Navigating Taxes IN Retirement

The road to lower tax paid runs through your entire lifetime, both pre- and post-retirement. The decisions you make before retirement critically impact your tax situation after retirement. But don’t dismiss the additional steps you can take within retirement to keep your taxes as low as possible. (This is especially important for a high net worth retirement, because the more money you have, the higher the taxes you’ll face.)

How is Social Security Taxed?

Social Security benefits are subject to taxation if your total combined income exceeds a certain limit known as the base amount.

- Combined income is equal to one-half of your Social Security benefits plus your adjusted gross income plus tax-exempt income

- Base amount for single filers is between $25,000 and $34,000

- Base amount for joint filers is between $32,000 and $44,000

- Base amount for married filing singly is $0

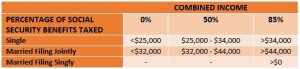

For 2021, the following chart shows how much of your Social Security benefits will be taxed based upon your combined income and filing status:

As you can see, there are 3 different percentages of your Social Security benefits that are subject to tax: 0 percent, 50 percent and 85 percent. The percentage of your benefits subject to taxes depends on how your combined income relates to the base amounts.

For example, single filers (including head of households and surviving spouses with a dependent child) who have a combined income of less than the $25,000 base amount do not pay taxes on their Social Security benefits, whereas those with combined income above the $34,000 base amount pay taxes on up to 85 percent of their benefits. If you fall somewhere within the base amount range, the amount of Social Security to include in your taxable income is the lesser of either:

- Half of your annual Social Security benefits or

- Half of the difference between your combined income and the IRS base amount.

The calculations get trickier if your income exceeds the higher base amount. Thankfully, IRS Publication 915 has all the details including a worksheet you use to figure the correct amount of your benefits to include in taxable income. Heritage Capital can also help! We can help you run numbers based on your specific situation and update your financial plan accordingly. We can also explain different tax-planning strategies that can help you keep more of your money as opposed to paying it to Uncle Sam. Check out our new guide: Understanding Social Security.

Taxes can be confusing and complicated. Besides federal income tax, 12 states also tax Social Security benefits in 2021: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont and Utah. If you’re unsure about how taxes will affect your retirement, talk to a financial advisor.

Start the discussion! Schedule a no-obligation conversation with the team at Heritage Capital.

How Is Retirement Income Taxed?

Different types of retirement income are taxed differently.

Traditional IRAs and 401(k)s

Distributions from Traditional IRAs and 401(k)s are treated as ordinary income, meaning you add the distributed amounts to your taxable income for the year. Distributions before age 59-½ may also be subject to a 10 percent early withdrawal penalty.

Roth Accounts

Distributions from Roth IRAs and 401(k)s are not subject to taxation, as long as you follow the rules.

Pensions

You’ll receive IRS Form 1099-R for any pension income and withheld taxes. According to the IRS, your pension could be fully or partially taxable, depending on how the money was contributed. If all the money was contributed by your employer, or the money was contributed pre-tax, it will be taxed when withdrawn. If the money was contributed after-tax, it will not be taxed when withdrawn.

If you will receive a pension in retirement, talk to your financial advisor about how your plan works.

Investment Income

You may receive non-sheltered investment income in retirement. The taxes you pay on this income depends on whether it is treated as ordinary income, capital gains or non-taxable.

Normally, qualified dividends receive long-term capital gains treatment, as do the profits on sales of securities held for more than one year. Non-qualifying dividends, taxable interest and profits on short-term holdings are taxed as ordinary income. Tax-free interest, such as that from certain municipal bonds, is not taxable, although it might be included in alternative minimum tax.

Know Your Tax Bracket

The United States uses a graduated income tax scheme, in which your income determines your tax bracket. Ordinary income is taxed at one of seven brackets ranging from 10 percent to 37 percent. Each bracket gives the marginal tax rate based on your taxable ordinary income. For 2021, the tax brackets are:

- 10 percent for incomes of single individuals with incomes of $9,950 or less ($19,900 for married couples filing jointly)

- 12 percent for incomes over $9,950 ($19,900 for married couples filing jointly)

- 22 percent for incomes over $40,525 ($81,050 for married couples filing jointly)

- 24 percent for incomes over $86,375 ($172,750 for married couples filing jointly)

- 32 percent for incomes over $164,925 ($329,850 for married couples filing jointly)

- 35 percent for incomes over $209,425 ($418,850 for married couples filing jointly)

- 37 percent for incomes over $523,600 ($628,300 for married couples filing jointly)

Short-term capital gains (on items held for a year or less) are taxed the same as ordinary income.

Long-term capital gains (on items held for longer than one year) are taxed at three brackets (0 percent, 15 percent and 20 percent), depending on your income.

How to Avoid Taxes in Retirement

Taxes can take a big bite out your retirement income, especially a high net worth retirement. Avoiding the sting of taxes is one of the many things a financial advisor can help with. There are many strategies you can incorporate into your retirement plan, including:

Have a Roth IRA

Distributions of contributions from Roth IRAs are not taxable. Distributions of income from Roth IRAs are not taxable unless you are younger than 59-½ or the account is less than five years old. Also, Roth IRAs do not have Required Minimum Distributions (RMDs).

Don’t Make Early Withdrawals

Unless exempt for certain reasons, withdrawals from IRAs and 401(k)s before age 59-½ are subject to a 10 percent penalty. (For other age-based retirement planning decisions, read our recent blog post: Important Retirement Ages.)

Don’t Miss RMDs, and Time Your Withdrawals Correctly

RMDs are based on your age and the amount in your IRA or 401(k). You must start taking RMDs beginning at age 72 (unless it’s a Roth IRA). You can postpone RMDs on your 401(k) if you continue to work beyond age 72.

The first RMD must be taken by April 1 of the year following the one in which you reached age 72. The second and all subsequent RMDs must be taken by the end of the year. For more guidance, speak to your financial advisor.

Donate to Charity

You can deduct charitable donations on Schedule A of Form 1040. The amount you can deduct is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income. However, you can deduct 100 percent of Qualified Charitable Donations (QCDs).

The Bottom Line

Taxes are one of retirement’s silent killers when not addressed ahead of time. If you have questions about how taxes will affect your retirement income that are not addressed here, contact us. Retirement planning for high net worth individuals is especially important. You worked hard for your money; don’t give it all back to Uncle Sam!