Stock Market’s Foundation is Rock Solid

As I mentioned the other day, stocks haven’t soared beyond their Pfizer Monday highs like most people “feel”. In fact, the opening from two Mondays ago turned out to be a pretty good selling opportunity in real time and in hindsight although I do not see this as a peak of any significance. There are two points of view now and both may end up being right.

I briefly touched on the fact that market sentiment has become on the frothy side. Investors are a little too happy and confident here. At the same time, the stock market’s foundation is pretty darn solid. This sounds like a good ole fashioned tug o’ war for bulls and bears. Let’s take a look at a few charts supporting the bulls.

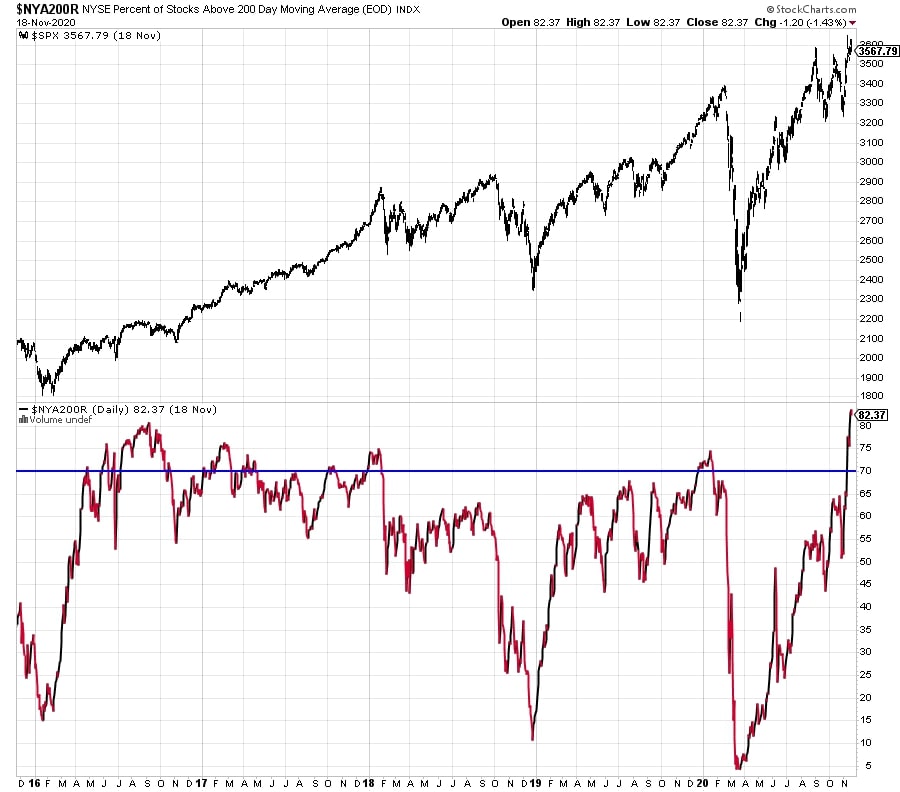

Below is a chart of the percentage of stocks on the NYSE trading above their long-term trend (average price of the last 200 days). When that number is in the single digits, a large decline has usually taken place and stocks are trying to bottom. Today, we have more than 80% of stocks above their long-term trend which is healthy and bullish over the intermediate-term. The short-term is a little iffy. Skeptical eyes should also notice that in February as stocks were making their final highs before COVID, there was some deterioration beneath the surface, but nothing dramatic.

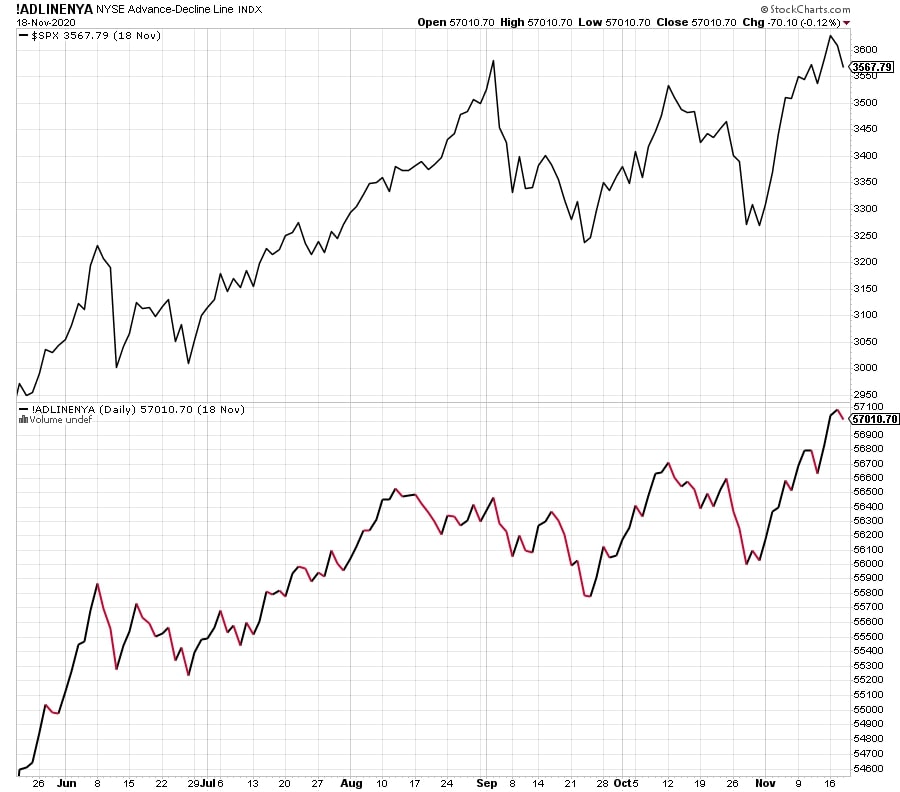

Let’s turn to one of my favorite canaries in the coal mine, the NYSE Advance/Decline Line which measures participation and is similar to the previous chart. As you can see in the lower chart below, the NYSE A/D Line is making a series of fresh all-time highs. That is also very positive over the intermediate-term.

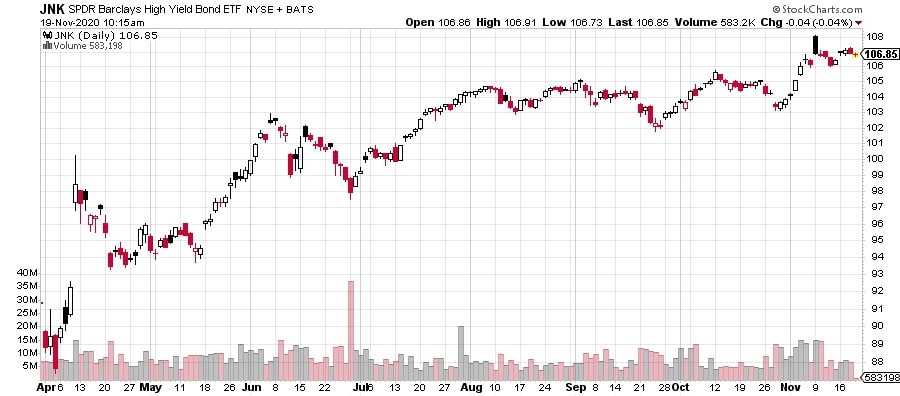

Lastly, let’s take a look at the high yield bond market, another favorite canary of mine. While it is not making fresh highs today, the overall trend of very favorable and one that indicates little stress in the financial system.

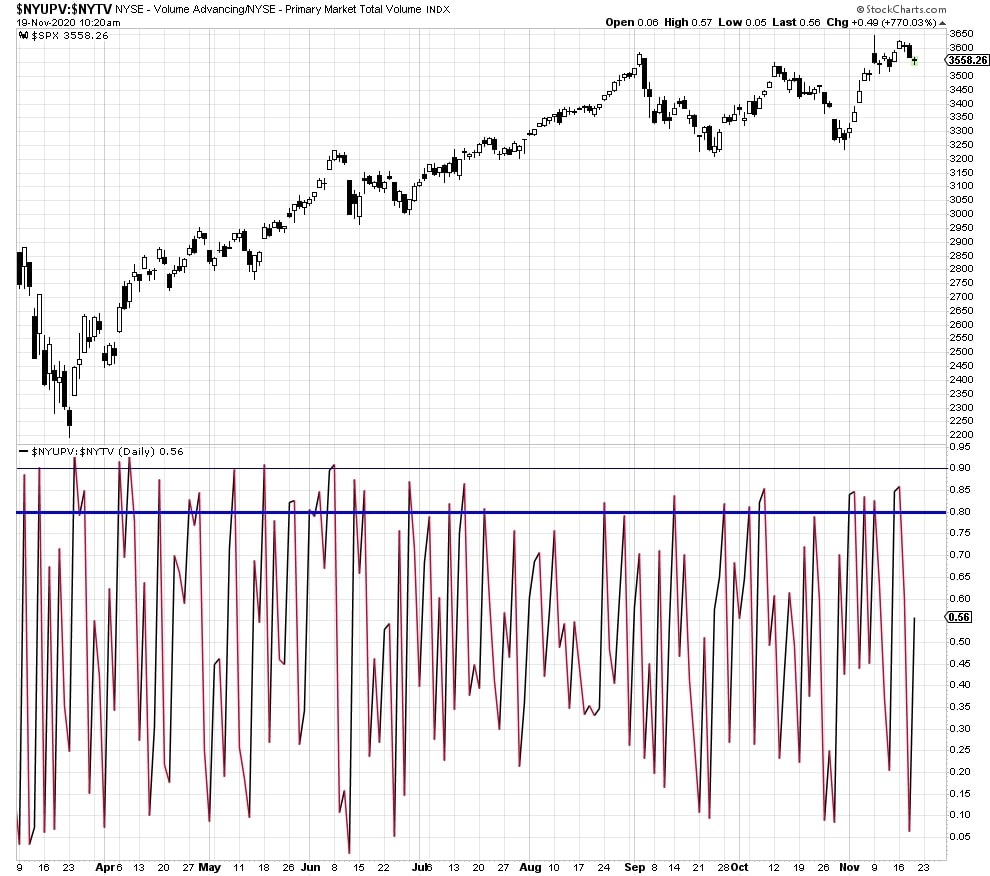

I’ll throw one more in as a bonus. Since the stock market bottomed right on my pre-election schedule, look at how many times we saw 80% of the daily volume in stocks going up. That’s the lower of the two charts below on the far right. 6 times! That is powerful my friends.

Putting this all together, we find a market that has run hard and fast. A pause to refresh or mild pullback should be expected, but any and all weakness is a buying opportunity until proven otherwise. Or, until you read the bearish case I lay out.