Volatility Drops as Short-Term Sentiment Remains Frothy

The stock market has been relatively quiet the past few days. Don’t complain. While it’s a welcomed change, it’s also very normal and healthy to wring more volatility out of the market. Friday is one of the big quarterly expirations of options and futures so we can expect enormous volume right away. Depending on which source you believe, there is supposedly between $50 and $80 billion dollars of equities that needs to be sold.

Looking at the non-NASDAQ major stock market indices, I can certainly make a case that one more rally to the levels right before the recent correction began makes sense. That’s about 27,000 and 3190 on the Dow Industrials and S&P 500 respectively. A 1% drop from here would negate that scenario and forecast at least a give back of this week’s gains.

Several people have asked what concerns me so much about short-term sentiment. The two charts below are the S&P 500 on top with the ratio of put options to call option. More plainly put, the short-term, very speculative trades looking for lower versus higher prices using the options market.

The first chart is a daily chart. You can see around June 8th that on a relative basis, very few people were looking for lower prices. In fact, it was the lowest level all year. Since these trades are usually wrong at extremes, this is a warning sign of froth in stocks.

The second chart on the bottom shows a 10-day average of what we see in the chart above. Also, just after June 8th, the 10-day readings are the lowest of the entire year. Again, since these folks are usually wrong and they are showing excessive behavior, it’s clearly a short-term warning sign.

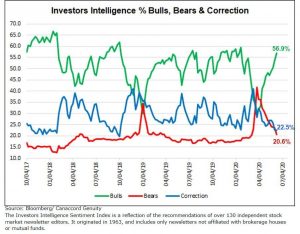

To go one step further, the chart below is courtesy of my friend, Tony Dwyer. It shows stock market sentiment among newsletter writers from the Investors Intelligence service. The bulls are soaring and the bears are falling. That’s not usually the recipe for extended short-term gains.