Was That All?

On Wednesday, I wrote that stocks were supposed to bounce and not to be surprised if they regained all they lost a few days earlier. However, the odds did not favor the whole pullback/consolidation being over. I am still in that camp although with this morning’s much stronger than expected employment report and the pre-market surge, I guess I have to be open to the notion that the little bout of weakness is over. We will certainly see in the coming days if all of the major stock market indices can hit fresh highs.

As I have mentioned for a month, by turning neutral to slightly negative in the short-term, it simply meant that I was basically in a holding pattern and not committing new money to stocks nor raising risk levels. In a perfect world, any pullback would be used to make some small modifications for the run into year-end I have been discussing.

I have been saying that leadership from the Dow, S&P 500 and NASDAQ 100 should cede to the lagging S&P 400 and Russell 2000. I continue to believe that with the two latters finally hitting all-time highs early in 2020. My four key sectors are all in good shape. Semis and banks continue to lead and be strong. Transports have a strong ceiling overhead but I expect that to be breached in early 2020.

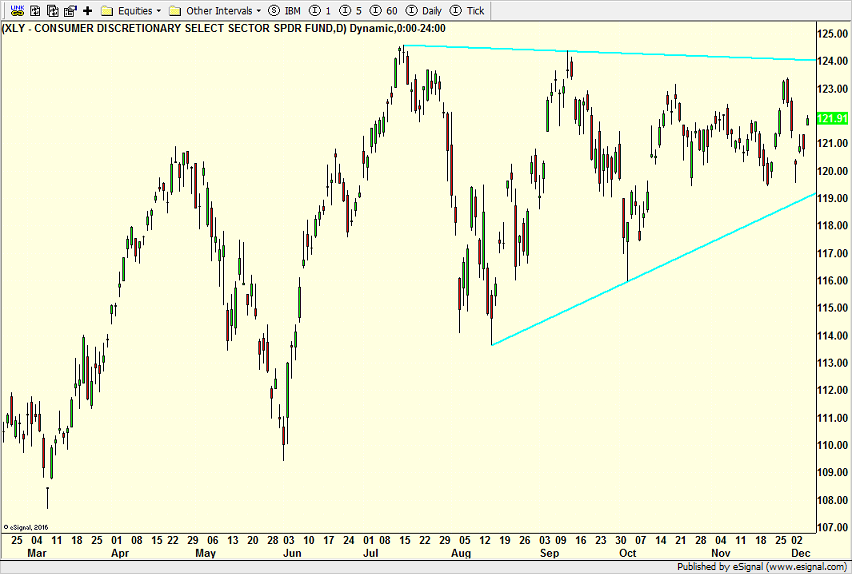

Discretionary offers an interesting opportunity as you can see below. Price has been in a range for 6 months with continued compression. Highs are lower. Lows are higher. Think of a coiled spring. Usually, prices will ultimately continue with the previous trend, in this case, higher. Sometimes, prices breach one side first as a fake out and the immediately head in the opposite direction, trapping the masses. In this case, while I believe the upside will win out, it doesn’t pay to take a stance right here.