Volatility Nice, Markets Solid, Inflation Tame

I guess the dog days of summer have firmly set in for the markets. It wasn’t long ago when volatility as measured by the VIX was at historic extremes above 60. It’s been in the teens for most of the summer and heading lower. VIX below 20 is a relatively easy environment to invest in when compared to the 30s, 40s, 50s and higher. However, never forget that high volatility almost always leads to lower volatility and vice versa. It’s just that lower vol can exist for months and quarters while high cannot.

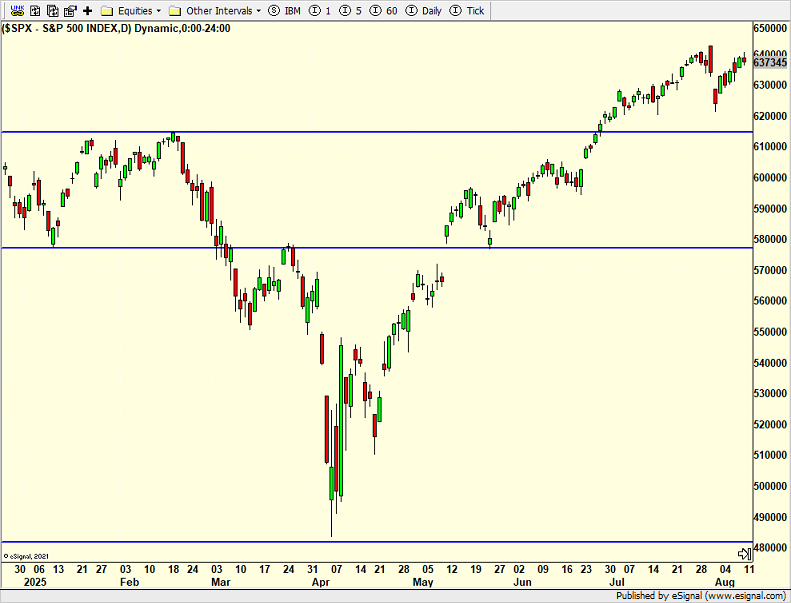

The stock market does enjoy lower volatility. What a run it has been since the tariff tantrum in early April. All those people who sold indiscriminately right near the lows. My favorites are those who kept emailing me in early April that the markets and economy were going to be worse than 2008. And they doubled and tripled down after that. Now, I mostly hear crickets. As I always say, using geopolitics to manage portfolios is a fool’s errand. And there are lots of fools who invest.

The S&P 500 has yet to regain new highs from that reversal day two weeks ago, but it also hasn’t weakened. While I remain in the 2-5% pullback camp this quarter, I also would not be unhappy if the market went sideways for a while longer.

The government released July consumer inflation this morning and it was basically in line with expectations to slightly cooler. I can’t tell you how many armchair economists have played Chicken Little about the sky falling with soaring inflation. All these narratives spun without data to support them. Download data, parse data, model data and analyze data. That’s what we do. I said the same thing when inflation was soaring in 2022. Plenty of people back then spun the recession narrative that never came. As I have said, inflation ain’t going back to 2% without recession. Anything below 3% is solid for now. There should be some warmer inflation months between now and year-end.

On Friday we sold some WRBY and some QLD . On Monday we bought CF and more SSO. We sold SOXX and QLD.