting which should be big affairs with volatility in both directions.

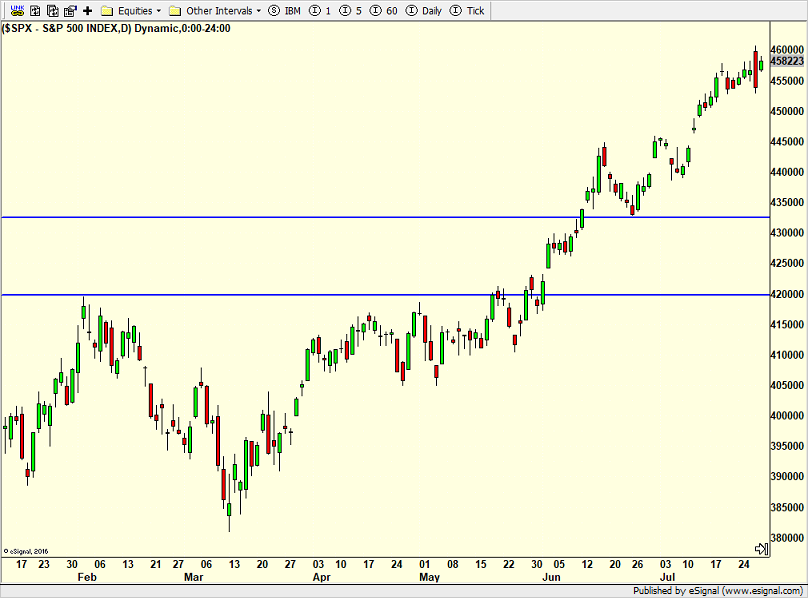

Price-wise, I want to see if the major stock market indices can close above the highs from last week. That will weaken the bear case in the short-term. The S&P 500 is below, but the indices mostly look similar.

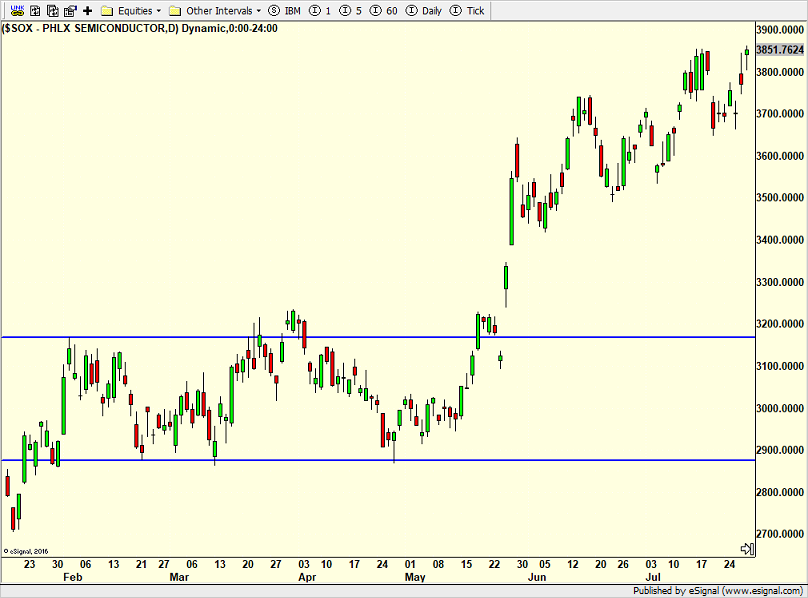

Interestingly, one of my perennial favorites, the semiconductors, are within a few points of new highs for 2023. It will be tough to see meaningful downside if this group stays strong.

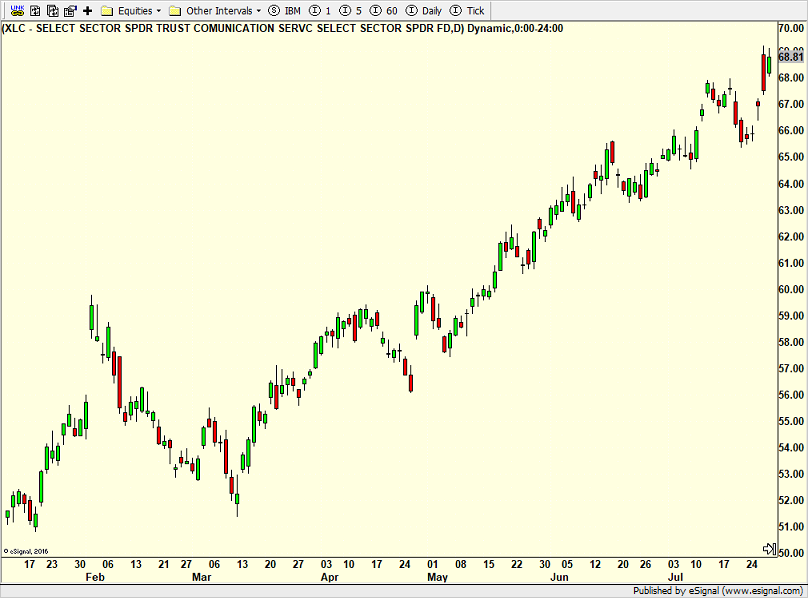

Same goes for Communication Services below.

I am flying on Wednesday so I hope to be able to publish at some point.

On Friday we bought EMB and HCPIX. We sold PEY, some QQEW and levered S&P 500.