Standoff at The O.K. Corral

Markets remain quiet. Early weakness seems to be find buyers. Early strength is not building on itself. We have a standoff at O.K. Corral. Last week I shared the S&P 500 and NASDAQ 100. The latter being the market leader with the former getting to the top end of its range.

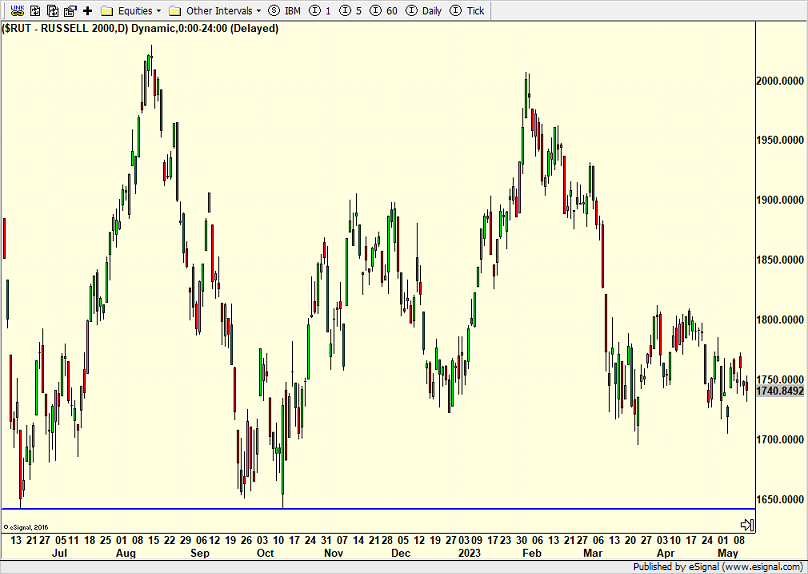

To be fair and balanced, below is the laggard which is the Russell 2000 Index of small caps. It looks nothing like the leading indices. The 1700 area has been visited and revisited several times. That’s where the bulls seem to be gathering the troops. A little bit lower is their final line of defense in blue.

In a perfect world, I would want to see 1650 broken on the next stock market pullback and immediately regained. That would flush out many weak bulls and embolden the bears on the break. Conversely, it would also be a positive sign to see the rest of the market pullback 2-5% with the Russell acting the strongest. The rest of the possible scenarios are not good.

I keep getting questions on what this all means. I will say this. The Russell is either telling us that recession is coming which usually hits smaller companies worse than large. Or, it is saying that recent banking challenges are resulting in very limited available capital from the banks for smaller companies. Neither is new nor groundbreaking information.

As I wrote about on Friday, I just came back from the annual NAAIM conference. There were equally compelling speakers selling the bull and bear case. All were armed with data and facts. In the end, as I have said for 30 years, price is the final arbiter. I sometimes need to remind myself. That’s the most important thing. With the constant barrage of bad news and worries, price remains firm in many places. And I remain positive as I have since September.

On Friday we bought more JNK and levered S&P 500. We sold EMB, PCY, some TLT and some DXHYX.