Does Your Retirement Plan Cover You for Life?

One factor that can complicate your retirement planning is not knowing how many years your retirement will last. While no one can know for sure, if you haven’t considered your realistic life expectancy, you risk shortchanging your later years or even running out of money.

According to the U.S. Census Bureau, the average length of retirement is 18 years. People retire at age 63 on average, and a general life expectancy is 81 years. That means a typical retirement plan should cover ages at least 63 to 81 – but no one is really typical. Many of my clients at Heritage Capital expect a retirement period of at least 30 years, sometimes longer, on the assumption (and hope) they will outlive the average retirement period. Is that you?

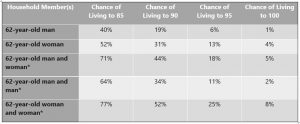

The problem with average life expectancies is that many folks will live longer than the mean. In fact, the number of people living to 100 is increasing, as we see in the following data from the Society of Actuaries:

Another thing that can extend your retirement is early retirement due to layoff or job loss. Maybe you had planned to work until you were 65, but you lost your job in 2020 due to COVID-19 shutdowns. Many times, when workers in their late-50 or 60s experience a job loss, retiring early makes more sense than trying to find a job that pays the same. In this scenario, the length of your retirement will increase. Will your plan cover that additional time?

Figure in How Long Your Retirement Will Last

Given the above figures, your retirement plan should last 20, 25 or more years.

Consider this: A 62-year-old retiree has a 19 percent chance of living to age 90, a 28-year span. This same retiree has a 6 percent chance of reaching 95, a 33-year retirement period. Women have even better odds of outliving the averages. Naturally, this data should have a significant impact on your retirement plans.

Of course, the more money you have relative to your expenses, the more flexibility you have, since there is more room to tighten your financial belt if that becomes necessary. But the whole point of careful retirement planning is to prevent austerity from becoming necessary. A better scenario is to have sufficient time to optimize your pre-retirement finances and increase your retirement cash inflows.

Contact us! Schedule a no-obligation test drive with the Heritage Capital team to see how we can help you plan for the retirement you want.

Figure in What Your Retirement Will Look Like

Speak with a fiduciary financial advisor to get a realistic idea of how much money you’ll need to live the retirement lifestyle you want. A lot of retirees will need anywhere from 70 to 100 percent of their pre-retirement income in order to enjoy their Golden Years as they would like. You can develop your personal percentage by pricing out the elements of your retirement lifestyle, including living accommodations, hobbies and interests. You may also want to include money you want to deploy to help others, including children, grandchildren, charities and foundations. Putting all these factors into your financial plan quickly reveals what is likely, possible, or unaffordable under your current assumptions.

Social Security will be of minor consequence if you are currently earning a six- or seven-figure income, because the maximum Social Security benefit will seldom exceed $42,000 before taxes. If you require pre-retirement income of, say $200,000 per year, then at best, Social Security may comprise 21 percent of your target. The other 79 percent ($158,000) is up to you.

Many folks use the 4 percent rule to estimate the nest egg they’ll require at retirement. The rule states that you withdraw 4 percent of your retirement savings for the first year and then adjust your withdrawal rate for inflation. Prudence dictates that you plan a 30-year retirement. Under these circumstances, a $1.5 million nest egg will generate about $60,000 per year, well short of your required amount.

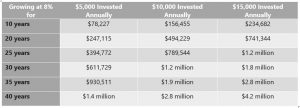

The earlier you start planning for retirement, the less you’ll have to save each year, but unfortunately, it’s common to put off retirement planning when you’re in your 20s for other short-term goals. The following table, courtesy of The Motley Fool, lays out some examples of how much you would need to save each year to grow a large-enough retirement fund:

As you can see, you may have to save considerably more each year to reach your goals if you start from a later age. However, it’s not your only alternative.

Social Security and Longevity

Knowing how long your retirement will likely last will also help you with important decisions you’ll have to make before, during and after retirement, such as when to start taking Social Security benefits.

Do you plan to retire at age 62, the earliest age at which you can start collecting Social Security benefits? This is an option. But if you’re expecting a long retirement, holding off on taking these benefits can help you down the road.

For every year you delay taking Social Security benefits between age 62 and 70, your monthly benefits increase by about 8 percent. While the overall amount tends to work out as the same in the long-run, if you push receiving these benefits off until later, when you finally do start receiving a check, the amount would be larger than if you took it sooner. This larger amount can help you later in life when medical needs generally increase.

Once again, the key question when determining the right time to start taking these benefits is, how long do you expect your retirement to be?

Although these illustrations are approximate, your financial advisor should work out the details appropriate to your own, unique circumstances. The bottom line is to plan for a long, hopefully happy and healthy life and take steps early enough to make your retirement dreams come true.

The team at Heritage Capital has been helping people retire with confidence for more than 30 years. We use active investment management and comprehensive financial planning to help you control your risks, so you can have a successful retirement no matter what happens with the markets or your world. If you’re ready to have a real conversation about you financial future, schedule a no-obligation meeting to see if we’re a good fit.