Quick & Ugly

On Monday I wrote that this “period of no volatility should end right about now.” Well, I didn’t think it would literally be that very moment nor to the degree that stocks fell on Tuesday. The decline on Tuesday was quick, ugly and relentless. Gold offered a little haven but bonds were really the only place to hide. If you are looking to assign blame I would look at the banks and more specifically to First Republic which has been a frequent target of the bears since Silicon Valley and Signature Banks became insolvent. You should now fully expect the rumor mill to be active over the coming days and weeks.

Frankly, I cannot believe the government is going to step and bail them out after letting the other two go out. Risk taking needs to be punished or bad behavior just repeats. I do, however, believe the FDIC and Treasury will always protect depositors. There is a huge difference between an innocent depositor losing money and a stock or bond holder.

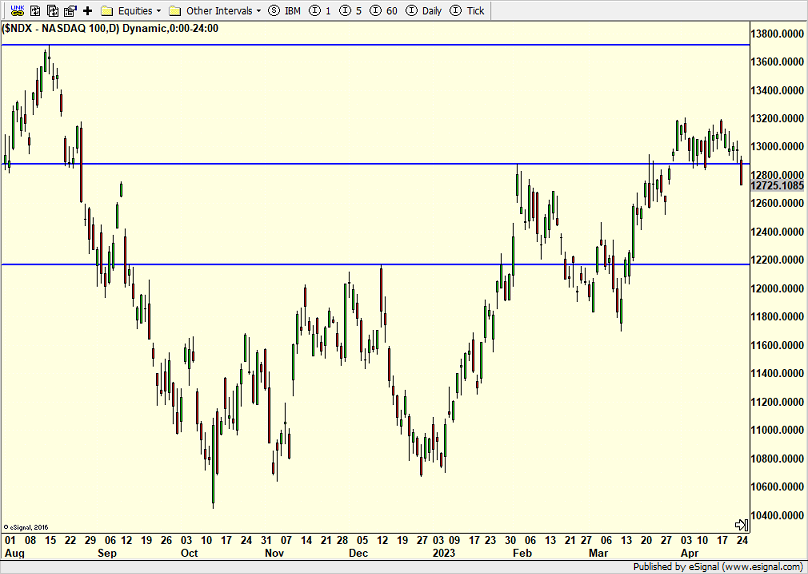

I think I was most surprised that the NASDAQ 100 below broke lower so hard. I expected that middle horizontal blue line to hold for now. And that was before the slew of big tech earnings were released.

After the close Microsoft and Google released Q1 earnings with the former coming in very strong. The latter’s were fine so you can expect choppy action. I guess it’s possible that Tuesday’s action could be erased today, but that is a real long shot to me. I am more concerned that rallies are now sold into good news. We will see today and on.

On Monday we sold SARK, BMRN, some ERX and some FREL. On Tuesday we bought PCY, EMB, GDX. We sold ERX, small cap value and some USHY.