Warning Signs Creeping Into The Stock Market

This week I saw that Goldman Sachs, Evercore ISI and Citi all raised their year-end targets for the S&P 500 which now sits just under 5500. For the record, their previous targets were 5100, 4750 and 5100. As with 2023, these firms have been woefully wrong. But they are really good at chasing the market higher and then claiming they got it right when the bell rings.

All this got me thinking that when the masses start chasing, should we start looking at the stock market with skeptical eye?

Very uncharacteristically for me, I have a few negative topics to discuss over the coming days and week. Today, I am going to offer some thoughts about the stock market from the bearish side. Before I go there, let me say that I am not bearish and I do not believe the bull market is over. Our models are generally positive with a few pointing to some minor trouble over the coming months.

Overall, it’s no secret that the rally has narrowed, meaning that fewer stocks are participating and leadership has waned. However, that’s the kind of behavior we see in all maturing bull markets. Sometimes, the bull markets end. Sometimes, they go sideways or correct. And sometimes they just keep on chugging higher.

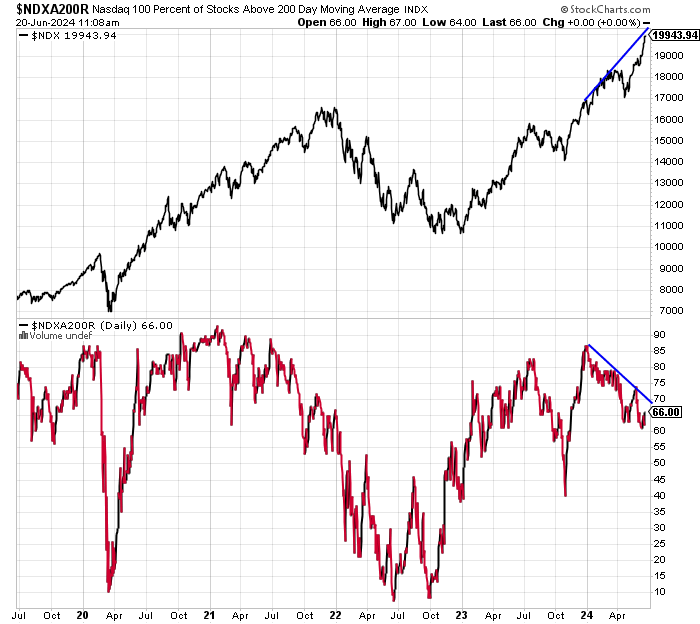

First, let’s look at the percent of stocks on the NASDAQ 100 where all the fun is that are in uptrends. In 2024 while the NASDAQ 100 has powered higher in the first chart, the percent of stocks in uptrends has steadily declined as you can see in the second chart. In other words, if this was a war, the generals are forging ahead while the troops have been dying off.

Astute readers may comment that this is exactly what happened in 2021 that led to the awful 2022. While that may be 100% true, there were many more issues by the end of 2021 that led to the bear market of 2022.By the way, we do not see the same warning signs in the NYSE.

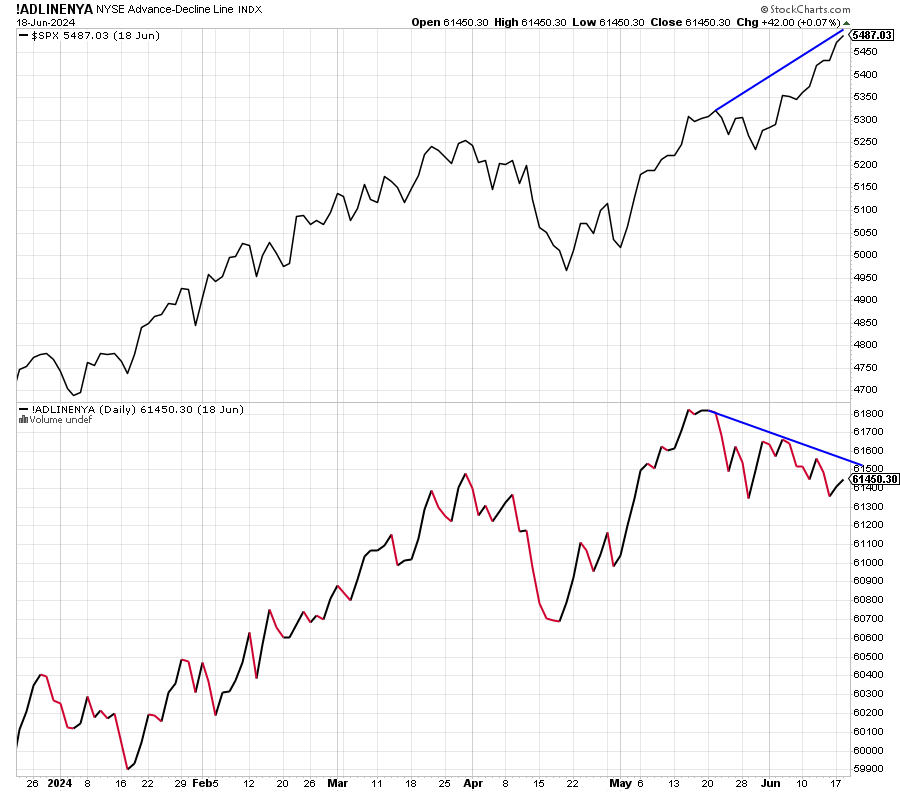

And speaking of the NYSE, I cherry picked one of favorite canary in the coal mine charts below. It is the NYSE Advance/Decline Line which just gives us a running total of all stocks going up and down on a daily basis. Since mid-May the stock market has marched higher while the NYSE A/D Line has gone down. In extreme cases, bear markets have started three months later. In 2000 it took two years.

Neither one of the indicators above are warning of imminent doom. And let’s be clear; just a single digit market pullback could potentially repair this. These are good things to keep in the back of your mind.

Risk has increased, a lot. The easiest money of this bull market has been made as you may recall from 2023. However, the bull market isn’t over. We now have cracks in the pavement to watch.

More on this topic either tomorrow or Monday. Stay cool…

On Tuesday we bought RYPMX, PMPIX and more UAA.