Two-Day Decline – No One Cares

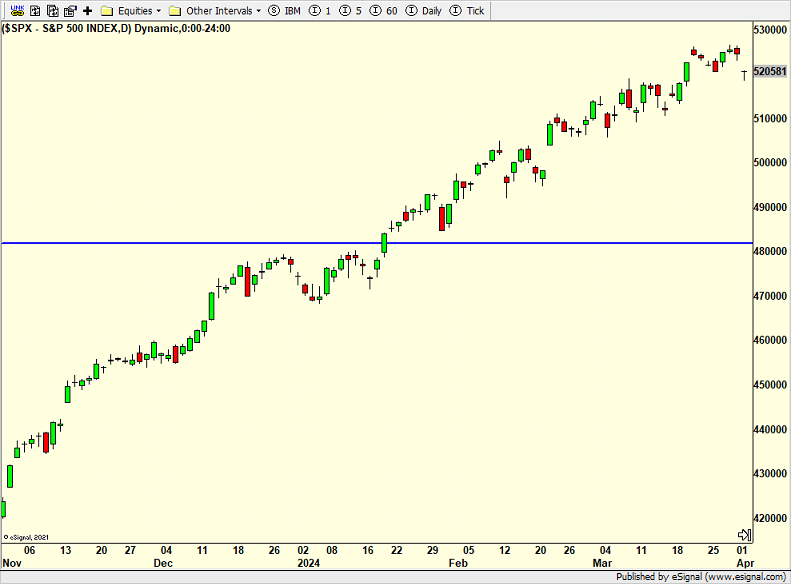

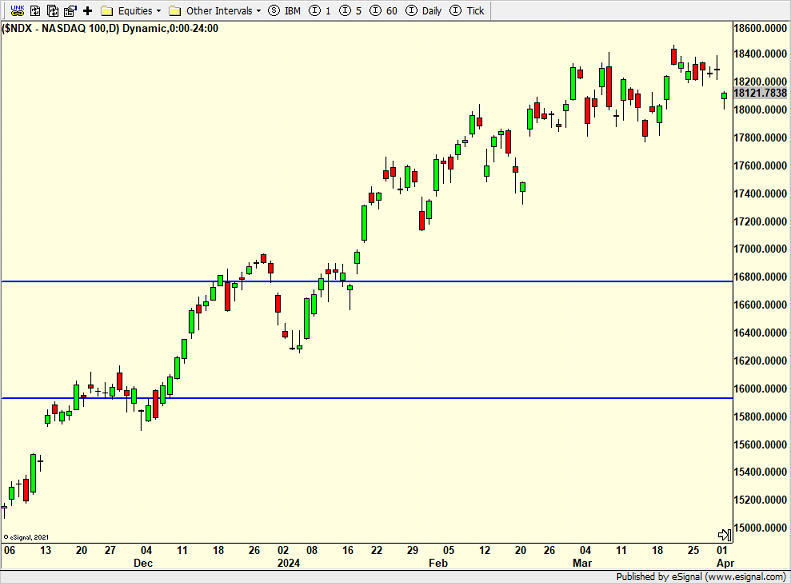

Two down days in the stock market, but it certainly didn’t feel like folks cared much as stocks closed near their high for the day on Tuesday. And the down days were barely noticeable on a chart. Here are the charts of the S&P 500 and NASDAQ 100.

As you know I have been looking for a Q1 peak followed by a less than 10% decline that wraps up by Memorial Day. We will see if that March peak holds and stock stop going up. Right now, because of the seasonal tailwinds this week, I think the bulls try and make a stand this morning. Don’t be surprised if they retrace the decline from yesterday before the week is done. Then the bears will need to step in again.

I am finding myself liking technology for a trade in here. Semis, internet and software all look appealing for a short-term rental.

I recently mentioned cocoa and its Dotcom-like, vertical rise as we bought Hershey’s. Someone asked for an update. Cocoa is below and it’s still rising parabolically. The second chart is Hershey’s and the stock is resisting, having not made a new low in 2024. That’s action I love as a trigger to own the stock which has tremendous fundamentals.

On Monday we bought levered S&P 500 and more levered NDX. We sold PCY, EMB, ARCVH, EAPR and some DXHYX. On Tiesday we bought more CVS. We sold SAPEX.