Warren Buffet Hangover as Bulls Prepare

The bears had a nice close to last week and to begin the new month. I posted a number of studies regarding May and the next 6 months on Friday. The overall theme is that the longer we look out into the future, the more positive the studies. The shorter we look, at least as of last week, the less positive they get. However, in the really short-term, if today is down, which would be the third straight down day, that should set up a nice Turnaround Tuesday opportunity for the bulls.

Stocks rallied very hard and far from the bottom on March 23rd, farther than I thought they would. I think it’s now time for the data to begin to catch up to stocks, meaning that the stock market would best be served be digesting the gains in a trading range. Looking at the Dow, that could be 25,000 and 22,500 or so. More on this later in the week.

With pre-market looking down only 1/2% after being down more than double on Sunday night, we should see lots of movement this morning. I expect much of today’s discussions to be about Warren Buffet’s virtual annual meeting for Berkshire Hathaway yesterday with a several hour question and answer online.

Twitter was all abuzz with comments that Buffet was really negative because he has been uncharacteristically quiet during the crisis as opposed to 2007-2008 when his phone rang off the hook from companies looking for capital. The Oracle of Omaha was very clear that the deals being offered did not smack of the desperation he usually looks for in crisis. And then the Fed came in with their nuclear arsenal, rendering Buffet almost impotent. Which company would do a Buffet deal as they fight for survival when the Fed and Treasury were essentially backstopping America?

His sale of his position in the four major was not new news. I don’t why it’s making headlines this morning. Warren has been a crummy airline investor over the years and he got burned again this time around. I sense there won’t be another foray into the airlines during his lifetime.

The only thing that did surprise me was his lack of adding meaningful equity positions in the 5-10% range. I would have all but guaranteed Buffet’s snatching up bargains in March. That didn’t happen. He actually was a net seller of stock. That’s really surprising the investing world today. $134 billion in cash in hand. I figured some would be needed for his portfolio companies that needed cash and then he would do a deal with Boeing, Fedex or UPS.

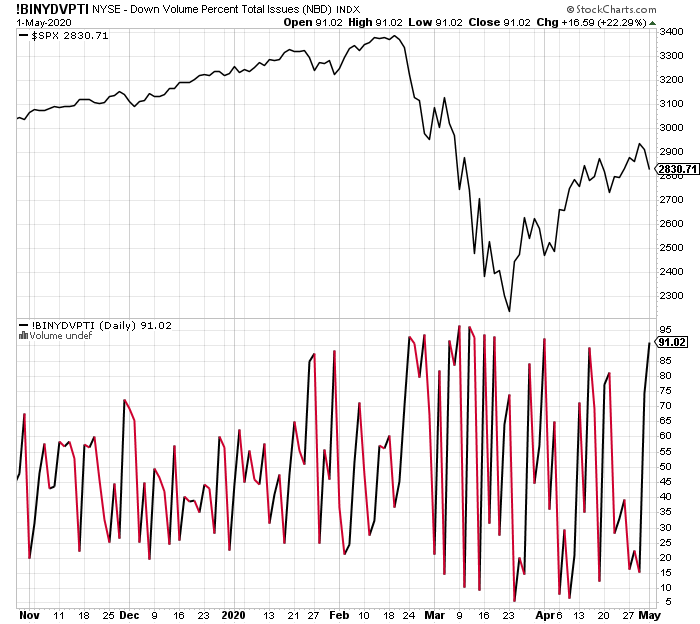

One tidbit from Friday, you can see the S&P 500 in the top chart below with the ratio of down volume to up volume on the NYSE beneath that. On Friday more than 90% of the volume traded was in stocks that went down. That’s an extreme. For the bulls to regain control, the market normally needs a 90% up day or two 80% up days.