Stocks Bounced and Declined – What Now? Omicron Not to Blame

Let me start out by reiterating what I have been offering for the past 5 weeks. Inflation is in the process of peaking. In late October with the good folks at Yahoo Finance, I was very firm about looking for inflation to peak between November and March. Few have joined my party which is A-Okay with me. It won’t even make my top 10 list of concerns for 2022. And with that, supply chain issues are no more by the middle of 2022. Advisors positioning for more inflation will be chasing their tails.

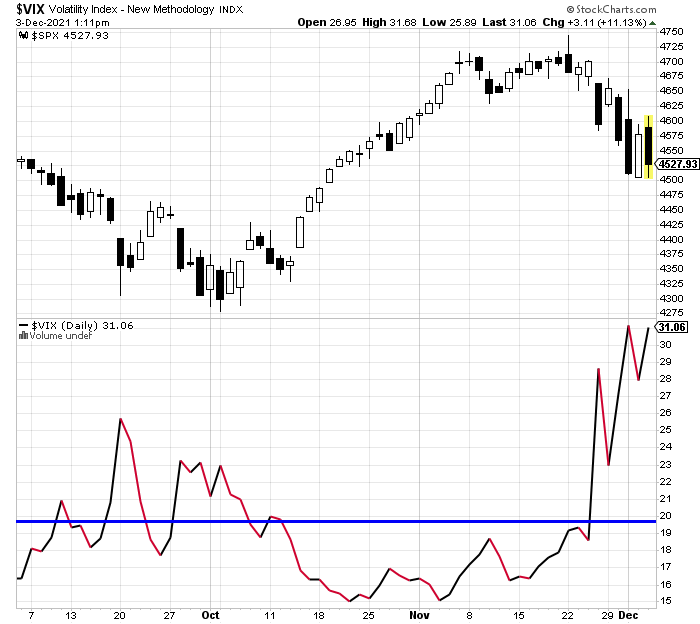

After last Friday’s holiday-shortened, low liquidity plunge, I warned that the inflation genie was out of the bottle and she would likely remain that way for a few weeks or so. And we have certainly seen our share of vol this week. On Wednesday, I warned of a bounce coming, but the bottom was not in yet. The bounce was not great and I still want to see the bulls show more enthusiasm before feeling comfortable that the low is in for Dec. I am just not there yet.

It would be nice and helpful if the Volatility Index, VIX, would not make a new high when the S&P 500 made a new low. In March 2020, the VIX made its highest high almost a week before the stock market bottomed, giving us plenty of warning that the trend may be changing.

A variety of sentiment measures which I wrote about being greedy, euphoric and frothy have come well off those levels, but I doubt we will see true panic, fear and despondency by year-end unless I am totally wrong and the stock market unravels from here. Remember, 10%+ declines this late in the year are rare. 2018, 2007 and 2000 come to mind. However, in years where stocks are up so strongly into Thanksgiving, December collapses have just not been seen. Yes, I know. There is always a first.

To date, the S&P 500 is down 4%+ from its all-time high seen last month. The weakness is worse in the mid and small caps. On Yahoo, I offered that the pullback has little to do with Omicron and more to do with the Fed. In fact, Omicron wasn’t even on my top 10 list. I thought stocks could find a low by 4500 on the S&P 500 which was very close on Thursday. Perhaps, the Fed meeting in 10 days will be the turning point. I still feel very strongly that the low is coming for a powerful rally into January.

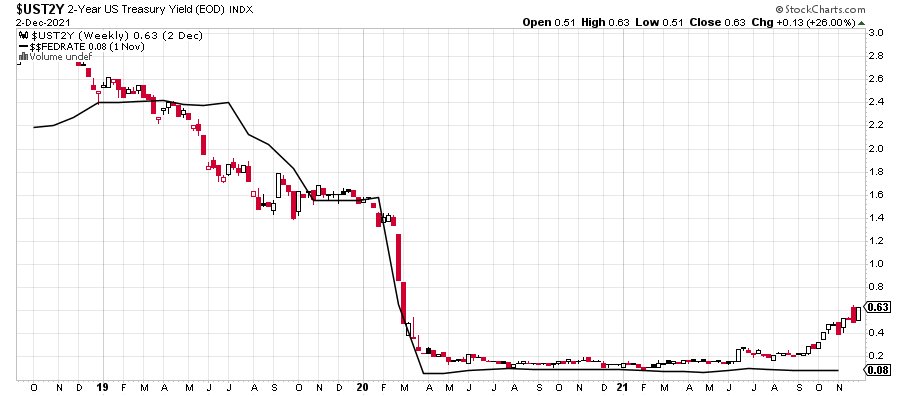

Looking at the 2-year treasury note below, the market already raised interest rates for the Fed to more than .50%. Short-term rates are going up in 2022; the timing is the only thing up in the air.

Lots of portfolio activity this week between real moves based on risk and reward as well as tax loss selling strategies to take advantage of the weakness. All advisors worth a nickel should be harvesting losses throughout the year, but especially now. And it’s not something you should have to ask about or remind them.

Over the past few days, we sold sector positions in materials and industrials as they bounced and no longer behave well and increased the position in energy. ROKU and VUZI were jettisoned along with reducing our position in MSFT. We added to ABNB and re-bought MDB. In the emerging space, we sold Russia and Poland and bought smaller positions in Israel and India. Some folks asked about the gold trade I have stalking. I am still stalking but it’s getting closer and closer. Stay tuned.

The stock market has seen more weakness than I first thought, however the theme remains the same. A bottom is coming and the bounce should be significant to what may be a good selling opportunity early in 2022.

It seems like fall left New England when I headed west a few weeks ago. Since then we have had mostly mild winter conditions. I am looking forward to being on snow with the boys tomorrow as the ladies volunteer at an animal rescue fundraiser. Skiing isn’t great but the crowds should be a lot less than last weekend.