Two Favorite Canaries Looking Fine

The final two canaries are probably my favorites because I believe they are the most powerful and predictive. In every bull market of the modern investing era, both of these canaries gave 3 to 21 months notice that trouble was brewing. However, that doesn’t mean that every time these canaries warn, bear markets occur. It just means that they haven’t missed any.

The first chart is that of New York Stock Exchange’s Advance/Decline Line which simply measures participation in the stock market on a cumulative basis. What we want to see is this indicator making new highs along with the major stock market indices. When it stops making new highs and the indices continue to do so, that’s a warning sign. As you can see, the NYSE A/D Line last peaked in early March with the stock market.

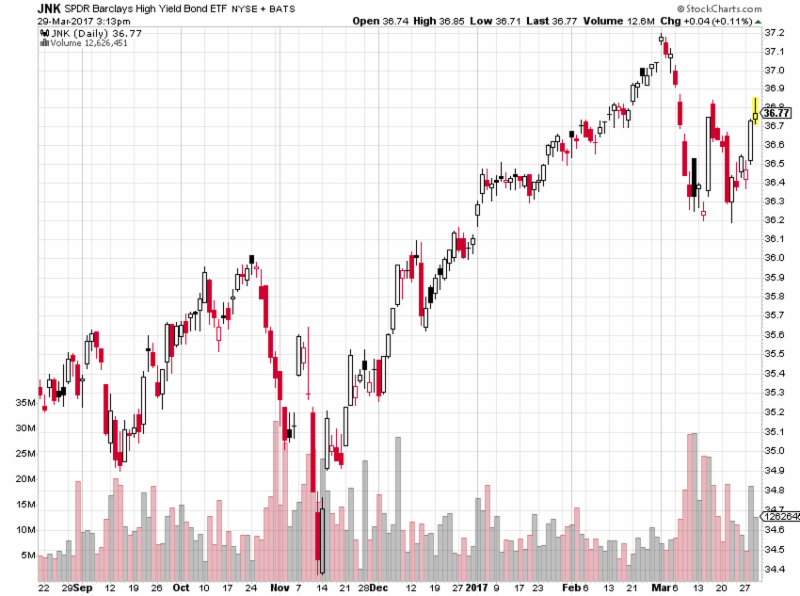

A proxy for the high yield bond market is below and I use it the same way as I do the NYSE A/D Line. It gives the same kind of red flags. Right now, we see that its last high coincided with the rest of the stock market.

These last two canaries, while off their early March highs, are not flashing any warnings signs that the bull market is ending anytime soon.

If you would like to be notified by email when a new post is made here, please sign up HERE