Watching Small Stocks For Another Huge Opportunity As Dow Hits An ALL-TIME HIGH

We have an incredibly wet and windy start to the week in the northeast. Lots of power outages, school delays and trees down. It’s 60 with inches of rain and rumors of hurricane force wind gusts. I guess a white Christmas is a pipe dream.

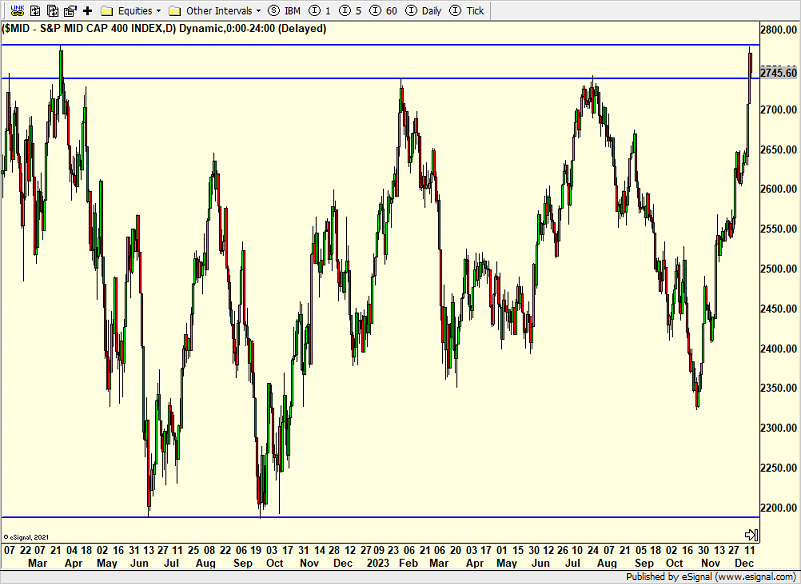

The bulls don’t seem to mind. We have the Dow Industrials at an all-time high. The S&P 500 is just a good one day rally away. The NASDAQ 100 could get there today. And while the S&P 400 and Russell 2000 have some work to do, the former just broke out to the upside and doesn’t look like it’s done.

The markets are also in a time of year where declines are tough to come by unless they are already unfolding. 2007, 2018 and 2022 come quickly to mind.

Oddly, we do have a few studies that do point to a pullback this week. I am not really sure what to make of them since momentum is so strong. The enormous December options expiration was last Friday and there is a trend for stocks to move lower the week after. Stocks also haven’t stopped since the Fed began its meeting last Tuesday. There is also a trend that suggests this week is red. Again, momentum is strong. I don’t think the bears will make much downside progress

I have already written about the trend for small caps to do well into January on an absolute and relative basis. There are numerous studies that support this. And if you look below, you can see that since mid-November the line is going up. That means the small caps are leading the large caps. With such power, that trend should not abate so quickly.

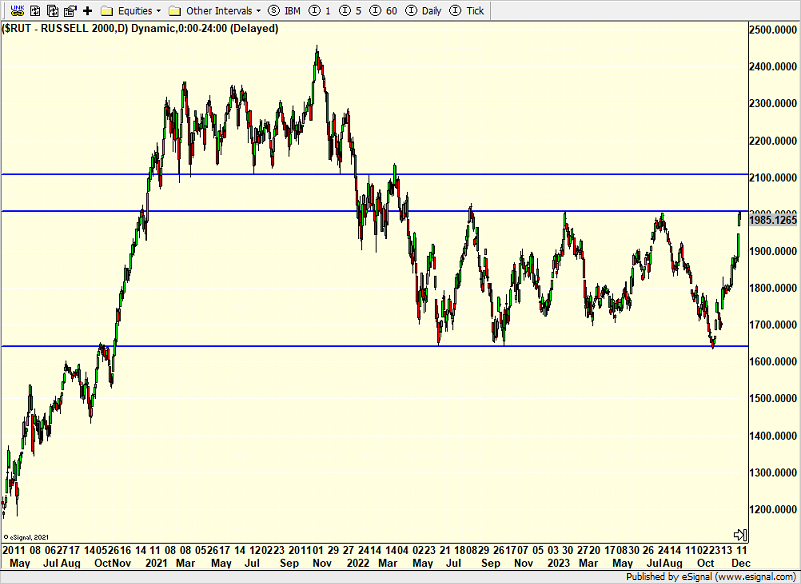

And while on the small caps, let’s look at the Russell 2000 below. Look how fast the index went from the bottom of its two-year range to the top where it failed its previous three times at the 2000 level. I do not sense that four times will be a charm. Given the almost giddy sentiment, small caps are poised to break higher from said range over the coming few weeks. And if so, don’t be surprised if they keep going straight to the 2100 level, another 5% higher by the end of January.

And for all those who think that this is all just typical Paul bullishness, think again my friends. I have uncovered some truly disturbing tidbits which do not paint a pretty picture in 2024. Stay tuned for more.

On Friday we bought more PMPIX, RYPMX and levered NDX.