BYE BYE Semiconductors, HELLO Small Caps! Generational Move!

Last Thursday, I wrote a blog downgrading my 1-3 month view of the stock market. That very day we saw a 6 sigma event or one in a million to billion year event that last occurred on October 10, 2008. My top concern had been eliminated which was the narrowness and diminishing participation in the rally. However, all concerns were not eliminated.

While we did not make any major portfolio changes we did take some actions to harvest some acorns in some high flying instruments. We sold part of our positions in Tesla and Nvidia. That felt really good. We also sold all of our remaining sector position in semiconductors (SOXL), a group I think we have owned since 2018. I kidded on Twitter that after owning semis for so long, I felt a bit “naked” without them. A long-term chart is below and you can see the wild swings in both directions.

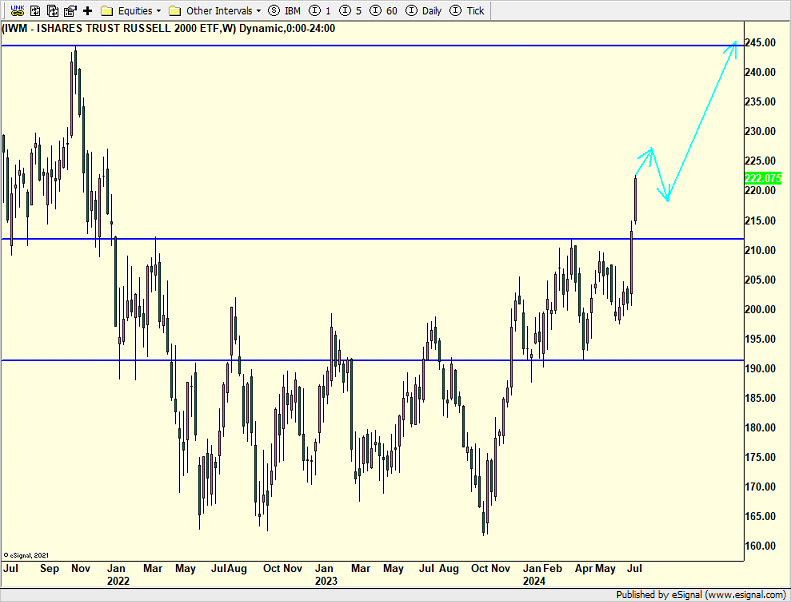

Moving on to what has been garnering all the headlines, the Russell 2000 Index of small cap companies is below. It has been very frustrating trying to invest and trade this index since the end of 2021. Lots of fits and starts and misguided optimism. That all changed last week.

Below is a long-term chart of the index and you can see my preferred path over the coming months. Since it seems like the world has hopped on board, I think the index pauses to digest before continuing to at least the 245 level later this year or into 2025. The strategies that own small caps have not changed their allocation and it is unlikely they will without a pullback. They will stick with what they have.

Finally, I want to share a chart of the Volatility Index or VIX. When everyone was fretting about it falling below the teens, I was confident that it would lead to even higher stock prices. Usually, when vol goes down, stocks go up and vice versa.

See anything unusual below? The VIX made a bottom in May and has slowly trended higher at the same time as stock prices have also gone up. This is atypical behavior and suggestive of some consolidation coming or a modest pullback in stocks.

On Monday we sold levered S&P 500 and some NVDA. On Tuesday we bought more SRPT.