When My Sandwich Guy Advises Me On Bitcoin

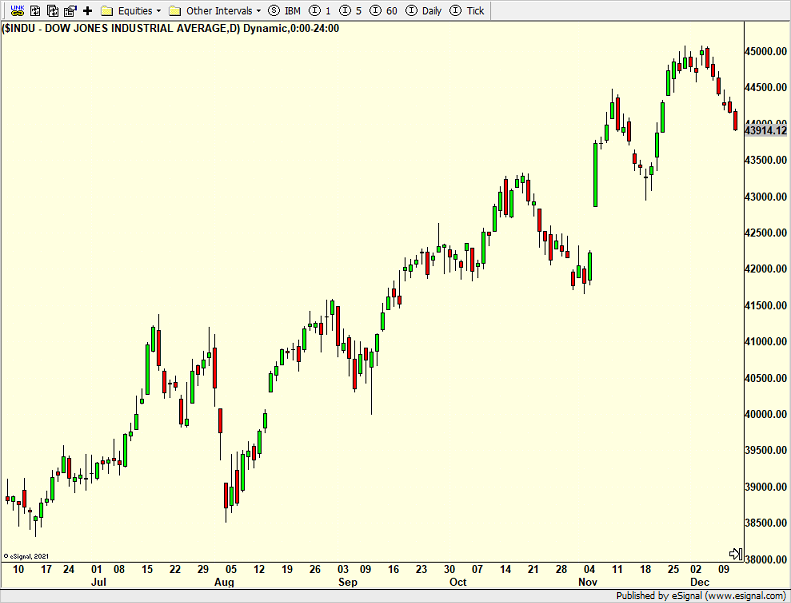

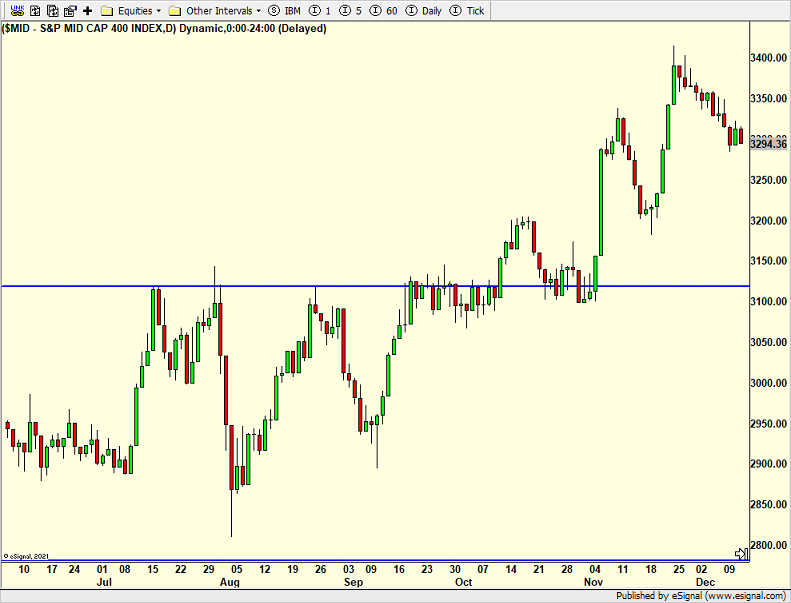

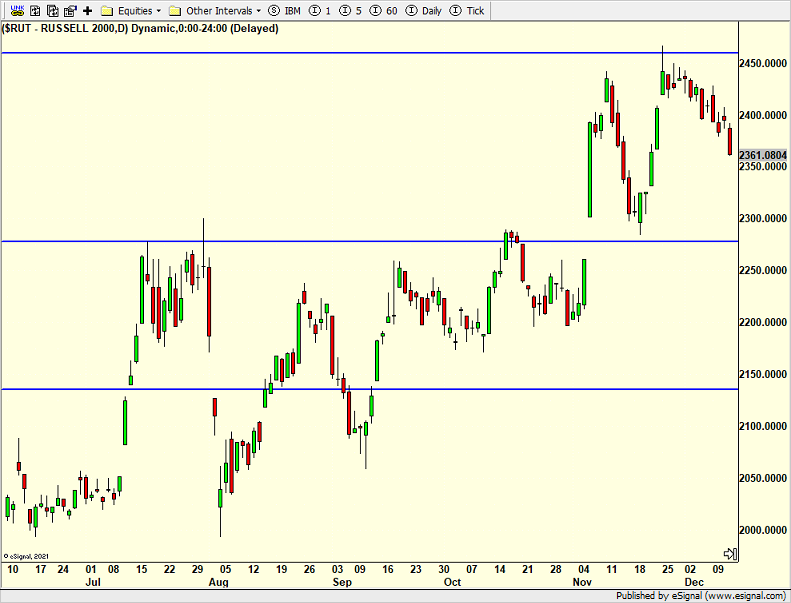

The stock market continues to digest and consolidate the recent move to all-time highs. However, everything is not in sync. The S&P 500 and NASDAQ 100 behave the best while the Dow Industrials, S&P 400 and Russell 2000 are relative losers. While I thought this would happen, I also thought it would be a Q1 2025 story and not right here.

All in all, as you can see below, none of the struggling indices look like death. Rather, they look like bull market pullbacks. When the weakness ends which should be before next Friday, they are supposed to make new highs again. It’s that next rally I am most interested in.

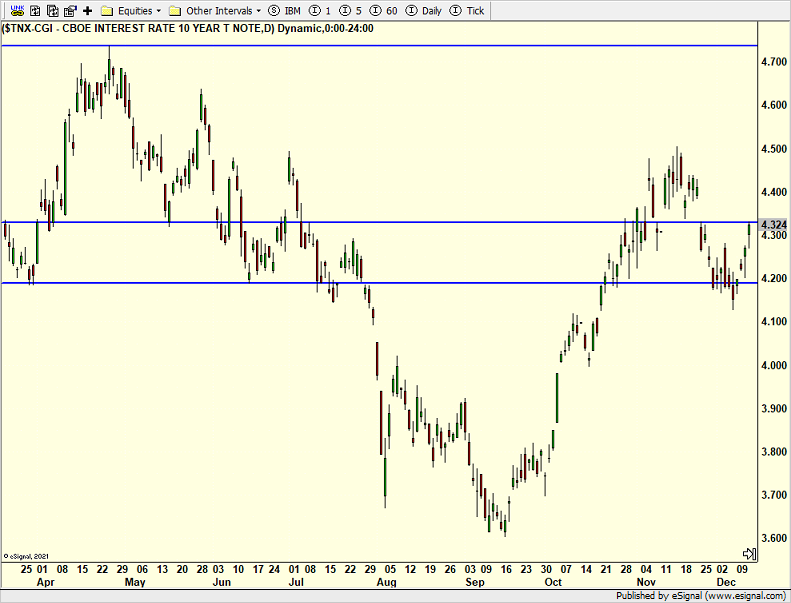

The chart below is the yield on the 10-Year treasury note. It certainly is not signaling recession. Rather, it looks like it wants to revisit the 4.5% area which will then bring on concern that 5% is up next. Bond yields going up because of a great economy is one thing. Yields going up because of inflation or soaring deficits and debt is another.

Sentiment remains too bullish. Seasonality favors the bulls. We will have crosscurrents for the next three weeks. There is likely a larger pullback in Q1 2025 coming. And judging by the anecdotal data surrounding Bitcoin, the easiest money has long been made. When my sandwich guy advises me to buy Bitcoin above $100,000 I recall the Dotcom Bubble.

On Wednesday we sold SSO. On Thursday we bought PDBC and SSO. We sold PCY, EMB, VGK, QQQW, JBHT, some PLTR and some SPYB.