Weakest Week Of The Year? Phooey!

For what has been the weakest week of the year, there has been a certain lack of teeth and downside over the first four days without much looking lower today. As I always say, seasonal trends, no matter how powerful, are just headwinds and tailwinds. You can’t react to them in a vacuum.

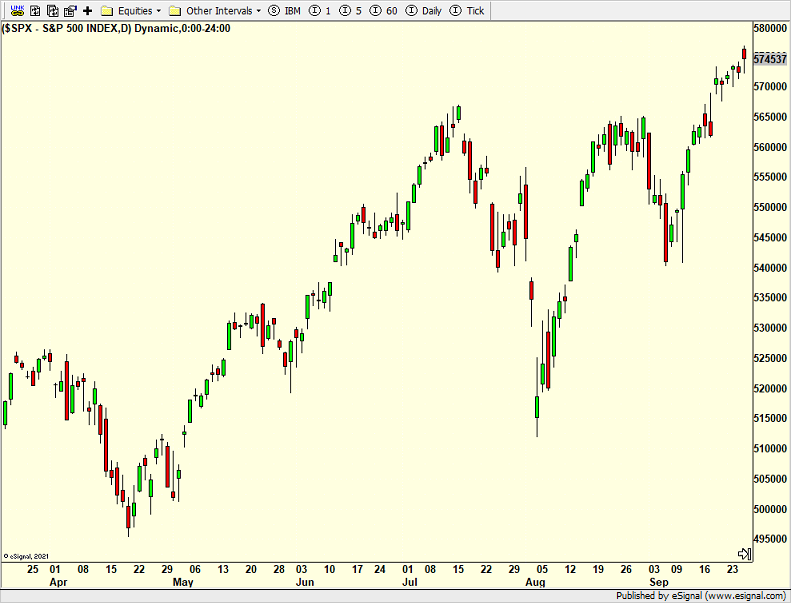

On the flip side, the markets haven’t really accelerated higher either. The S&P 500 looks like it’s just drifting higher into month and quarter-end.

It seems like ages ago, August 5th, when market unraveled and volatility spiked when the Japanese Yen soared. Today, no one even talks about it.

Gold has been the quiet bull market story all year. In interviews and here I have speculated that China has been the primary driver and strong bid beneath the market as they prepare for war, economic or military. When a country knows war is coming, they sell assets in the currency of their enemy. There is also fuel from the perception that the Fed is going to cut interest rates faster than any other major central bank which puts the U.S. dollar in harm’s way.

Looking forward to a nice fall weekend with baseball, family and maybe a little golf. Macoun apples are out and they are my all-time favorite fruit! Nice win for my Cowboys, but I already decided that this is the year they stink it up and clean house. They’re just not close to being elite. I am all in on the J-E-T-S, Jets, Jets, Jets. I know. It’s a curse. Thankfully, the Yankees won their division and UCONN fall sports are red hot.

On Wednesday we bought SPYB, EZA and FXI. We sold FDVV, FVD, EPI and EWM. On Thursday we bought QQQW and more QDEC, BAPR, FFEB and FJAN. We sold SPYB.