What’s Been Falling As Stocks Soar Post Another 20% Plunge

I don’t have to say that it’s good to be home yet again because my trip to Florida never happened. I had scheduled client get togethers for Orlando, Melbourne and Boca on Monday with a few more on Tuesday. My flight kept getting delayed 10-15 at a time with mechanical issues. At the 90 minute mark I knew I would miss Orlando and jeopardize Melbourne. Then news came of severe weather in Florida. The choice became easy.

I received a great email asking what has been going down in the markets at the benefit of “risk on” assets which have ripped higher. The answer is that pretty much whatever rallied during the tariff tantrum plunge.

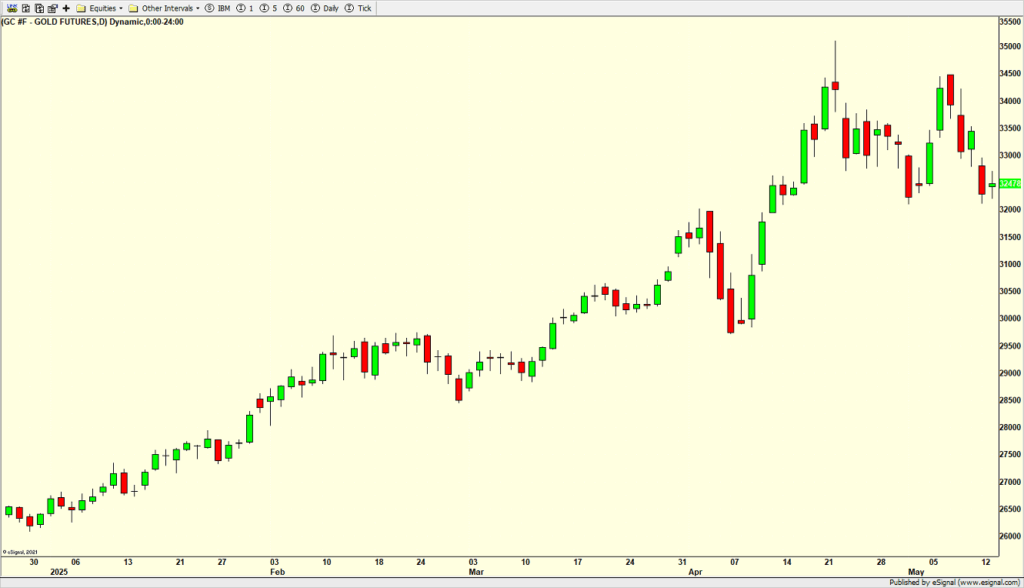

Gold was the most high profile and it’s below. I do not believe it is done going down. On this first decline I would be a buyer on further weakness.

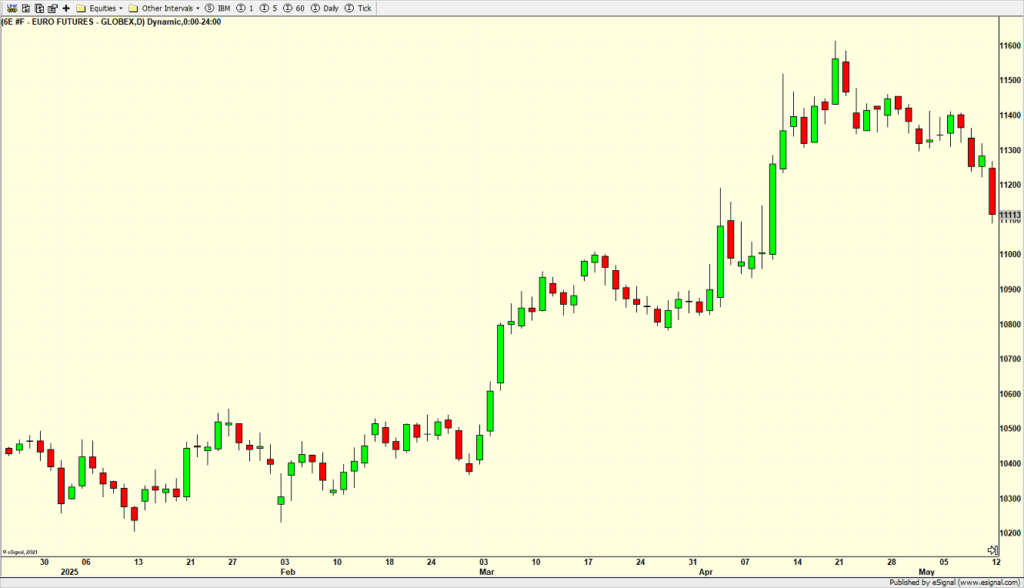

The next asset class is currencies. The Euro is below.

And finally, we have the Yen.

For full fairness, I cherry picked these. Sectors like low volatility, staples, utilities and REITs haven’t really fallen although they haven’t rallied either.

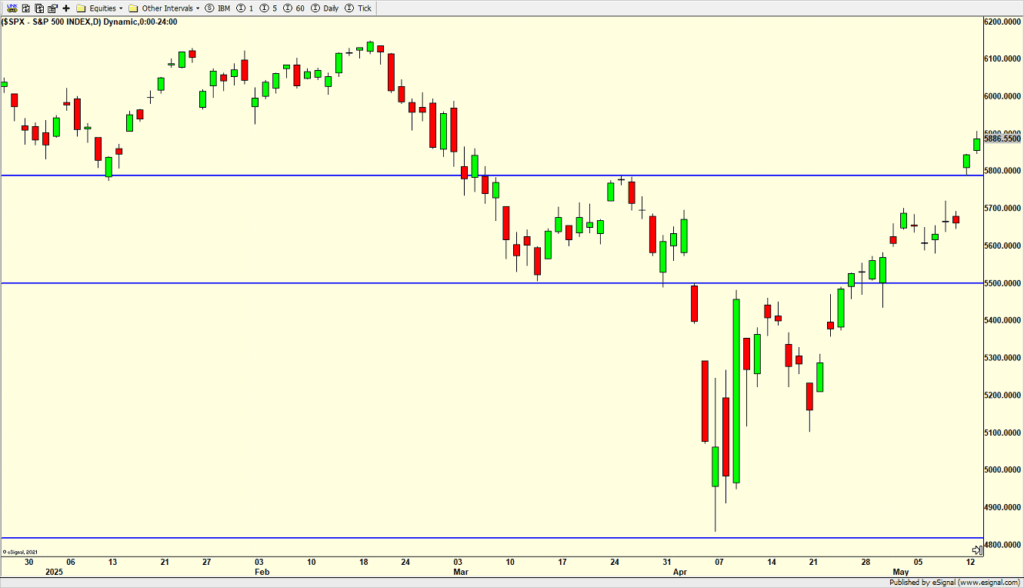

The stock market had another solid day on Tuesday. Less stocks participated and the index dominant companies, well, dominated. The S&P 500 is now positive on the year. And so many of those bears who have been chirping for two months have suddenly disappeared or gone silent. As you know I so tire of geopolitical narratives to spin on investing. They do not work. They haven’t worked. They will not work.

The S&P 500 fell 20%. Some folks act as if it’s some calamity. I got news for them. The market went down 20% in 2025, 2022, 2020 and 2018. That’s four times in 7+ years. 20% declines are happening with more regularity, but so are 20% rallies. For those curious we also 20% declines in 2011, 2009, 2008, 2002, 2001, 1998, 1990 and 1987. That period from 1990 to 1998 was blissfully non-volatile.

I thought stocks would pullback this week. So far, the bulls have thwarted any attempt. But I think the bears will take a stand today as seasonal patterns turn negative for a few days.

On Wednesday we bought QLD. On Thursday we bought QID, DG and more RAIL. We sold QLD, QDEL, some MQQQ and some BX.