Trading Range Continues But Lots Beneath the Surface

Stocks fared fairly well last week in the face of overbought conditions and a few tiny cracks in the pavement. As I continue to offer, I believe the bull market is alive and reasonably healthy, especially for one 9 years old. However, my shorter-term view is that stocks are in a trading range with perhaps a slightly upward bias for the time being. The stock market just doesn’t seem like it wants to launch a fresh leg towards my next target of Dow 23,000. On the flip side, while it’s long overdue for some kind of pullback, I do not believe it will be anything but shallow unless there is some kind of geopolitical event.

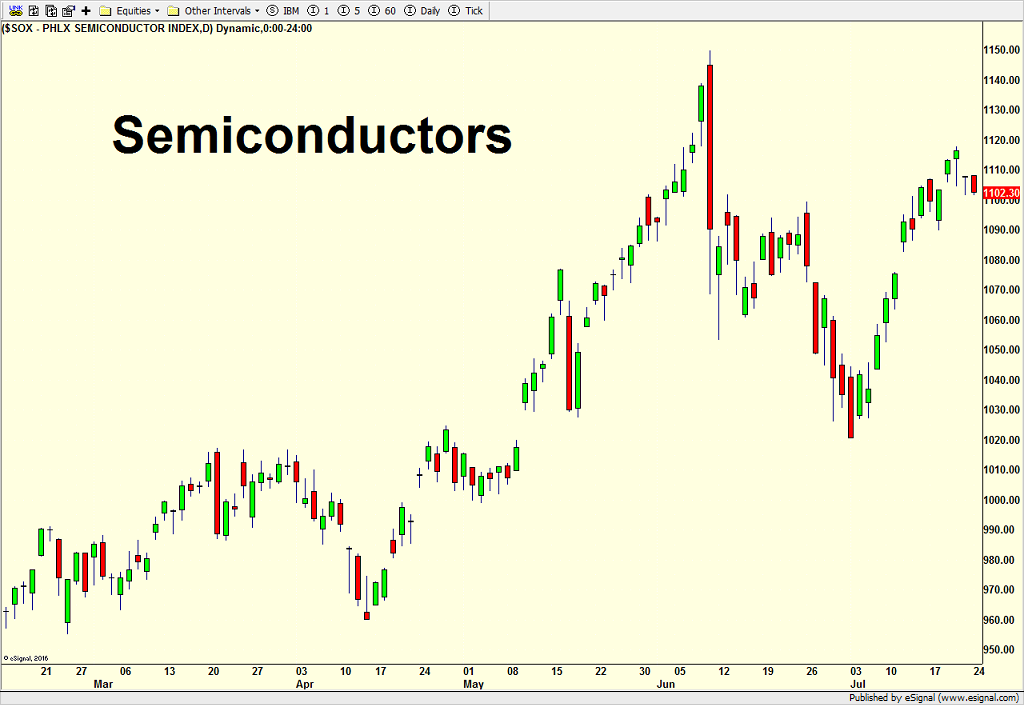

The four major sectors are behaving very differently. While semis have bounced back smartly from the June swoon, they are lagging tech and the NASDAQ 100 and really need to score a fresh high sooner than later. Discretionary is behaving much like semis and need a new high close as well. The transports have pulled back more than 2% and look very interesting from a bullish perspective. Only a close below last week’s low will change my opinion. Banks continue their 2017 trading range and do not appear to be ready for an upside thrust just yet. Finally, high yield bonds are quietly scoring new highs which has bullish intermediate-term implications.

If you would like to be notified by email when a new post is made here, please sign up HERE