Warning Signs Abound

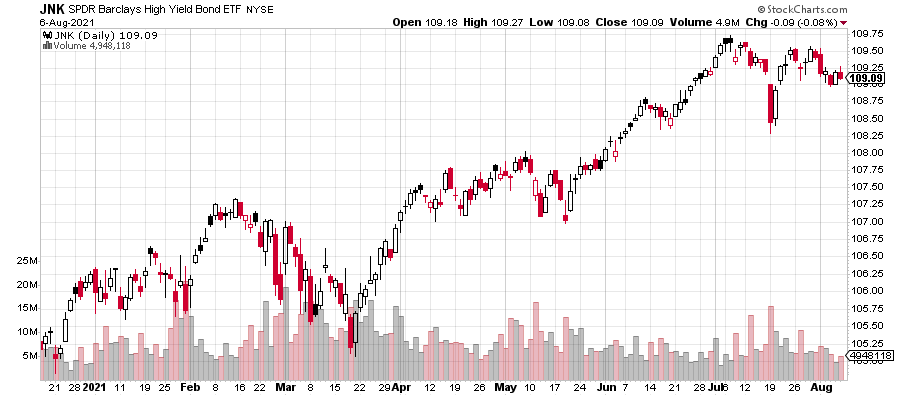

Stocks begin the new week with most of the same challenges as I have been discussing. The five major stock market indices are not all in syn as the S&P 400 and Russell 2000 remain well below their all-time highs. While semis and discretionary are at or near new highs, transports and banks are well below. The NYSE A/D Line is repairing itself, but it is still a strong few days from new highs. Whether we are looking at the more liquid high names in the JNK ETF or a more broad-based mutual fund like PIMCO High Yield, that sector is not at new highs.

Let’s throw on top that August is a seasonally weak time of year, especially when there is a new occupant to 1600 Pennsylvania Avenue. The warning signs are abound. Yet, price just keeps on chugging higher. Remember, in the end price is always the final arbiter. I can warn and warn and warn as prices either go sideways or higher and higher. Eventually, it will matter, but markets can stay irrational much longer than any investor can stay solvent.