Ready or Not, October is Here – Major Bottom Coming

Seasonal trends are like headwinds and tailwinds. They typically do not act as buy or sell signals. Nonetheless, the trends I wrote about a month ago definitely played out. The S&P 500 lost 10% in September and its reputation as a cruel month plays out again. When I penned September is a Cruel Month I did not think that September would be down 10%. That’s a huge outlier in the distribution of monthly returns. And let’s recall that the stock market rallied smartly into September 12th. But much didn’t sit right with me and I had high conviction that the early month lows would not hold.

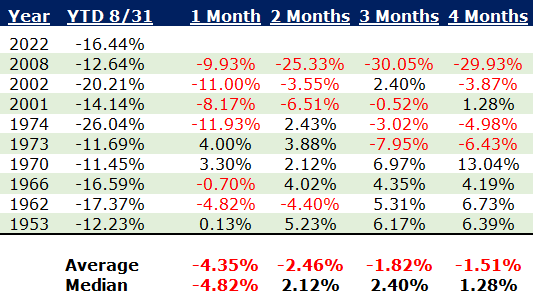

I reported on this study below with more negative implications for September.

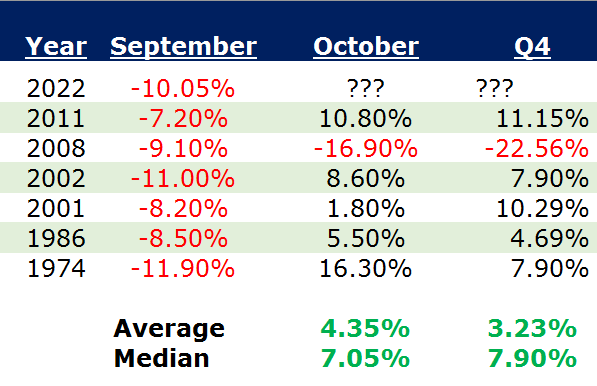

Now that September has closed down more than the arbitrary 7% I set, let’s see how October and Q4 performs.

There haven’t been too many of these down 7% Septembers and most have led to a green October with 2008 being the outlier. I have repeatedly stated that for so many reasons, this is not 2008.

On a more granular level as my friend Scott Cooper would say, October typically sees strength during the first 5 days with the first day or two being particularly strong on a seasonal basis. It is only one of two months (February) that performs better when it starts the month in a downtrend like today, averaging more than 2.5%. It is also a month known to kill bear markets like we saw in 2002, 1998, 1990, 1987 and 1974.

Midterm election years often see stock market bottoms in Q4 with October seeing the most. Think December 2018, October 2002, October 1998, December 1994 and October 1990. 2022 should be no different. The only real ingredient missing is the final flush to new lows that creates some panic and despondency. In fact, my most bullish scenario has a major bottom in the next few weeks followed by a 50% rally in the S&P 500 over the next 14 months with the NASDAQ 100 soaring even more. Let’s get through the next few weeks first and then we can discuss more scenarios.

I have written about something breaking in the global financial system HERE and HERE. It certainly seems that way and I expected to hear a bevy of rumors swirling about some European institution over the weekend. That hasn’t materialized.

Twitter is all abuzz about the Fed’s unscheduled meeting on Monday as if it’s some conspiracy. I got a good chuckle reading all the reasons why the Fed is meeting and what the outcome will be.

On Friday we bought NUGT, SDS and more levered NDX. We sold SLCA.