It Wasn’t Easy But The Bottom Came In As Expected

Good morning from Chicago, one of my favorite cities to visit where the weather is very mild and pleasant in contrast to my visit to South Carolina last week where I woke up to 34 and cold. Go figure. I am in town for the annual National Association of Active Investment Managers Outlook conference where I have proudly been in leadership for more years than I can remember. It’s a trade association very near and dear to my heart as my dad joined in 1990.

My trip wouldn’t be complete without my usual visit to one of the great deep dish pizza eateries. Since I already love Giordano’s stuffed pizzas and it was the closest place to my hotel, the choice was easy and amazingly delicious. I ate so much at lunch that wasn’t even hungry for dinner. Of course, watching my Cowboys lose to Philly didn’t help.

Last week was an enormous victory for the wounded bulls like me. The decline turned into a full-fledged correction, meaning it went 10% down from the high. Recall that since July I had been looking for a mid-single digit pullback. Nonetheless, our work showed a series of lows in August, September and October would then lead to strong rally into January. The final bottom was a bit later than expected, but it did come in. And as you know, I am definitely not perfect, or even close to it.

Below should be a familiar chart of the S&P 500. With the amazing benefit of hindsight you can easily see the three bottoms I have been writing about. You can also see the light blue arrows that I drew last month as a guide to how I envisioned the stock market trading in Q4. So far so good, but the market will absolutely break away from the pattern I very quickly drew. As I discussed last month, it will be important for the bulls to get the S&P 500 to close above 4400 which should also cause more bears to throw in the towel. I think that’s coming this month.

I have been asked to show other major stock market indices so below is the NASDAQ 100 which is roughly 40% dominated by Apple, Amazon, Facebook, Microsoft, Google, Tesla and Nvidia. The correction doesn’t look so serious when take into account how meteoric the rise has been in 2023. The decline looks very orderly and ended in between the two blue, horizontal lines which was the range for a bottom. If I am correct about the low, this index should be one of the leaders into January.

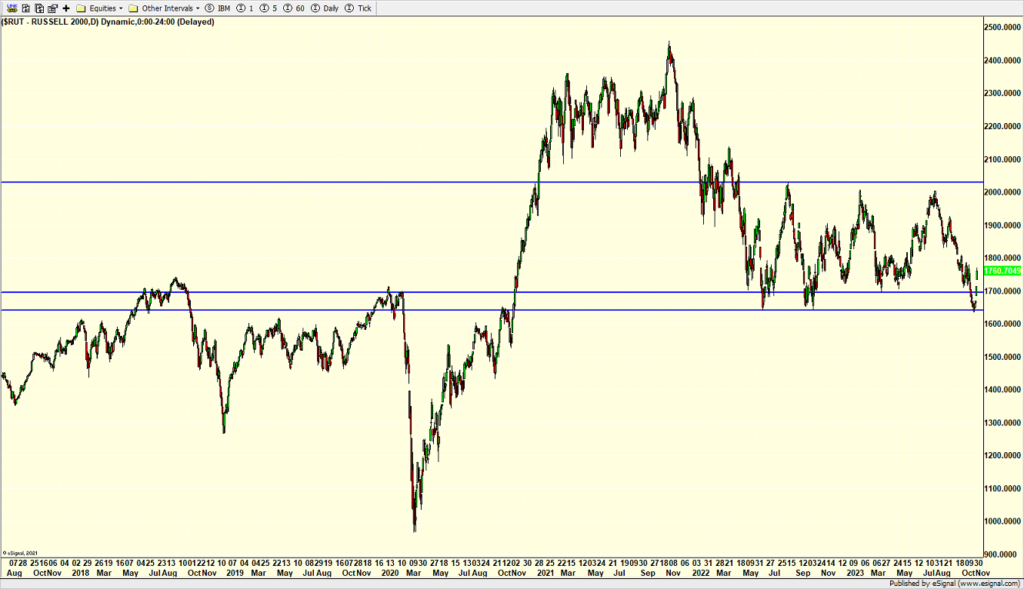

Finally, here is the Russell 2000 index of small cap companies which has been the weakest index, by far. That’s why I am showing a longer time frame. Think about it. With interest rates soaring over the past two years, which size companies are the most exposed? Small ones which rely so much on financing and have the least options to combat higher rates.

The two-year, 40%+ decline was been devastating with every rally being a selling opportunity. The last 18 months have seen a wide trading range that looks so easy in hindsight to trade. It has been anything but in real time. Of note, the bottom of the range also coincides with the peaks from 2018 and 2020. In other words, there is a lot of fighting at those levels between bulls and bears. The bulls took control last week, but it is hard to have high conviction just yet.

Last week I wrote about some things that bothered me in the stock market. The lack of s spike in the VIX was one and that still holds true. I was also concerned that we hadn’t seen an overwhelmingly amount of buying interest. Some call that a buying stampede while other say it’s a thrust. That all changed last week and the bulls are now in control. I will use Wednesday’s piece to discuss the thrusts and their implications.

On Friday we bought RYPMX, PMPIX, levered inverse S&P 500, more JHFYX. We sold PDBC, levered S&P 500 and some XLU.