Where’s the Worry About Inverted Yield Curve and 10 Year Plunge?

While the past few days did nothing to clear up the four-week trading range, I still give the nod to the bulls as I have been saying for weeks. That’s regardless of whether stocks first poke through the bottom of the range or not. I do find it funny that yields on the 10 year bond hit fresh lows on Wednesday and stocks did not collapse as some media analysts have been selling as a tried and truism lately. One thing you can almost bank on is that when the media become forecasters instead of reporters, whatever trend they think they spotted is about to end.

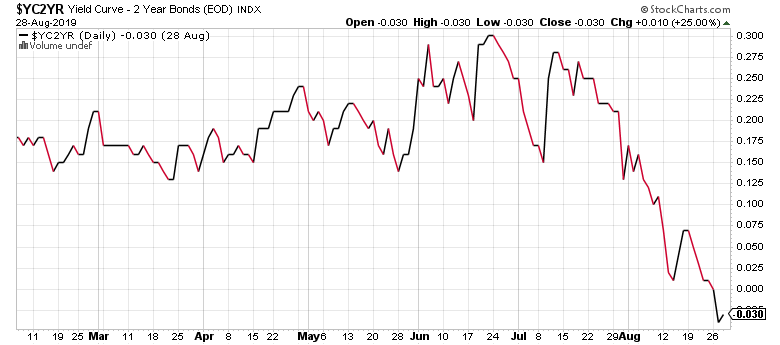

Guess what else the market didn’t care about? The yield curve inverted even more this week which I discussed the other day on Fox Business’ Making Money.

Here’s the bottom line. The markets are a terrific discounting mechanism and they hate being shocked by outsized moves. The second or third time around with the same worry, markets usually absorb the information much better and behave in the realm of normalcy.

You may also hear about the huge move in bonds this month relative to stocks and how pension funds’ asset allocation may have gotten away from their targets. In turn, this would mean selling bonds and buying stocks. This is pure nonsense and something we only hear when bonds have the big move. I rarely ever hear it when stocks have the big move. The theory also doesn’t stand up to scrutiny when testing with the S&P 500 and Barclays Aggregate Bond Index. Subsequent moves fall squarely in the normal distribution of returns. In other words, those pundits have no basis for the conclusion.

As I finish this up stocks are indicated to open higher by about 1%. If there is any follow through during the day, that could test the upper end of the recent range. Ultimately, as I keep mentioning, I believe we will see the bulls resolve the market to all-time highs and Dow 28,000 by year-end. For now, we want to see where leadership unfolds.