Transports Lagging Badly Since 2021 – But Does It Matter?

Friday saw a new closing high in the NASDAQ 100 which was unaccompanied by any of the other major indices. That index is below. It really doesn’t see clear skies until it closes above last Thursday’s nasty reversal day.

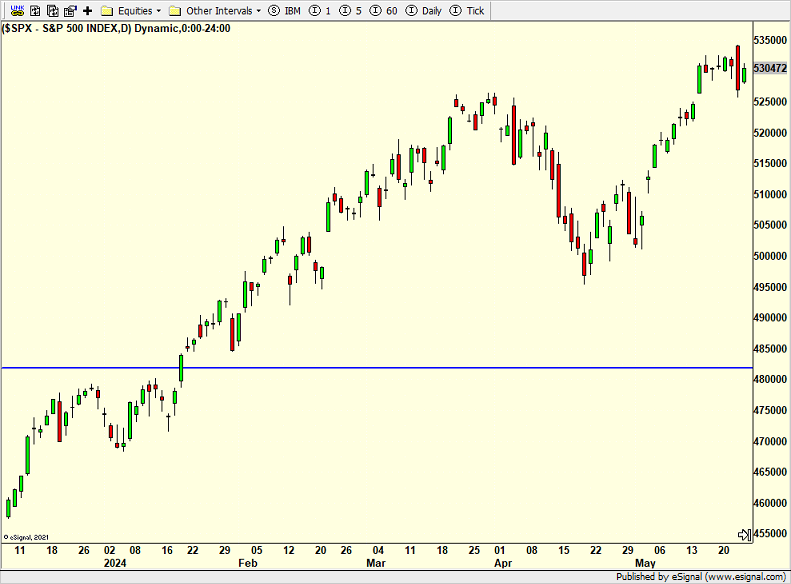

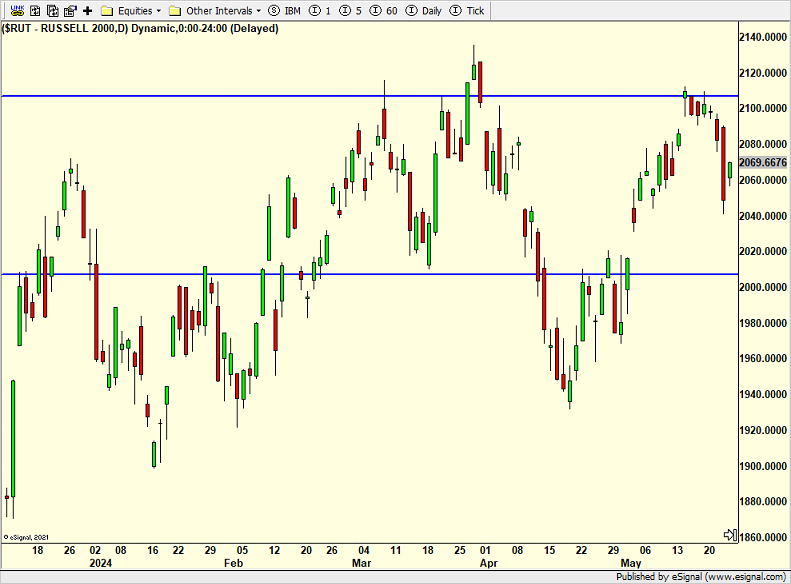

The S&P 500 and Russell 2000, both below, obviously look weaker, but the former can be repaired rather easily. The latter not so much.

What I have really wanted to discuss was the Dow Transportation Index which has been super weak against the backdrop of a strong market and economy. Its chart is below. First, unlike most of the other indices, that blue, horizontal line across the top is not the previous all-time highs. It’s not even a secondary high which is up at 16,700. The all-time closing high is at 17,000.

Something is clearly wrong with the transports. It’s not new news and it may not even matter. Old fashioned Dow Theory says that the Industrials and Transports must move together. The former makes the goods while the latter delivers them. In a manufacturing based economy like the U.S. used to have, it mattered, a lot. I am not so sure anymore. In a technology based service economy, it’s harder to make that case.

Nevertheless, some analysts still view the industrial/transportation relationship as important. I am pointing it out, but not really fretting about it since the divergence has been in place since 2021.

I think the surge in bullish sentiment in May is much more important and actionable.

On Friday we bought AMJB and more levered NDX. We sold levered S&P 500.