Top 9 Tips for the Successful Investor in 2012: Tip #7

7 – Residential real estate begins the stabilization process.

It’s no secret that the real estate bubble has burst and many areas of the country are left in ruins. It was no secret in 2008 that the energy bubble burst. And it was certainly no secret that the dotcom bubble burst 10 years ago. The problem is that it was only apparent to the masses after the initial collapse occurred! The chart below can be applied to any bubble or mania as they are largely based on psychology and human nature just doesn’t change.

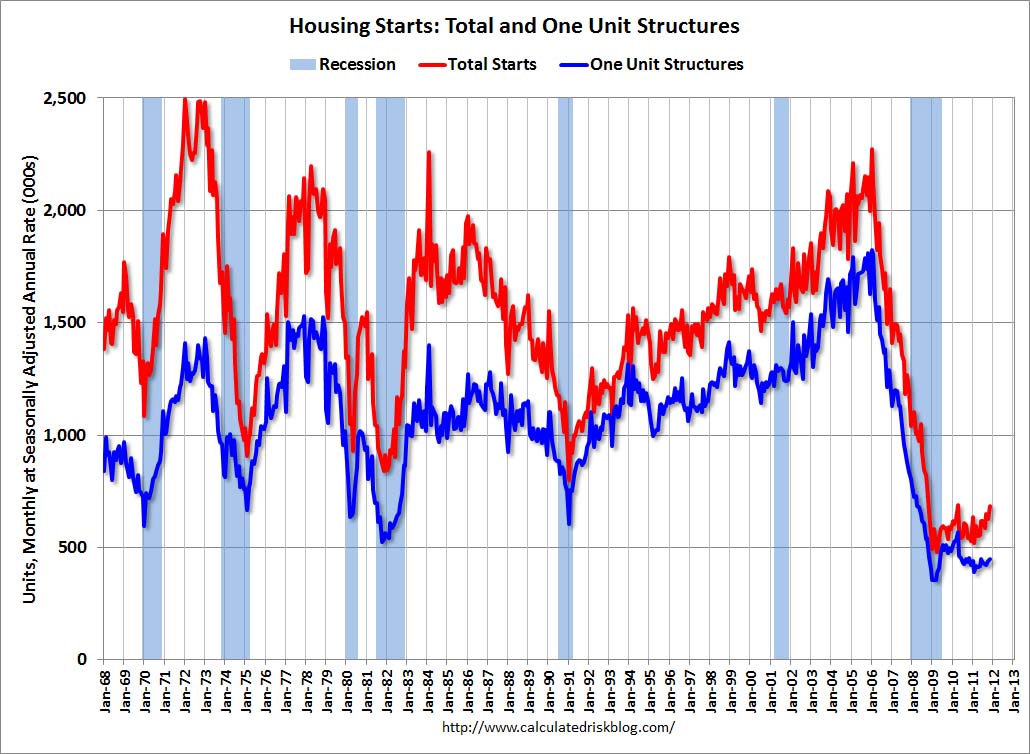

In 2012, the operative word in residential real estate will be “stable”, the first time that can be said in many years. The government spent trillions of dollars trying to save the real estate market and they are not done. But similar to Europe’s problems, the ONLY solution here is T-I-M-E and the process is entering its fourth year. The glut of properties on the market is being soaked up naturally by demand (see chart below) and the largest lenders are finally unclogging the bowels of the system. Water finds its own level and so does real estate.

Housing starts are very, very slowly growing again as you can see below and the nascent real estate stabilization should begin to get back to historical growth rates of 5%.

The three biggest tailwinds of the past 25 years, declining mortgage rates, demographics with the baby boomers and easy access to capital, are no longer blowing. Rates currently sit at record lows. While they could certainly scrape along the bottom for months, quarters or years, I think we all know that they are not going much lower. The refinance, home equity party of the past 25 years is over, for a long, long time.

No doc, low doc, no income verification (aka liar) loans are a thing of the past. Bank balance sheets have been getting stronger every month and quarter as they proactively address problems, tighten lending standards and hoard cash. The days of easy money are long over and, in fact, it’s downright difficult to get a mortgage without putting 20% down!

With so many potential homebuyers no longer able to secure a mortgage, baby boomers becoming a net seller of real estate and the interest rate environment unable to improve substantially, stability is the most likely path after the decimation in prices. And that is not such a bad thing if the residential real estate market can eventually get back to trending towards historical growth rates of 5%.