Volatility Low As More All-Time Highs Click In Weakest Week

For what has traditionally been the weakest week of the year, so far so good for the bulls. I need to do some work on what happens after the weakest week goes by without weakness.

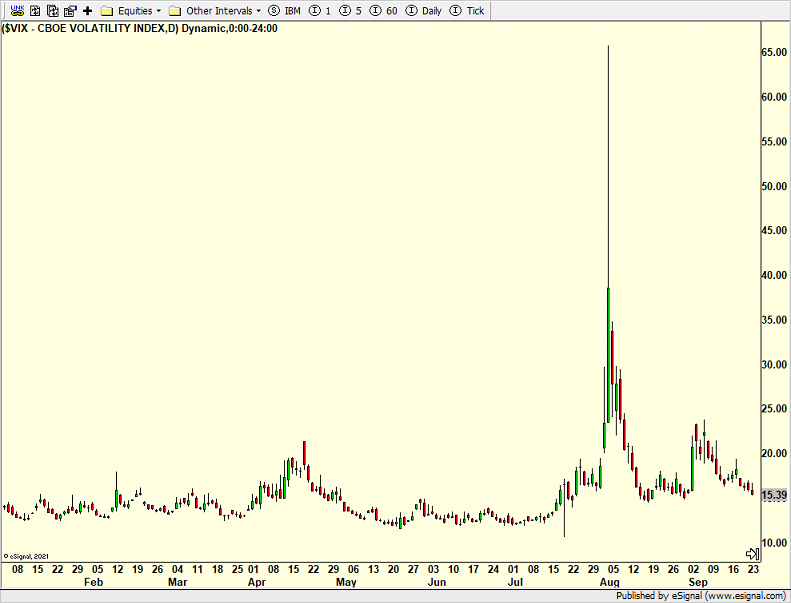

As the Dow Industrials and S&P 500 have hit fresh, all-time highs, the markets have really quieted down. Take a look at the Volatility Index (VIX) below. It is a solid teenager and looks to be headed lower. However, I would be surprised if it plummeted to new lows as it is supposed when stocks make new highs. That’s a divergence or non-confirmation which probably does not matter anytime soon.

I also want to point out the very quietly the S&P 400 is flirting with new highs. That would leave only the former high flying NASDAQ 100 and Russell 2000 left to score new highs. I do think both will by Q1 2025. And remember, I still have Dow 47,000 and then 50,000 as future upside targets coming.

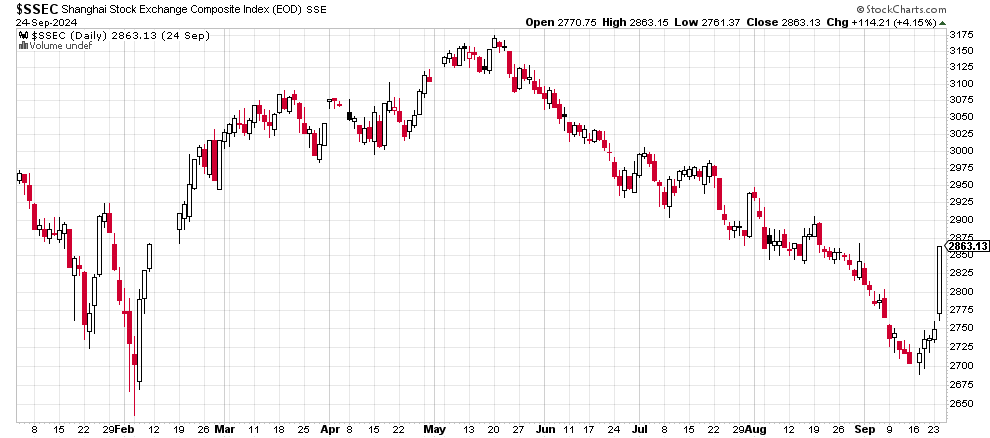

Finally, some of you may have noticed the massive stimulus the Chinese government unveiled the other day to help its collapsed economy. It’s definitely shock and awe. And it looks like it struck a chord with the markets. China’s markets and economy should respond.

On Monday we bought IWF, SPHB, QSPT, RSSE more FSTA and more BKLN. We sold SPYB, PCY, some QQQW, some RYZAX and some levered NDX. On Tuesday we bought more IWF and RYAWX. We sold EMB and some QQQW.